Dear Survivor,

When my mom and dad come over for dinner, they will always bring something. Recently, it was tomatoes they grew in their garden, a delicious cheese, and cookies. What makes the gifts even better is my mom’s excitement about each one. “You won’t believe how good the tomatoes are this year,” she said. “I love this cheese.”

Growing up, receiving a gift from my mom was as much about the story of how she got it. “You won’t believe what a deal I got,” she would say and then explain how she did it, and often, she would not tell us how much she paid, unless she left the price tag on by mistake with three lines crossed out above the purchase price. “Give me that,” she would say.

In my conversations with you or your spouse, you’re the same way. Even when you have money to spend on yourself or each other, you may have a tough time doing it if the price is not right. When you save your pennies and create wealth, you still don’t feel rich. You cannot buy, no matter how hard you try, if the price is not right. You have an internal gauge.

When you reach your retirement life, this internal gauge does not go away. It never leaves you.

Just the other day, I was speaking with a client who could have bought the entire store he was shopping in but wouldn’t buy the merchandise because he thought it was too expensive. “You never lose that feeling,” he said. “It is in your gut forever, no matter how rich you are. You cannot bring yourself to spend too much if the price is not right.”

With Stocks Up, How’s Your Portfolio Risk?

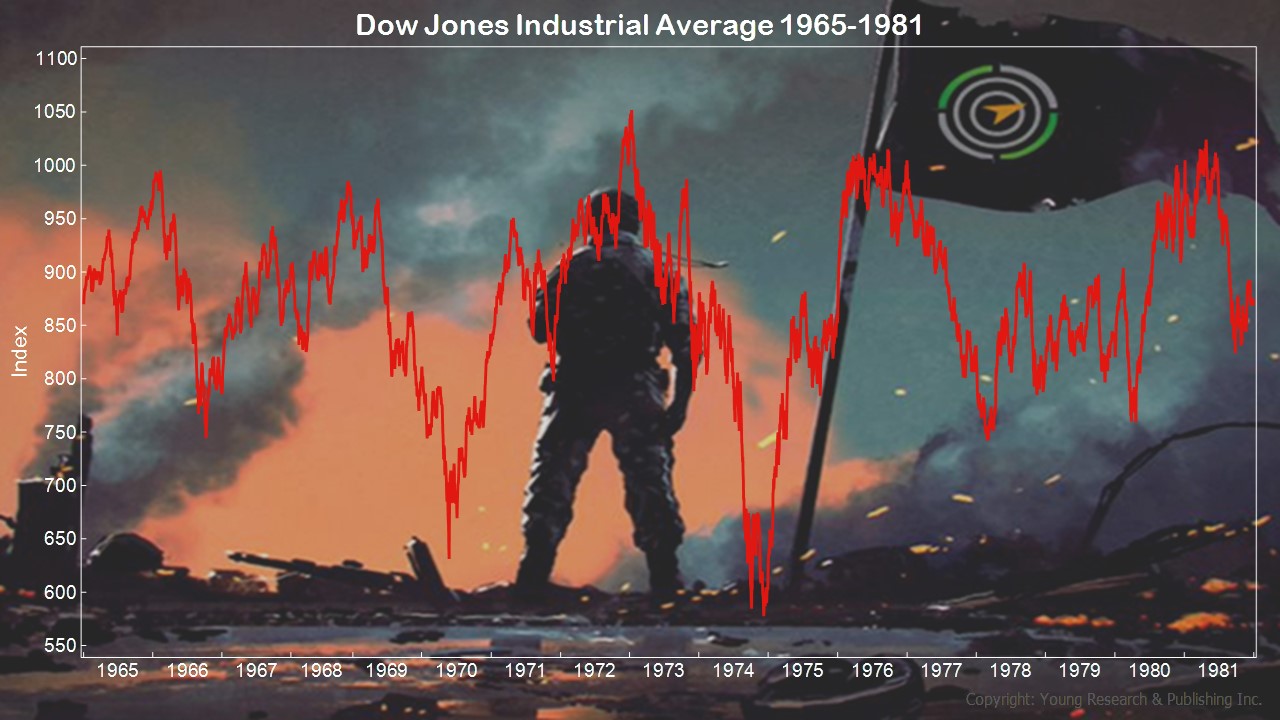

With stocks having a banner year, today may be a good time to look at your overall asset allocation. Do you have enough bond exposure? Are you generating income to help guide your retirement life? What if the market declines by a third? Will you be able to ride it out? Remember, stocks can stay down for a long time. Look what happened to the Dow Jones Industrial Average from the mid-60s to the 1980s. Not pleasant for equity investors at the time.

Your Survival Guy is a natural optimist. But I’ve seen my fair share of disasters, both manmade and natural. The manmade ones can be the worst. Because it’s today’s market, being up so much this year, that guides investor emotions. When stocks go up, the average investor feels they will continue to go up.

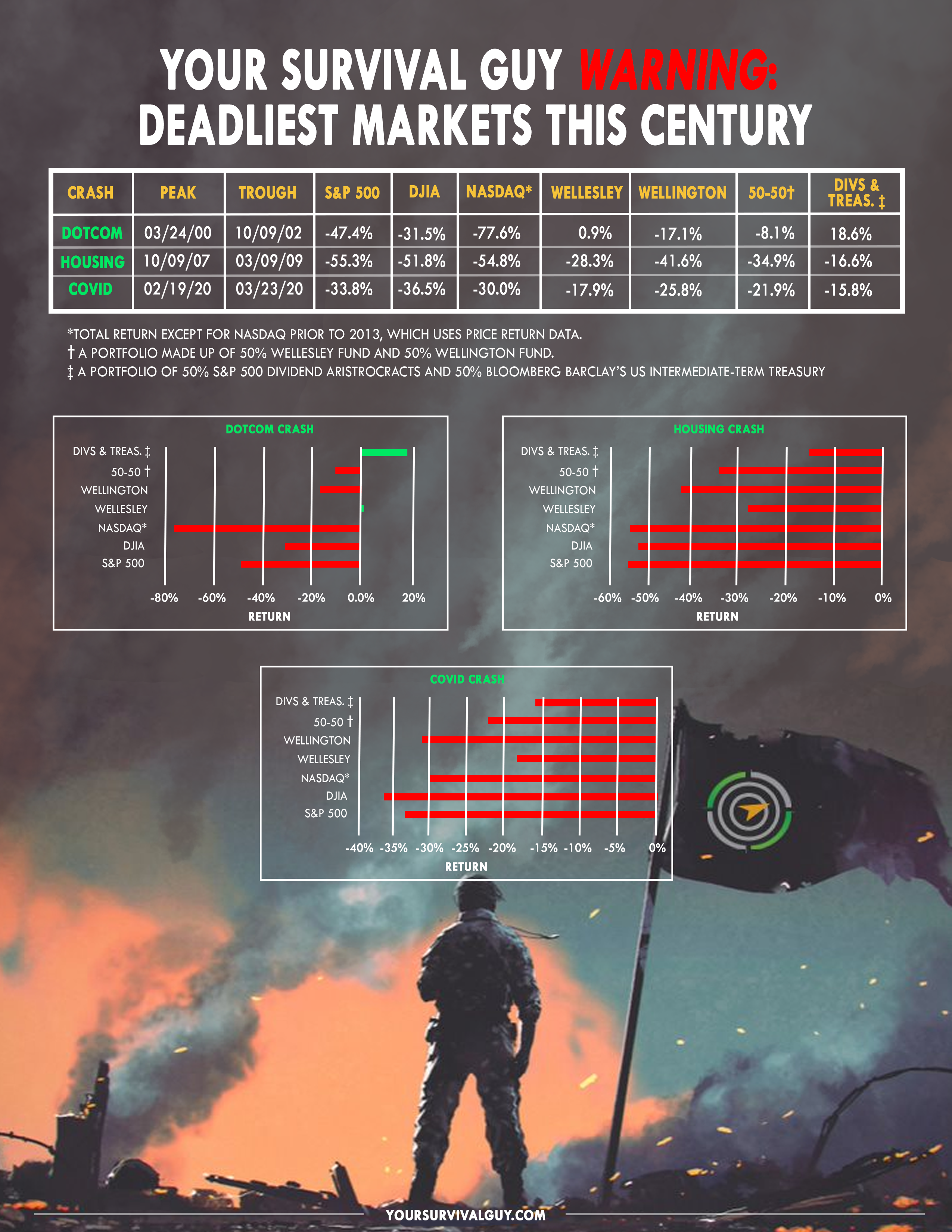

Then, like frogs in a pot, investors look at a year’s worth of declines and wonder if it will ever turn around. Too late. Then all they can think about is whether stocks will ever go back up. We’ve been through some brutal markets so far this century.

And like clockwork investors have short-term memories of how bad it really was. They don’t think about the fact that today they’re quite a bit older than they used to be and don’t know how their emotional response will be because they’ve never been this old without a paycheck.

Today, not after the fall, is as good a time as any to run back the clock. It’s a good time to take out a napkin and look at how you’d respond if stocks were down 30% this year instead of up. It happens. Put your age in bonds and think about how you’d weather a future storm.

One of the hardest things for investors to do is to reduce stock holdings while markets are up. But this shouldn’t be about stock prices and where they are going. It has to do with you and making sure your investments reflect your risk tolerance.

Are You Ready to Calculate Your Income Potential?

You read above about how hard it can be to spend money, especially in retirement. It’s not easy for successful Americans on Main Street, to whom I write, to let go of the purse strings. When you spend your entire adult life working and saving, it’s hard to let go—to rely on other sources of income to live your life. I know this because you tell me.

In my conversations with you, we talk about the psychology of no longer getting a paycheck. Yes, it’s nice having the option not to work, but at least when you were working, you knew how to make your financial life work. Now, there’s uncertainty, and that’s not a great feeling.

Recently, I reviewed the annual draw rate with clients of mine. And, not surprisingly, what they spend is well below four percent and, in fact, is below three percent in many cases. Nice.

When you get below three percent and realize your income needs are mostly met by dividends and interest, you realize prices aren’t your biggest concern. Being paid is what matters most, not necessarily what prices do. Prices are qualitative. They’re opinions of the mass market. Separate yourself from the crowd. Focus on the quantitative. Focus on your income.

Hoping and praying for prices to do something for you is not investing—it’s a form of speculation. When you’re ready to look at your portfolio’s income potential, let’s talk. But only if you’re serious. Email me at ejsmith@yoursurvivalguy.com.

Survive and Thrive this month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. Cash may not be king, but it’s still royal, yielding close to five percent in money markets. When your lazy cash is treated like a peasant by banks, it can be frustrating.

How about your stocks? It’s hard to see the big picture. It’s hard to act and put money in the stock market even if you know your allocation isn’t right for you.

It can be easy to get out of balance: too much in stocks, too much in cash, not enough in bonds.

Now, with the longer end of the yield curve rising for fear of too much debt, what are investors to do? For one, I recommend turning off your news feed. Today’s news is old news by tonight or sooner. But any nugget of news can keep an investor from taking action.

Many of you tell me, in my conversations with you, that you’re glad we’re working together, and your only regret is that we didn’t start earlier. Imagine if we started working together 25 years ago, I think to myself. And I wonder how different investor lives would be if we did.

One of my favorite quotes is from Jack Bogle, founder of the Vanguard Group, who said, “Don’t just do something, stand there.” With so many reasons to justify your actions or inactions today, it’s hard/easy to stand there. We can find any number of articles to support our gut feelings.

What’s important for you may not be important for the next guy. Only you know your risk tolerance and what I’ve learned is that investors don’t realize their intolerance, like a food allergy, until it’s too late.

If you’re sitting on a pile of cash, is it the right place for you? Consider the yields we’re seeing today and consider taking action. You don’t want to miss the boat.

P.P.S. Growing up, Your Survival Guy’s mom would always talk about prior planning. It would often revolve around a vacation we felt lucky to be taking. “Prior planning,” she would say with a smile, hardly believing it herself, deep down knowing how hard it was to spend the money. When you learn at an early age the value of a dollar—how hard they are to come by—you do not overpay even when you can afford it.

Which brings us to you and your spending plan in retirement. You want to have a plan. You want to prior plan to take those trips on your bucket list and be a good spender. You worked your entire life to be able to have the retirement you deserve. I’m here to tell you that you can have your cake and eat it, too.

I know this because I’ve helped countless clients live through every stage of their retirement. It just takes some prior planning and staying on top of how much you want to do and at what cost. I don’t want to hear about inflation. You saved ‘til it hurt and worked forever. Now it’s time to enjoy it.

You can do this because you understand values, and you will be ready to pounce when they’re right—they don’t have to be perfect. There will be some pain. But you deserve to dress nicely. You deserve to take the trips you dream about. You will feel like a million bucks being with your loved ones in a different setting. Do it. Whoever said it’s about the journey was right, but they say it after they’ve arrived. Let’s not forget the destination is pretty nice, too.

Prior Plan. Be like Yves Saint Laurent, who said: “The most beautiful trips I took were through books, on my couch, in my living room.” Now, get your lazy cash off the couch, go shopping, and plan that trip.

P.P.P.S. Earlier this month, the ocean liner Queen Mary 2 was anchored in Newport. “I know you,” I thought to myself, remembering the Atlantic crossing we made on her in May of this year. It was a seven-day crossing. Returning from France by air last weekend in a matter of hours felt like a time warp.

In the book The Only Way to Cross: The Golden Era of the great Atlantic express liners—from the Mauretania to the France and the Queen Elizabeth 2 by John Maxtone-Graham, we learn about what once was the only way to cross, and the ships that made it happen. Even if it’s not the only way to cross today, it was a trip worth taking.

As you plan your retirement life and take the trips you want to take, I want you to focus on how you generate the income to make it happen. Too often, investors think about how much income they need and then buy investments to fit the bill. They end up with a portfolio littered with garbage. That’s no way to invest in bonds.

Your number one goal when it comes to income generation, Your Survival Guy way, is with a safe and predictable stream of income. As you know, we’ve been through some nasty markets so far this century, and like clockwork, lesser quality assets (if I can even call them assets) end up on the rocks, ruining investment lives for generations.

When it comes to quality, you need to start with Dick Young’s North Star, the T-Bill. This is your Queen Mary 2—built to handle the rough and tumble seas. And the food in the Queen’s Grill is incredible so consider your own crossing.

In my expert opinion, you can live out your dreams with less yield and more safety. Too often, investors sacrifice principal for a few basis points and sink the ship. Unfortunately, they learn this lesson, like a food allergy, after the fact.

Landing in South Hampton, England, we spend four days in London at the Dorchester. If you’re there, check out the Chiltern Firehouse and MJ: The Musical. You won’t be disappointed.

I believe you’ll find you can live quite comfortably off your portfolio with a manageable risk level. When you’re hoping for higher income that isn’t safe, it’s time to look at the man in the mirror. Email me at ejsmith@yoursurvivalguy.com

Download this post as a PDF by clicking here.