Dear Survivor,

Your success as an investor has much to do with your temperament. It’s more art than science. That’s not coming from me. That’s from years of reading my father-in-law’s newsletter, Richard C. Young’s Intelligence Report. He’s pulled me aside many a time to remind me: “Survival Guy, listen to me, investing is more about art than science. Yes, you’ve got to have the chops, but it’s the art that makes the music.”

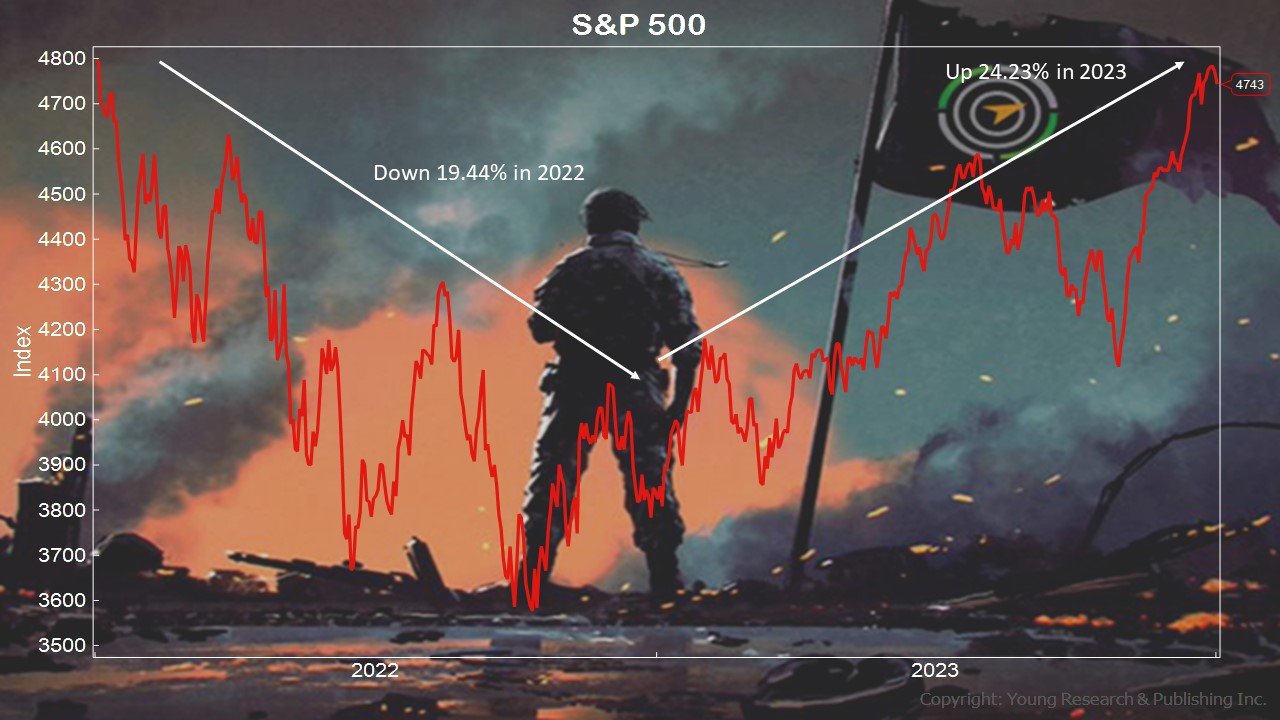

And here we are at the national anthem stage of 2024. And yes, it’s been a wild couple of years for the S&P 500. Sort of reminds me of the Daytona 500, with investors circling back around the track after some close calls. That doesn’t sound like fun, but hey, I’m Your Survival Guy. I don’t like my investments spinning their wheels. A slow and steady pace is just fine by me.

Which reminds me of the onslaught of advertisements investors face about past performance. Remember, past performance is the hook that snags the average investor. I hope you’re not average. The late Charlie Munger reminded investors once of when he asked a bait and tackle shop owner if a certain lure caught fish. “I don’t sell to fish,” the owner said.

The late great Jack Bogle said, “Don’t just do something, stand there.” A perfect tenor for today’s volatility or fast money. I know, it’s hard not to look. And unfortunately, we will need to deal with the mess.

There may come a time in your retirement life when you won’t want to deal with the violent swings on your own. Where you’ll want someone like Your Survival Guy to help guide you. Don’t look at it as defeat. You simply realize you have too much to lose. Understanding when that is, is more art than science.

Your Survival Guy’s Mt. Rushmore of Investing Legends

If you were in shop class back in high school (remember that?) and you were instructed to build your own Mount Rushmore out of wood, I would have one piece of advice: leave room for expansion. Because when I think of my visit to the site back in the mid-80s as a kid, I remember the magnificence of the late presidents but also how more names were still being considered. Note to self: There will always be someone to add down the road.

Which leads me to this: who would be on your “Investment Mt. Rushmore?” Take your time. This isn’t a quiz, but allow me to help. First, let’s make sure there’s room for Mom and Dad, who taught you the value of hard work, and for that inspirational boss who you’ll never forget. Then move to the legends like Ben Graham, Jack Bogle, Ned Johnson II, and perhaps those guys over at Berkshire Hathaway. And allow me, dear reader, to include my father-in-law, Dick Young. I know you’re thinking that’s a bit self-serving, but allow me to explain.

When you think about building wealth in America, do you imagine Wall Street hotshots? Sure, we all know the celebrity investors who talk their book into the bright lights. But who is actually helping your neighbors on Main Street increase their wealth? The list in my opinion is short. Which is why I believe in the work Dick Young has done for decades to assist many investors through both his Richard C. Young’s Intelligence Report newsletter and the boutique investment firm run by his son Matthew Young (www.younginvestments.com). I think that’s why Forbes once described Dick as “worth his weight in bullion.”

Each month Dick signed off his report with the words, “Make it a Good Month,” knowing that beating the mighty foe of inertia was up to the reader. A fortune cookie of wisdom.

“Survival Guy,” Dick said to me in a recent call, “Remember what I’ve told you: Simple is sophisticated.”

Click.

The problem with these bits of wisdom is they leave you wanting for more.

Dick Young to Your Survival Guy: “Diversification Is Discipline”

One of the more common trends Your Survival Guy sees in investment portfolios is a lack of diversification. Through the years, investors add more money to the winners while the losers are shoved to the side like misfit toys. Over time, portfolios look less like a toy box and more like a mantle of six or seven trophy stocks. That’s dangerous.

If you look at the S&P 500 today, it reminds me of that mantle or trophy case. It looks nice. Who doesn’t like a shiny trophy? But will the winning continue?

Recently, in another conversation with Dick, we talked about diversification. “Survival Guy,” he said. “Greetings from the Key West. As we were discussing the other day, diversification is discipline. Many investors are simply not up to the task. It’s too hard to overcome inertia to make the necessary decisions.”

Later in the day, in a conversation with clients, we talked about the “Magnificent Seven” in the S&P 500: Seven names make up a third of its value while the other 493 only two-thirds. That’s not a level of diversification I’m comfortable with. Where’s the margin of safety? And it’s not just the S&P 500 Index funds that concern me. Look at the top 10 holdings of a lot of mutual funds or ETFs and you’ll see the same seven names.

It’s the Snow White portfolio with the same seven doing all the work. But for how long?

Portfolio managers are under tremendous pressure to keep pace with the S&P 500 or lose their jobs or their investors. If you consider the makeup of most funds, including the target maturity ones, you’ve got a lot of money in just a few names. But keeping up with the Joneses, or the Dow Jones, for that matter, is what their game is all about. This movie’s not over.

If you need help with your trophy case, I’m here.

Survive and Thrive this month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

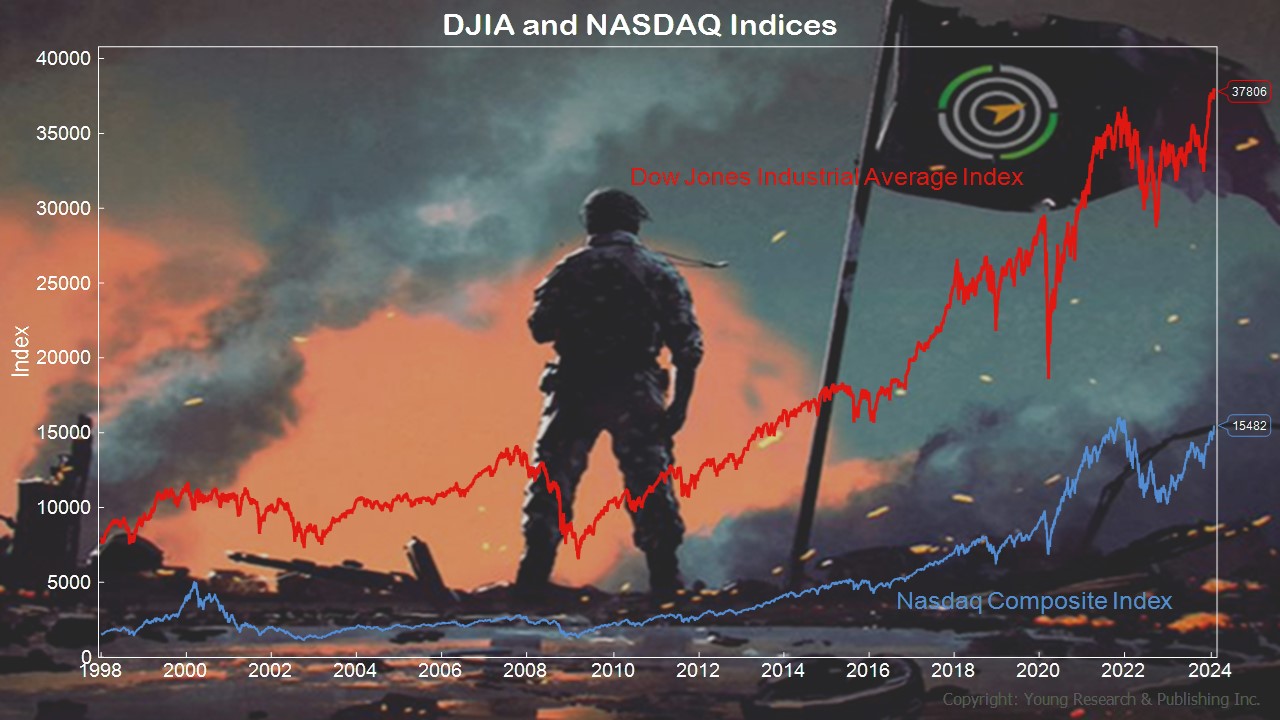

P.S. Let’s not get too excited about Dow 38,000. Your Survival Guy remembers when we hit Dow 10,000 in 1999. As you can see, we crossed that bridge again and again.

What’s always amazing to me is how short the average investor’s memory is (you’re not average, dear reader). Look how long it took for Dow 10,000 to gain some terra firma. Then, look at how long it took for NASDAQ. Not pretty, as an entire generation was lost to price wars—prices were stagnant.

With the so-called Magnificent Seven running a third of the show for the S&P 500, let’s not forget that diversification is discipline.

P.P.S. When Citigroup lays off 20,000 employees, as it recently announced it will do by 2026, then Your Survival Guy concludes: not all is right with the financial world.

When Charles Schwab’s stock, the largest publicly traded U.S. brokerage, declines by 17% as it did last year and was down seven percent through Friday of this year, not all is good in the financial world.

When Citi announced its exit from the municipal bond market, as it did recently, who will be the buyer of last resort as it was for so many?

When Citi got into a Second Amendment battle, some states, Texas being the big one, decided it had options. Guess which state issued the most muni debt last year? Don’t mess with Texas.

Meanwhile, if you saw Dumb Money, you know the individual investors it portrays aren’t exactly dumb (maybe a bit too aggressive), and they handed it to the hedge funds during the meme stock craze. That is until their leader was dragged in front of Congress.

Then you have Schwab’s bank division that, like most banks, pays a pittance on deposits and lends at higher rates, held way too many long-term bonds on its balance sheet, and has indigestion from the TD Ameritrade takeover that isn’t going exactly as planned as investors look for greener pastures. (My favored Fidelity Investments is one, for example.)

A lot of the old Schwab money is trading on Robinhood (tagline: Run Your Money).

Between the layoffs, the muni bond debacle at Citi, and if you live in a red state and like your Constitutional rights, you might ask yourself why you’re banking with them.

With Schwab’s stock price decline, there’s always room for improvement. But will there be? “Last year, there were some challenges. Let’s not kid ourselves,” James Kostulias, head of trading services at Schwab, said in an interview earlier this month. “Now that we’re past the vast, vast majority of that, I think there will be more time, energy and resources we can devote to innovation, to growing the business.”

A lot is banking on that.

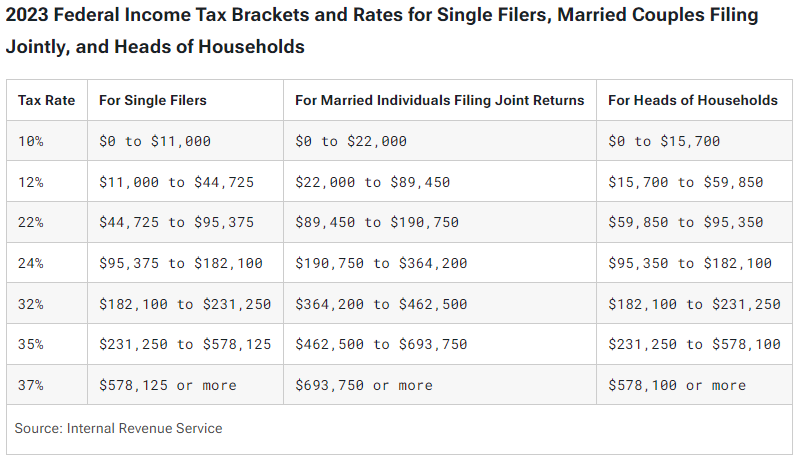

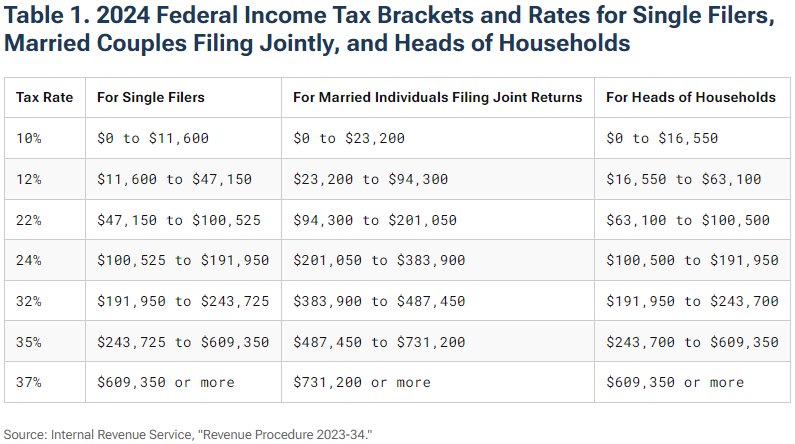

P.P.P.S. Every year, the IRS adjusts certain taxes for inflation. Here’s what the federal income tax brackets look like for 2023 and 2024 from the Tax Foundation.

Download this post as a PDF by clicking here.