The U.S. once dominated rare-earth mining and production during what is known as the “Mountain Pass era” from 1960-1980. In recent decades China has become the largest producer, now controlling 90% to 95% of the world’s rare-earth mineral mining and production.

Rare earth elements are crucial to modern U.S. military aerospace technology. They are used in everything from high-powered lasers to missile guidance systems, radars, sonar systems, and more.

Rare earth elements are crucial to modern U.S. military aerospace technology. They are used in everything from high-powered lasers to missile guidance systems, radars, sonar systems, and more.

China has the ability and has shown its willingness to manipulate the supply of materials and technologies deemed strategic and critical to U.S. national security.

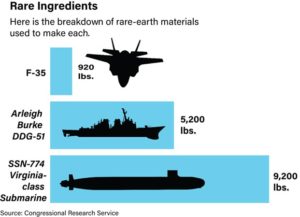

According to the Department of Defense, the F-35 requires 920 pounds of rare earth materials, the Arleigh Burke DDG-51 destroyer uses 5,200 pounds and the SSN-774 Virginia-class submarine needs 9,200 pounds.

According to the Department of Defense, the F-35 requires 920 pounds of rare earth materials, the Arleigh Burke DDG-51 destroyer uses 5,200 pounds and the SSN-774 Virginia-class submarine needs 9,200 pounds.

In other words, China has become a chokepoint for materials necessary to the strategic defense of the United States. This situation has Washington kicking the tires on restarting the Mountain Pass Mine in order to secure a domestic supply of rare earth minerals. “It would be the first financial investment by the US military into commercial-scale rare earths production since World War II’s Manhattan Project to build the first atomic bomb”, says Ernest Scheyder of Reuters. He writes abridged:

China, which refines most of the world’s rare earths, has threatened to stop exporting the specialized minerals to the United States, using its monopoly as a cudgel in the ongoing trade spat between the world’s two largest economies.

“The U.S. rare earths industry needs big help to compete against the Chinese,” said Jim McKenzie, chief executive officer of UCore Rare Metals Inc (UCU.V), which is developing a rare earths project in Alaska. “It’s not just about the money, but also the optics of broad support from Washington.”

The Army division overseeing munitions last month asked miners for proposals on the cost of a pilot plant to produce so-called heavy rare earths, a less-common type of the specialized minerals that are highly sought after for use in weaponry, according to the document.

Responses are due by Dec. 16. UCore, Texas Mineral Resources Corp (TMRC.PK) and a joint venture between Lynas Corp (LYC.AX) and privately-held Blue Line Corp are among the expected respondents, according to company officials and sources familiar with the matter.

The Army said it will fund up to two-thirds of a refiner’s cost and that it would fund at least one project and potentially more. Applicants must provide a detailed business plan and specify where they will source their ore, among other factors.

This latest move by the Army, a division of the Pentagon, comes after a military study earlier this year on the state of the U.S. rare earths supply chain.

The rare earths tension between the U.S. and China goes back to at least 2010, when China limited exports to Japan after a diplomatic dispute, sending prices for the niche metals spiking and fueling concerns across the U.S. military that China could do the same to the United States.