Dear Survivor,

“How long have you been in the investment business?” he asked.

“Most of my adult life,” I said.

“Did you know when you were my age (18) what you wanted to do?”

“Not really. I went to business school at Babson College, worked at Fidelity Investments, and I’ve been here for 25 years.”

“That’s cool,” he said. “My grandpa and grandma tell me all about you guys.”

…………

Here’s the longer version.

Growing up, we always talked about business at home. But it wasn’t about money. My dad would talk about interactions with customers he’d had that day, and because this was pre-internet, he had all kinds of tidbits about what was going on at the local level.

My dad was an incredible salesman because no one ever viewed him as one.

He learned the people business by scooping ice cream, pumping gas, going door to door as a Fuller Brush Man, selling Electrolux vacuum cleaners, and Dictaphones when living in Boston.

Then he worked at Acushnet Co. (maker of Titleist golf balls), where he wasn’t in sales, and when cuts came around, it was LIFO (last in, first out). A lifelong lesson we talk about to this day.

After he and his dad talked, it was clear he needed to be in front of the customer, not behind closed doors.

With a young family to support, necessity put a sign on our front yard saying he was open for business. He wanted to help you sell your home. Over the years, he bought an office overlooking beautiful Mattapoisett harbor, working on the first floor and renting out the second. It’s where he and my mom live today.

Everyone in town knew my dad. They liked doing business with him. He worked all the time. Not just Saturdays, every day. That’s the nature of working for yourself. But what I’ll never forget is he was always around for us.

Now my mom, she always had CNBC tuned in on our little tv in the kitchen. She was passionate about stocks. She just loved the business of investing and seeing the markets work. This was during an exciting time for the markets. But that’s not the biggest impact my mom had on me.

My mom, as a sixth-grade teacher, would have a stock market contest every year for her kids. She would teach them how to read stock quotes in the newspaper. And here’s the kicker. For me as a third grader, I would hang on to every word she told about the big kids on the playground. I’d hear about who was in the band, on what hockey team they played, and who was the lead in the play—the stock game was a way for me to learn more about the big kids. That was fun.

Business was about a beautiful Porsche under a cover in a customer’s garage, or a soda machine that had sarsaparilla and cream soda that he brought home, or a chocolate almond crescent from a baker friend, or a box of Dorothy Cox candies because he was in Fairhaven, or peanuts for my mom from the corner store in New Bedford that were still warm.

I want to hear your stories. When you’re ready to talk, let me know.

Yes, Your Children Are Listening to You

You may not realize this, but your kids/grandkids are listening to you. How does Your Survival Guy know? Because they tell me. More on that in a minute.

Yesterday, for example, I spoke with a daughter and son-in-law of yours and, later in the day, a grandson. The first conversation was focused on traveling along the road to saving for retirement, while the other was about starting out a lifetime of saving and building a career.

“But we don’t have enough to meet your minimum,” they always say.

“There is no minimum for you,” I say. “Once a member of your family is in the door, you’re good to go.”

What if you’re looking to become the first client in your family? If you have some savings—our current minimum for investment is $500,000—the door’s wide open. Add up your IRAs and brokerage accounts, and you’re probably there.

Now if you’re already a client, not to bring up a dire subject, but there’s a chance I’ll be speaking with the next generation at some point, don’t you think? Doesn’t it make sense that they get to know me sooner rather than later?

Back to how I know they’re listening to you. They make statements like this. “My grandfather, grandmother, mom, or dad say we/I should”:

- Invest like a Prudent Man

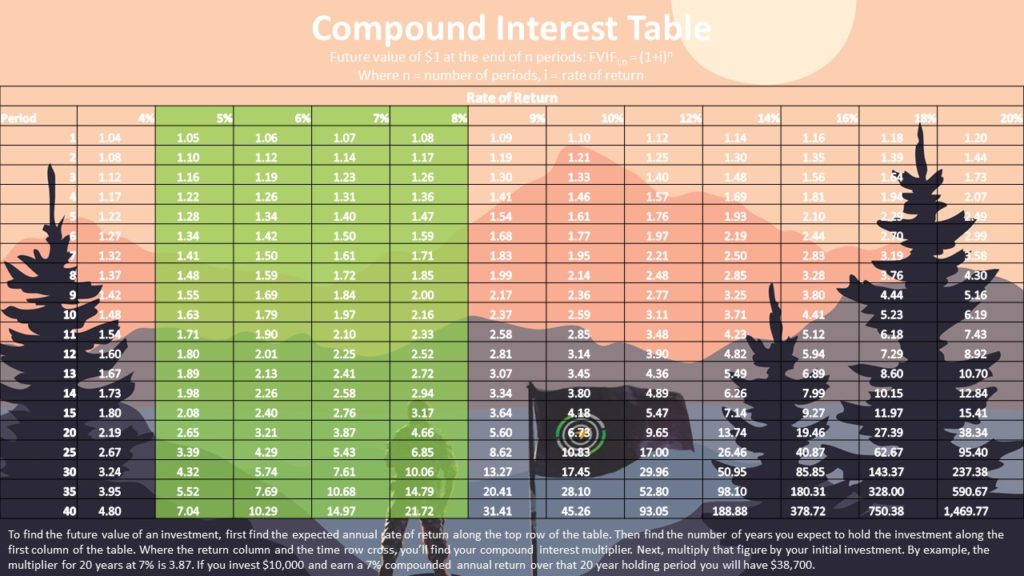

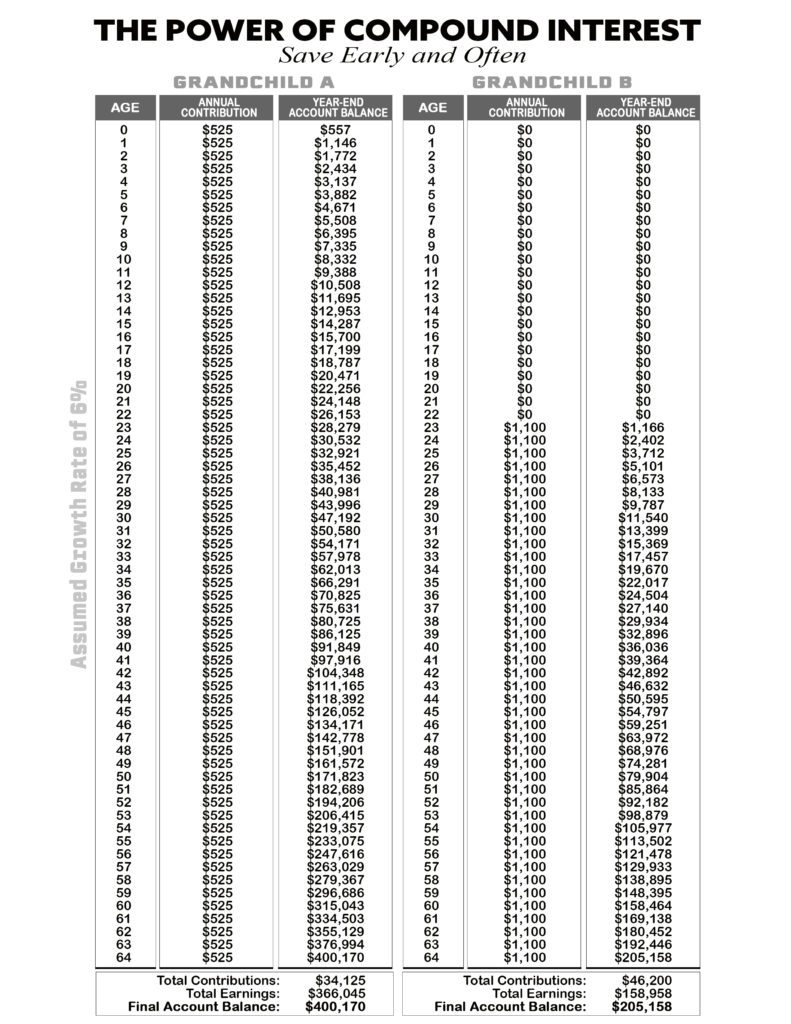

- Focus on compound interest

- Buy dividend paying stocks

- Have some bonds in my portfolio

- Avoid 12b-1 fees.

“Do you know what they’re talking about?”

Keep talkin’ to them. They’re listening. When you’re ready to talk with me, let me know.

Sometimes, they ask me about bitcoin and cryptocurrencies. I hope they didn’t get that from you.

Early Advice from Her Dad on Tipping at Charlie Trotter’s

We’ll be married 25 years this November. Together for over 27 years. One of our first trips together was to Chicago, where, after Babson, Becky went to graduate school at DePaul University.

Back in 1995, when a fraternity brother invited us to his wedding in Chicago, this was a chance to visit Becky’s old stomping grounds and explore the city with friends. We ate deep-dish pizza, drank draft beer, listened to music—all not far from where she lived—and we hit the major sites and shopped the Miracle Mile. It was a blast.

The highlight was dinner at Charlie Trotter’s. I felt like I knew Trotter’s already because of the stories I’d heard from when her parents would visit and they’d go out for a special occasion dinner. Also, because in her Newport, RI home, Trotter’s cookbook sat on their coffee table where I’d thumb through it, while talking about my job at Fidelity Investments with her dad and wondering what was taking someone so long to get ready. I knew the menu because it was framed in the kitchen.

When we stepped into Trotter’s on that special trip, I felt like I was inside the cookbook. The menu seemed familiar to me. The tastes were out of this world, and the wine pairings were amazing, thanks to master sommelier Larry Stone. Ahhh, trips down memory lane.

With our kids off to college, there’re nights when Becky will visit our daughter in Boston for dinner with friends. I wasn’t expecting empty nesters to be singular. Anyway, home alone one night like a deserted child, I watched the recent documentary on Trotter: Love, Charlie and thought about that weekend in Chicago. It’s so sad he’s gone. Dead at 54. Such an intense life.

Here’s a picture of the menu from our visit. What stands out this morning are two things. One, inflation, and two, advice her dad gave me before we left. “If you buy the book, don’t include it in your tip.” Lesson learned.

Two Ways You Can Make Time Stand Still

Your Survival Guy survived a weeklong liver cleanse, and I’m here to write about it. OK, it was a five-day deal. I made it four and three-quarters. I can’t say I recommend it, but here I am, wondering how this week will go. So far, so good. Now I’m thinking about every little bite and sip I take.

But hey, a little bit of self-reflection goes a long way. That’s the beauty of a reset.

If you want to make time stand still, dear reader, and not let life pass you by, then do a liver cleanse. Talk about watching paint dry. Five days will feel like an eternity.

All in the name of prolonging one’s life? Wow. What did I sign up for? Anyway, glad that’s behind me.

Here’s What’s on My Mind This Morning

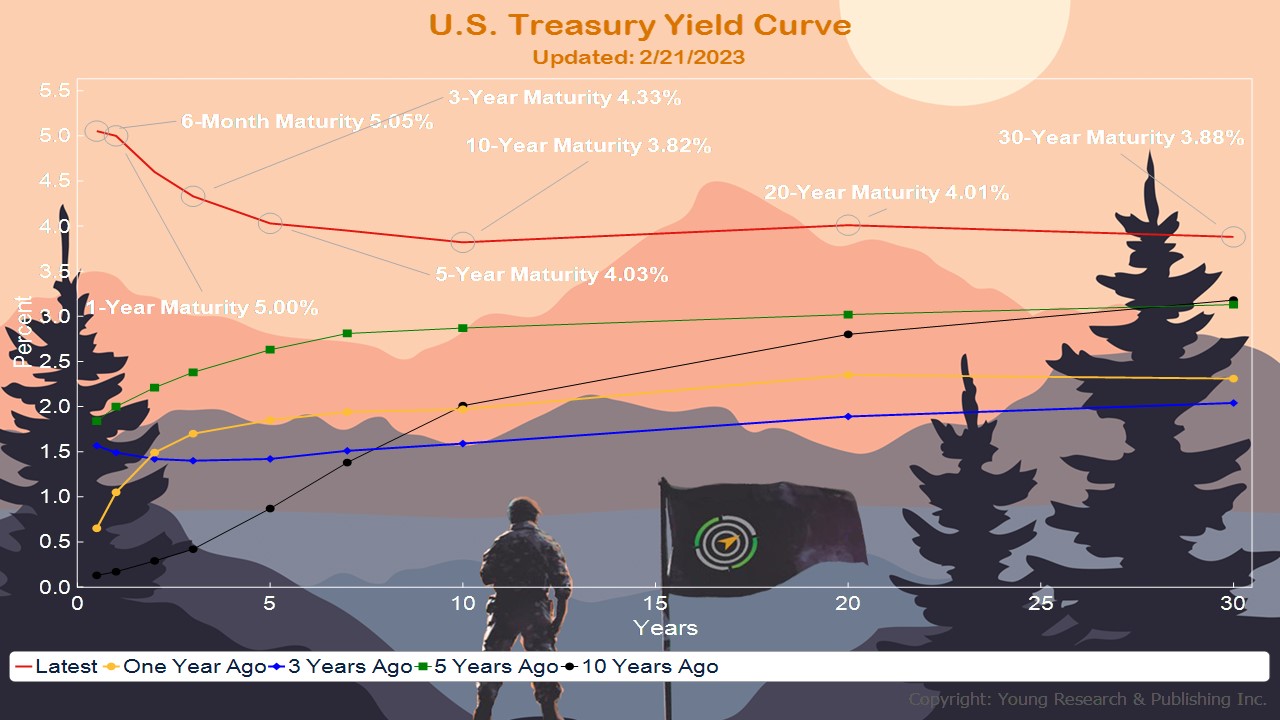

It’s been ten years since we’ve seen yields at a level we could really sink our teeth into.

Now is a time when investors can make up for lost ground. To make time stand still.

I don’t mean swing for the fences; I mean, it’s a time when being moderate is virtuous. It’s a time when, if you watch what you do with your money, you can avoid heavy losses like the ones that befell so many investors last year. Not you, I hope.

When the North Star for investors shines bright, there’re plenty of opportunities to be had.

You always want the North Star to be your guide. To give you the lay of the land. Investors have been crawling along the desert floor, thirsting for yield for far too long.

We’re all living longer these days. You can do a liver cleanse to make time stand still, or you can become a compounding machine and let interest on interest do the heavy lifting while you live your retirement life. Imagine how great you’ll feel.

Survive and Thrive this Month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. It’s going to be a cold one today, especially at the summit of Mt. Washington, home of the world’s worst weather. Here’s your forecast:

“As far as wind chill values, if we go with a milder and less gusty setup of 33F below and winds of 95 mph, summits will have values around 87F [degrees Fahrenheit] below,” meteorologist Ryan Knapp of the Mount Washington Observatory said in a statement. “If we go with a colder, windy setup of 40F below and 110 mph, summits will have values around 101F [degrees Fahrenheit] below.”

With that in mind, it’s good to see pics from your adventures in warmer climes.

E.J.

Just dropping you a quick email and pictures from the Exumas. The weather, islands and water are incredible.

Thanks for your continued financial and survival guy guidance. Please also forward our thanks to Dick, who helped make this possible through all the years of investing following The Intelligence Report.

Hope you are enjoying some good skiing this year.

Have you ever seen a peacock bass? Me either. Here‘s what a client texts from his fly-fishing trip to Brazil:

Just so you know what a peacock bass looks like. I only caught 31. My buddy caught 40, but he’s 10 years younger and still cares about numbers. I’m perfectly happy with 31. By the way, I can still beat him steelhead fishing. Take care, and let’s enjoy the year-Dr. P.

Another client sends this from the free state of Florida:

Your Survival Guy greetings from New Hampshire:

P.P.S. With all this saving and investing, let’s not forget about living. Because once you have water, food, shelter, and a riverboat cruise through Europe, what’s the point? You want to get out there and see what you see. Go for a drive. Hit the trail.

A couple of weeks ago, Becky and I were driving west on 302 through Crawford Notch, New Hampshire, on our way to ski Bretton Woods. It’s a steep, narrow pass with Mount Willard on your left. We could see a group picking their way up one slippery face of its ice falls. It’s serious terrain. Mt. Pierce is on your right.

In speaking with you this week, you told me you made the ten-hour drive from Pennsylvania to the notch, commenting, “Hey, Survival Guy, we were in your neck of the woods a few weeks ago.” You told me how you broke trail in over a foot of snow, snowshoeing up Mt. Pierce, a four-thousand-plus footer in the Presidentials. You did Mt. Willard too. And on the other side of Mt. Washington, in Pinkham Notch, the Nineteen Mile Brook Trail.

“The sounds in the woods must have been awesome,” I wrote.

“The most awesome ‘sound’ in the woods was the quiet.”

When you start living your retirement life, you never know what you’ll see. Start your planning now for summer before it’s too late. I’d love to see you in Newport. Last year attendees of the Newport Folk Festival (’23 sold out within hours) were treated to surprise appearances by Paul Simon and Joni Mitchell.

P.P.P.S. Look at these yields and see how far we’ve come over the past ten years, let alone twelve months. While banks pay you peanuts on your checking and savings, you can sink your teeth into treasuries (and investment-grade corporates). Remember, earning 4-5% on your lazy cash turns you into a compounding machine rather than an ATM for your bank’s lending team.

When you need help building a portfolio of individual treasuries and corporate bonds, let’s talk.

Download this post as a PDF by clicking here.