Dear Survivor,

Life throws you a curveball when you least expect it. Which is where I found myself recently when I came home from work.

“I’m doing a liver cleanse,” she said. “You can join me or fend for yourself.”

Bam! No warning. No time to grab a snack at the office before heading home for dinner. Just trapped like a rat. Cornered. What was I going to say, “No, you do it alone. Take care of yourself. I’ll be fine.” No. I like sleeping in my bed. We’re in week two. I’ve strayed here and there. Don’t tell anyone.

One of the problems with the internet is you have all sorts of personalities in your life whether you like it or not. I’ve come to recognize Gucci Westman, Gothamista, and Wendy Myers. I don’t know that much about them. What I do know is they create hours of content that can result in Your Survival Guy hearing a loud slap of a laptop closing and these four awful words: “You should try this…”

Uh oh. Like I don’t have enough on my plate (I don’t).

Which brings me to our generator part that was slow to come because of the supply chain. The part is in. Installed. Generator is still not powering up properly. I’m told it’s another part, and that one should be here Friday. Swell.

You know stuff happens in threes, right? Dishwasher croaked out too. Plumber installed a new one a week later. Not a total disaster in the middle of a cleanse because there aren’t too many dishes, unless, of course, a soup is being made. That’s a two-day cleanup, no matter what. It’s like taking inventory of every pot and pan we own. Amazing how many we have.

Anyway, Sunday, I ventured down to our wine cellar. I was met by a pool of water seeping under the cedar closet door. The dishwasher install? Not so good. Rookie mistake. Insurance company is in the mix. You do the math. But that wasn’t the worst of it.

“Why were you in the basement?” she asked.

What Kind of Life Are You Investing For?

Wouldn’t it be nice to forget it all and live without a care in the world? Ah, the good life. Sounds pretty nice, doesn’t it? But is it really that good? Living the good life isn’t necessarily a healthy one.

Now let’s contrast “the” good life with “a” good one. Living “a” good life is hard. When you hear “John lived a good life,” you picture a different individual than when you hear “John, he lived the good life.”

As an investor, you want to live a good life. Nice and steady. No crazy ups and downs that push you out of positions, forcing a sale. Because that’s what can happen overnight with an investor who is living “the” good life as if investing is a party. It’s not.

The good life investor—maybe he’s a friend of yours—tells you all about his winnings and shows you his new foreign car to boot. Then when the lease is up, and the money’s gone, you don’t hear too much about how hard life got. You just know.

Now, an investor focused on living a good life is quiet. Laser-focused on slow and steady, just putting one foot in front of the other and compounding successes. Collecting dividends from stocks and interest from bonds. This investor understands it’s much easier to buy stocks than it is knowing when to sell.

Two lives. Easy to understand. One much harder than the other.

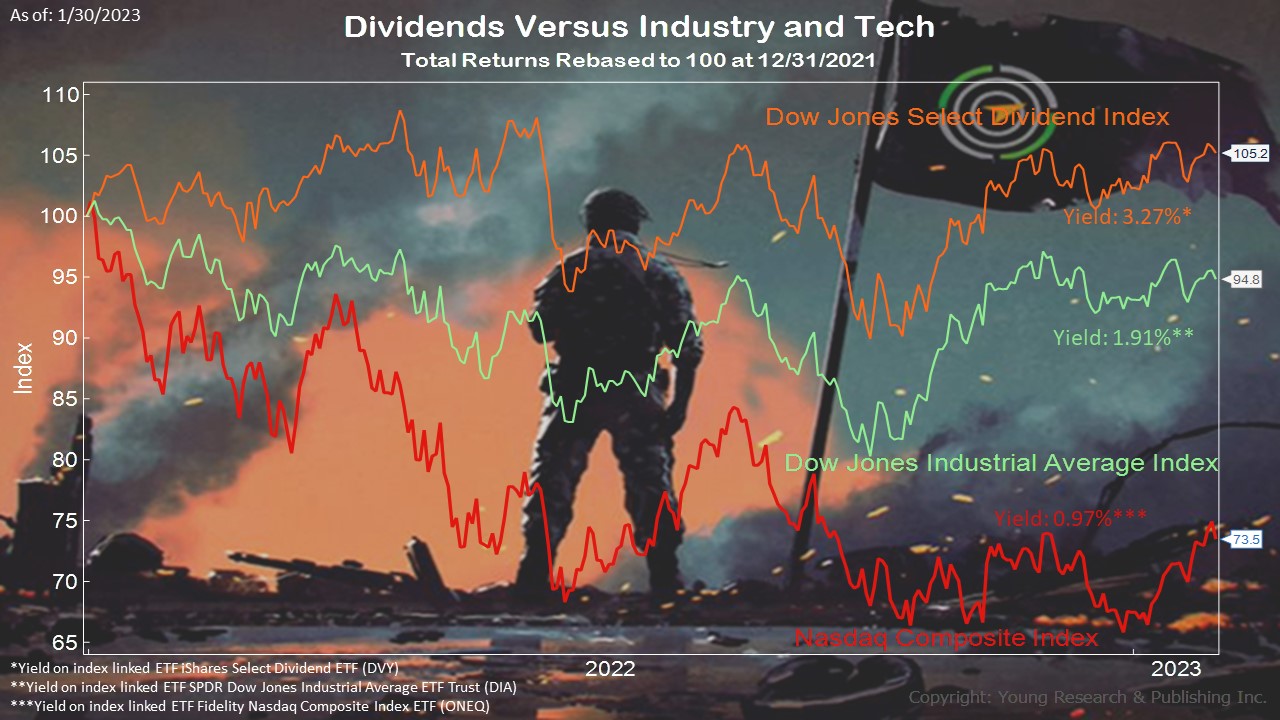

Look at these yields and understand stocks are selling for less than they were just months ago.

Invest with Peace of Mind and Comfort

When will the coast be clear, dear investors? Let’s take a minute and think about that question.

When investors were gobbling up tech shares at the beginning of this century, the crash that followed was brutal. The phrase “this time it’s different,” turned out to be wrong.

Later that decade, the idea that real estate values “would always go up,” also proved to be wrong.

What seems to me to be a better bet is to make sure you have an anchor to windward in full faith and credit Treasuries to help get you through thick and thin.

Hope is not a strategy. Look for safety and return of assets and not return on assets. It’s hard to do when most investors can’t handle the steady method of compounding.

The Importance of a Balanced Portfolio

For the person who can handle the slow and steady road to wealth, the importance of a balanced portfolio cannot be overstated.

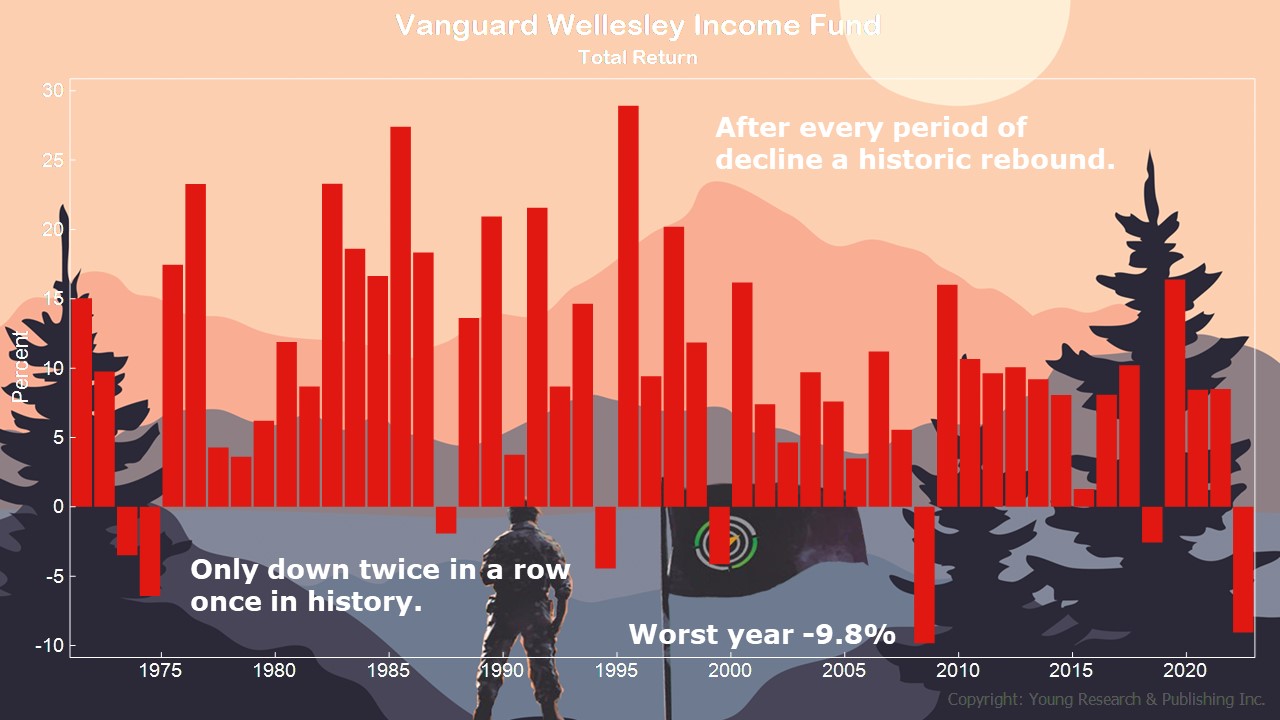

In 2011, I coined the phrase “Sleep Well-esley at Night” to capture the safety first, survivalist manner of the balanced Vanguard Wellesley fund.

It’s not an exciting fund. After all, close to two-thirds of the Vanguard Wellesley fund is in bonds. The rest is in stocks. The fund’s performance over time is a testament to the power of a balanced portfolio.

You can see in the chart above that during Vanguard Wellesley’s long performance history, the fund has had a big bounce back after nearly every year of decline, with only one instance of two consecutive down years in history.

A balanced portfolio is important, but I still encourage investors to be the owners of their own securities and to mostly eschew mutual funds. If you need help building a balanced portfolio of individual stocks and bonds, let’s talk.

Survive and Thrive this Month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. You’re not the only one seeking more return on your cash from your bank. Despite interest rate increases initiated by the Federal Reserve, banks have been slow to increase interest paid to savers. Non-bank players like Fidelity Investments are the beneficiaries of bank inaction, with money market accounts paying owners close to four percent. The Wall Street Journal’s Rachel Louise Ensign explains:

Wealthy savers are starting to take their cash out of bank accounts in search of higher yields.

Big banks are still paying paltry interest on checking and savings accounts despite the Federal Reserve’s steepest rate increases in decades. Their wealth-management customers are done waiting: They are moving the extra savings they accumulated during the pandemic into products whose rates have more closely tracked the Fed.

The typical savings account is paying a 0.33% interest rate, according to the Federal Deposit Insurance Corp. Treasury notes, money-market funds and brokered certificates of deposit, meanwhile, are all paying between 4% and 5%.

“Every time the Fed hikes, the opportunity cost of leaving idle cash in low-yielding accounts increases,” said Jason Goldberg, an analyst at Barclays PLC. “You’re seeing consumers who have extra cash being proactive with it.”

P.P.S. Your Survival Guy lost power last week and the worst part about it was I wasn’t at home. Why was that so bad? Because my significant other was home.

Making matters worse, our generator didn’t kick in. Imagine the horror going through my mind when I’m told it’s pitch black in the house and she’s all alone. I suggested walking out to the generator with a flashlight to get a look at it. That was met with silence. OK, then.

Long story short the power came back on within an hour. The generator part we need is on backorder thanks to the supply chain mess. That’s getting installed today in an hour or so.

Things break. Then the power goes out. You’re out of town. Things tend to go in that order. What can I say? Learn from me.

P.P.P.S. Turns out you don’t need to be young to be a success. As I wrote to you this week, there’s nothing wrong with being a beginner at different times in your life. Don’t just take my advice for it. Look at what this 93-year-old writes in the WSJ.

No one has seen entrepreneurship help minorities improve their economic circumstances more than I have—and that’s not only because I’m 93.

I saw the power of entrepreneurship firsthand after co-founding the Home Depot. My experiences led me to believe that preserving and expanding entrepreneurship is the key to advancing racial and economic equality.

Entrepreneurship offers all Americans, no matter their background, a way to achieve financial independence and the American Dream. Entrepreneurship rewards goods and services that the market values independent of the financial resources, SAT scores or personal pedigrees of the people selling them.

I didn’t start out in the home-improvement industry. I worked my way up the corporate ladder only to be fired by a capricious boss. When I found myself unemployed at 49, I had every reason to be bitter. But I turned to entrepreneurship, which made my life’s second act far better than I could have imagined.

With almost no money, I had the idea to open a hardware store, a lumberyard and a garden store all in one. What began as a single store in Georgia grew to more than 2,000 locations nationwide and made me a billionaire in the process. Only in America could a member of an ethnic minority from a poor immigrant family write that kind of success story.

Imagine what you can do if you’re not afraid to be a beginner. Beating inertia and making the first step are as important in your life as they are in investing. If you need help beating inertia and making the first step in investing, let’s talk.

Download this post as a PDF by clicking here.