Dear Survivor,

OK, so you want to go to Paris? Your Survival Guy is back from another three-week research trip, the second this year, and I have plenty to report.

For one, Paris is open for business, big time, as travelers from around the world, (sans China) are moving about the country. As for Paris itself, especially in the service/tourism industry, it’s at maximum capacity based on the sheer demand post-Covid and lack of labor supply. There’s still a hangover from lockdowns and the reluctance of workers—still living off government payouts—to get back to work. Sound familiar?

Now, you didn’t come here to talk about work. You’re here to plan your next trip to Paris. You’re hungry. This is about Paris, after all. But there’s so much that goes into making Paris—Paris. The behind-the-scenes pastry making, up at dawn, or up all night, to make sure your morning croissant is the flakiest, most buttery one you’ll ever have. Those who work are making Paris work. And I wonder, what happens if the Ayn Rands’ who make Paris tick, decide not to tock? It’s a fine line. Stay tuned.

OK, you want to start your trip with the peace of mind and comfort you deserve, and that involves coordinating a private flight through my friend Andrew Flaxman at ExpertJet. He’ll arrange a heavy jet to get you and your family to and from France, whether it’s on a Bombardier Global Express 7500, 6000, Gulfstream IV, V, or VI. Either way, I can tell you, the Ruinart or Veuve is chilled.

Now then, once you land at Le Bourget and disembark into the Dassault fbo, you’ll wonder: Where are all the people? Don’t worry, you’re not in Charles de Gaulle anymore, as you’re whisked away in your Mercedes to your destination, in this case, Le Bristol Hotel.

At Le Bristol, Leah Marshall, who brings new meaning to the title hotel manager, welcomes you home with a warm smile and an iconic laugh that puts you at ease. Madame is the lead actor in the performance that is Le Bristol—the setting for the movie Midnight in Paris. Le Bristol is the queen of the fleet among the handful of Paris hotels that can truly be called a palace. You can see for yourself by the plaque out front that says Palace.

And finally, one of the nicer parts about staying at Le Bristol, and there’re many, is the breakfast/lunch in Café Antonia upon your arrival, and, later that night, a glass of champagne in Le Bristol After Dark (B.A.D.), followed by a short walk through the lobby (not a taxi) to 114 for dinner. You’re tired. You don’t want to deal with a taxi to dinner on your first night.

And for your plat (entrée)?

“Tell me,” Your server may ask, “Will that be the sole meuniere?”

“Oui Monsieur.”

“Tres bien.”

Welcome to Paris.

Le Bristol Hotel Manager Leah Marshall and Your Survival Guy at 114.

Cafe Antonia

Le Bristol After Dark

Your Survival Guy’s Number One Recommendation in Times Like These

OK, what’s Your Survival Guy’s number one recommendation in times like these–when inflation is running hot and interest rates are going up? Well, it’s this: Don’t believe the hype.

Inflation isn’t anything new, and interest rates need to be higher. But don’t bank on recommendations to play the market. That these two I’s are going higher is baked into the cake. That doesn’t mean they’ll be higher a year from now.

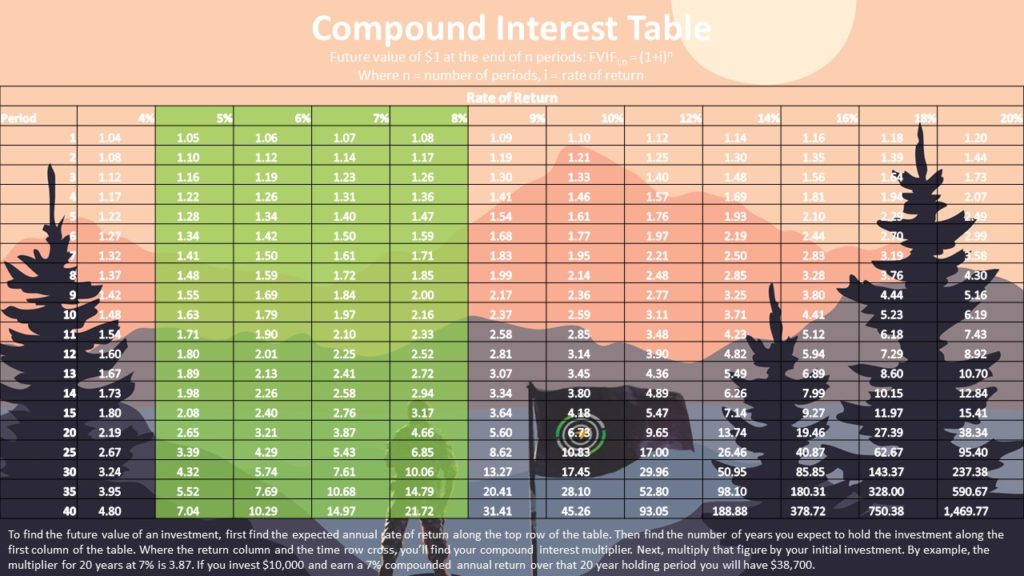

You know Your Survival Guy doesn’t like playing the prediction game, especially when it’s hard enough to understand what’s really going on today and why. The why is always the juicy one because it’s so misleading. Short term predictions are cheap. It’s why I want you to think outside of the box and not follow the crowd. Go against the street. Become a compounding machine.

What’s the street recommending? This: Keep your low-rate mortgage and let inflation help pay it off. Garbage. My number one recommendation is to do the exact opposite. I’m Your Survival Guy, not “Mr. Roll the Dice,” and see how this plays out for one and all. I like the peace of mind of living debt free and owning my house. I’d like the same for you. Believe me, it feels good.

When so-called experts begin their sentences with “The right play today is….” I want you to consider going the other way. This isn’t a game. It’s your life. Stick with me. It’s time to be a contrarian.

Your Survival Guy’s Hunkering Down in His Cave, Join Me

Happy Friday. What a trashing in the tech sector. Meta is off 70% year to date, Amazon is getting trashed this morning, and Apple’s earnings disappoint. Your Survival Guy can tell you my new iPhone 14 Pro is heavy and glitchy. iPhones account for half of Apple’s revenues. Seems top-heavy to me.

When you look at the carnage of the so called FAANGs, you can see why investors are freaking out. Not Your Survival Guy. Slow and steady is a way of life. My life, at least. There’s no problem with getting rich slowly. I have no problem collecting dividends and interest when some investors find them “boring.” It’s a long race. Stick with me.

You’d think the Biden admin believes we heat our homes with gasoline. Before taking that victory lap, maybe they should consider winter is coming. Fox Business reports:

However, other energy prices have surged over the last year and are projected to continue rising during the critical winter months ahead, according to multiple analyses. While gas prices have spiked 11% year-over-year, fuel oil surged 58.1%, utility gas service increased 33.1% and electricity prices went up 15.5% on an annual basis last month, Bureau of Labor Statistics data showed. “For consumers, the problem is that a lot of people think that because gasoline prices have come down, the cost of home energy has come down as well which isn’t true,” Mark Wolfe, the executive director of the National Energy Assistance Directors Association (NEADA), told FOX Business in an interview. “They’re different fuels and different dynamics,” he continued. “So, as we go into winter, for families struggling with very high inflation for the last year, this is another issue that’s going to fall.”

The hubris and lack of understanding by leadership are breathtaking:

- In the past, Amazon’s Jeff Bezos said he wanted to build cities in space and do heavy manufacturing up there to preserve earth. Well, that sounds nice Mr. Bezos, but what happens to the rest of us left behind while earth freezes over?

- With Elon’s purchase of Twitter and the firing of its CEO and CFO, I’m looking forward to seeing some old accounts reinstated.

How about BlackRock walking back its ESG campaign? Nothing like money going out the door to change one’s attitude. From RealClearMarkets:

BlackRock looks to be in some trouble. It’s assets under management have fallen from $10-11 trillion to $8 trillion, with profits falling 16 percent in the third quarter. Much of this is the result of falling markets, but for BlackRock, that’s no excuse because it and its CEO Larry Fink have been so integral in pushing the policies and creating the conditions that have caused markets to fall.

Some of the drop has also come from withdrawal of assets, particularly by red states and their pension funds. In recent days, South Carolina, Louisiana and Missouri have withdrawn more than $1 billion in funds. There’s every reason to expect that more will follow as the economy slows and the partisan and incoherent nature of BlackRock-based investments become clearer.

Sizing up the situation, UBS recently downgraded BlackRock from buy to neutral and reduced its stock price target by more than 17 percent – a price still not as low as the one that BlackRock was trading at last week. In its message, UBS indicated that it expected more significant withdrawals from BlackRock to occur and for regulatory, investigative and legislative risks to increase.

In response to all of this, BlackRock has thrown up a new webpage claiming to “set[] the record straight” on the investment house’s “energy investing.” Instead, though, the information on that page (and in a lengthier letter from BlackRock to state attorneys general) muddy the issues at stake and demonstrate just why UBS is right – perhaps more than it realizes – in its decision to downgrade BlackRock.

When the hubris is thick, and there’s an endless supply of it, stick to what you know. It’s a rough world out there. As Your Survival Guy, I have no problem hunkering down in my cave. Please join me.

Survive and Thrive this Month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. You don’t have to work on Wall Street to have noticed that Joe Biden’s economic policies are taking America in a bad direction. For many Americans, a look at their 401(k) is proof enough. In the NY Post, economists Stephen Moore and E.J. Antoni from The Heritage Foundation, explain the damage Biden has done to the American economy. They write:

Have you taken a peek at the balance in your 401(k) retirement accounts lately? Here’s our advice: Don’t bother. It will ruin your whole day, week and month.

Here’s why: We’ve now had seven straight months of 8%+ inflation. A year ago we were assured by the White House economic wizards that these rapid price increases in everything from groceries, to rental cars, to gasoline at the pump, to health insurance were merely “transitory.” Whoops.

The most immediate sticker shock from Bidenflation, of course, has been to shrink real take-home paychecks of workers. We have calculated that over the past 20 months, this rise in consumer prices over wages means that the average family in America has lost nearly $6,000 in purchasing power. This from the Lunch Bucket Joe president who promised to help boost the incomes of the middle class. When, exactly?

But this pay-cut effect on family incomes is only part of the curse of runaway inflation.

We’ve just completed an analysis of how the highest inflation rate in almost 40 years has impacted the retirement funds of ordinary Americans. Here is what we found.Not surprisingly, since President Biden took office, monthly savings have collapsed, falling 83%. (We could never understand how Biden could say with a straight face that Americans are saving more. His “transformation” of the US economy has had just the opposite effect.) Many millions of Americans who are living paycheck to paycheck just don’t have the money after paying the inflated bills to save much.

But to add insult to injury, even what has been already saved and invested by older Americans over past years and even over several decades has been erased from these accounts.

Thanks to the thief of inflation.

Most of the 150 million Americans with one form or another of retirement savings have invested the majority of those tens of thousands of dollars in stocks. The major stock indices are all way down since Biden came into office. Here are the returns as of Oct. 10, according to the Federal Reserve Bank of St. Louis:

Dow Jones Industrial Average: -6%

NASDAQ: -18%

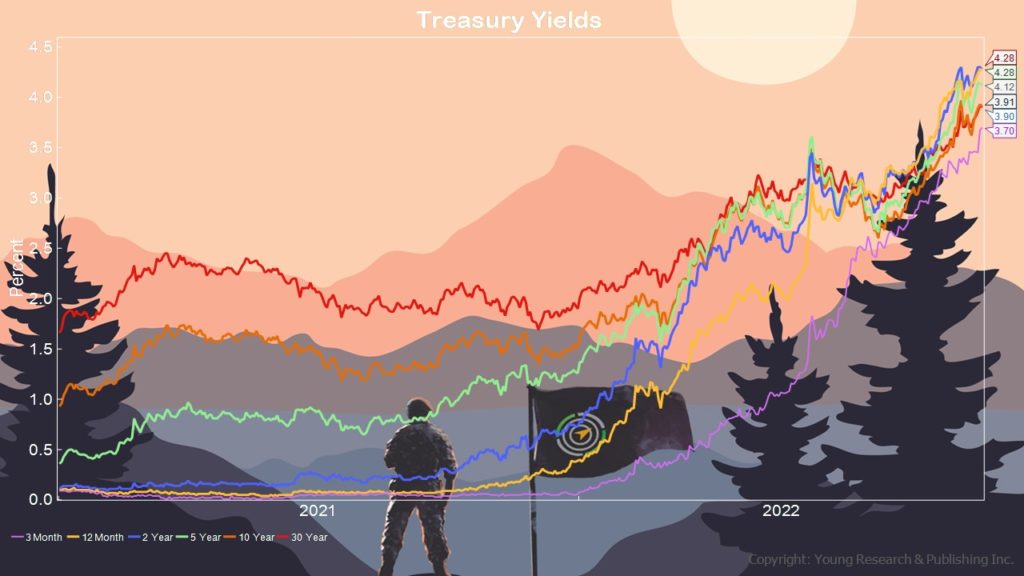

S&P 500: -6%These negative returns don’t even take account of inflation. Doing so adds roughly another 13% or so to these stock losses. Inflation also hurts returns from bonds — which typically account for between 20% and 40% of retirement fund investments. That is because, as we are now seeing, higher inflation means higher interest rates, which lower the value of the bonds you own.

Tie it all together and we calculate that since the start of this year, 401(k) plans have suffered $2.1 trillion in losses. The average 401(k) plan had over $135,000 at the start of this year. Today, those assets have shrunk on average to about $101,000.

In other words, the average 401(k) plan is down about $34,000 — more than 25% in less than one year!

If your 401(k) is suffering, collecting dust, and in need of attention, it’s time to take a closer look at what it’s doing for you. I’m here to help if you need to talk with someone about the ins and outs of doing a rollover. Let’s get that lazy cash working.

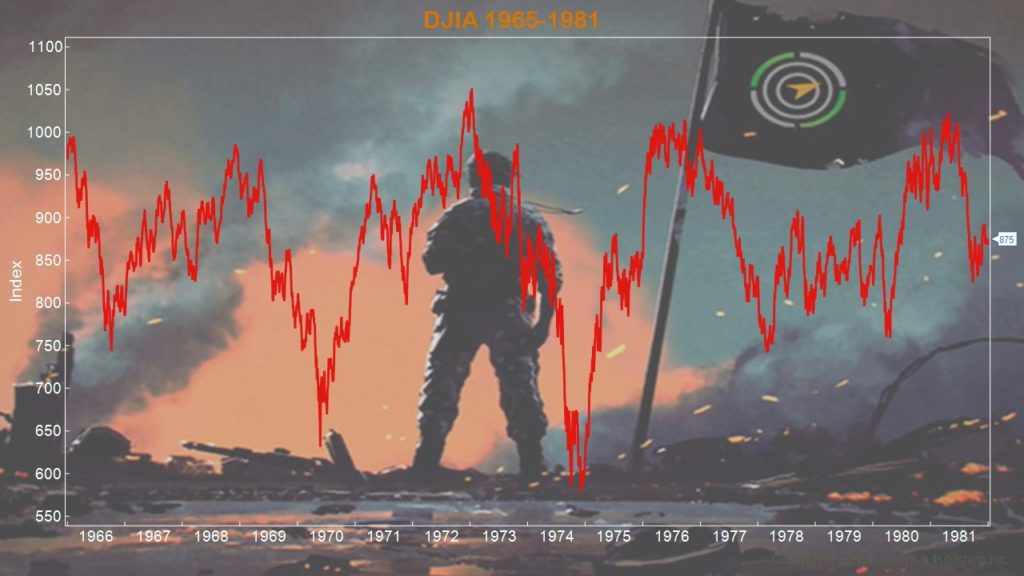

P.P.S. The chart below displays the performance of the Dow Jones Industrial Average from 1965 to 1981, with no real gains. The point is that equity markets can leave investors hanging for quite a while. Now is the time to get your bond game going. When you buy bonds you don’t worry about prices, you focus on being paid interest. Prices are for speculators. That’s not for me. Let’s talk.

In the chart below you can see that yields on treasuries have become much more attractive.

On the chart below, you can see the destruction in the value of Nasdaq stocks since November 19, 2021.

P.P.P.S. You know that the inflation is intentional. But are there other ways Joe Biden is harming America? Economist Stephen Moore thinks so, and he outlines seven of them at The Washington Examiner, writing:

Here are seven Biden administration steps to undermine an economy and a society from within. They will all sound familiar with the president’s policies since he took office 21 months ago.

1. Dismantle the nation’s energy supply. We get 70% of our energy from fossil fuels. Biden has declared war on American oil and gas, making us more dependent on our enemies for our basic energy needs.

2. Don’t enforce the border. Biden is letting hundreds of thousands of potential criminals, terrorists, welfare recipients, and enemies of the United States into our country through a porous southern border with Mexico. Immigration is good, but it must be orderly and regulated.

3. Devalue the nation’s currency through inflation. Inflation is up nearly 15% since Biden came into office. Inflation is a means to erode the value of a currency.

4. Destroy the nation’s finances by running up the debt by multiple trillions of dollars of debt. No president in modern times has so recklessly pushed our nation into debt as rapidly as Biden through his $4 trillion in spending paid for with red ink.

5. Divide rather than unite the nation. Rich versus poor, black versus white, gay versus straight, rural versus urban. Biden promised unity. Instead, he pits groups against each other. This is the identity politics of the Left that is the opposite of “e pluribus unum.”

6. Dumb down and indoctrinate our children with anti-American propaganda in the schools and media. And allowing teacher unions and left-wing activists to take over the curriculum with anti-American propaganda. It is the opposite of nurturing patriotism and love of country.

7. Decriminalize a lot. Let criminals onto the streets. End bail. Empty the prisons. Let minor crimes go unpunished. Biden’s policies favor criminals over victims. It’s a scene out of a Batman movie.

Are these policies intentional or simply completely misguided? I don’t know. But does it matter? Either way, our country is in grave peril.

The Great Reset is about controlling your behavior to reach the goals of the “elites.” The inflation is intentional. It’s policy-driven. You need to be aware of it, prepare for it, and work to avoid it. Other policies are harming America as well. They must be stopped.

Download this post as a PDF by clicking here.