Dear Survivor,

Last year I brought you the first installment of my Super States. The fundamental characteristic of a Super State is one that treats its citizens with respect, as though they were the state’s best customers. Businesses and citizens in Super States are encouraged and aided by state policies, not encumbered and held back by restrictions and regulations. Now, Your Survival Guy is pleased to present the Super States of 2022. This year my focus is on promoting the states where your freedom is a top priority.

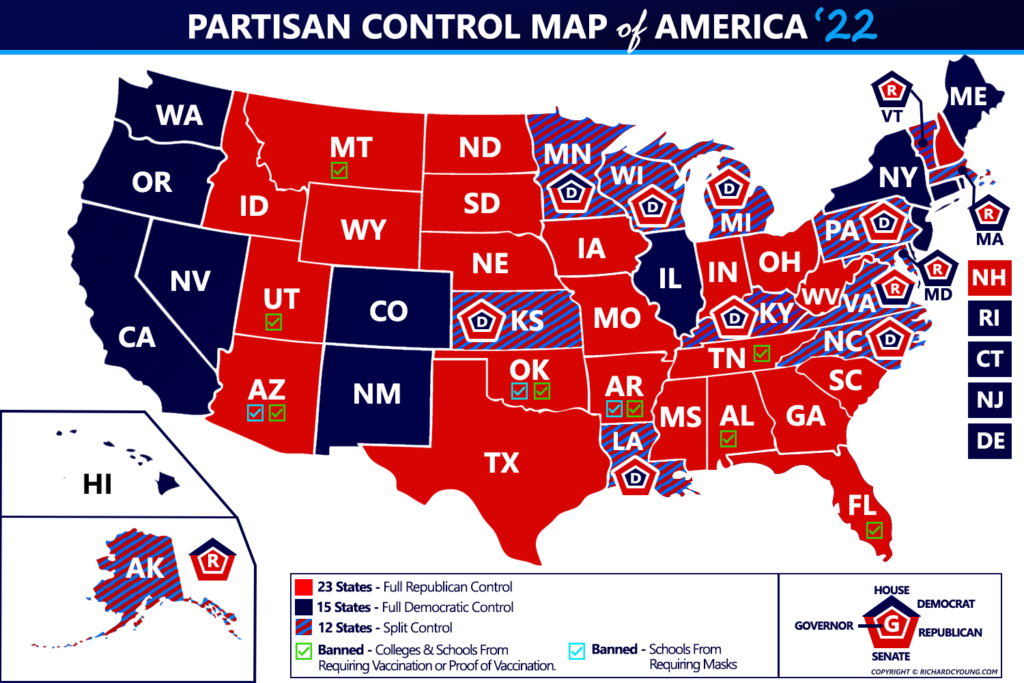

Here on the map, you see my Super States in green. States showing up in red are the ones from where you should plan your escape.

Your Survival Guy’s 2022 Super States

| Rank | Super States |

| 1 | New Hampshire |

| 2 | Idaho |

| 3 | North Dakota |

| 4 | South Dakota |

| 5 | Utah |

| 6 | Texas |

| 7 | Tennessee |

| 8 | Florida |

| 9 | Wyoming |

| 10 | Arizona |

| 11 | Georgia |

| 12 | Virginia |

| 13 | Oklahoma |

| 14 | Montana |

| 15 | Kansas |

| 16 | Indiana |

| 17 | North Carolina |

| 18 | Colorado |

| 19 | Iowa |

| 20 | Missouri |

| 21 | Nebraska |

| 22 | Wisconsin |

| 23 | Nevada |

| 24 | Maine |

| 25 | Massachusetts |

| 26 | Kentucky |

| 27 | Arkansas |

| 28 | Pennsylvania |

| 29 | Michigan |

| 30 | Connecticut |

| 31 | West Virginia |

| 32 | Vermont |

| 33 | Alabama |

| 34 | South Carolina |

| 35 | Minnesota |

| 36 | Alaska |

| 37 | Washington |

| 38 | Rhode Island |

| 39 | Mississippi |

| 40 | Louisiana |

| 41 | Oregon |

| 42 | New Jersey |

| 43 | Ohio |

| 44 | Delaware |

| 45 | Illinois |

| 46 | Hawaii |

| 47 | Maryland |

| 48 | New York |

| 49 | California |

| 50 | New Mexico |

Your Survival Guy’s 2022 Super States: #1 New Hampshire

Coming in at number one on Your Survival Guy’s 2022 Super States ranking is New Hampshire. Why? For starters, it’s a beacon of freedom in New England. And its motto is “Live Free or Die.” What’s not to love? Because in times like these it’s your FREEDOM that matters most. Look at the island of freedom New Hampshire offers to New Englanders, and you see why it tops my list. Plus, it’s a great escape from any city, including Newport, from seasonal crowds.

My family has been going to New Hampshire skiing for as long as I can remember. When I was a kid, we’d go to King Ridge, where you parked at the top and skied to the bottom. Over time my parents bought a house in Bartlett, and my family followed in their footsteps. It’s been a home base in the White Mountains ever since.

In America today, you are being told by the Federal government how to live. You’re seeing pressure to change the Electoral System in favor of a popular vote, which goes against the Founders’ ideas of the power of the states. The framers of the Constitution were not about democracy. They created a Republic—if you can keep it. It is at the state level, the laboratories of the country, where your Freedom will be cherished or kicked to the curb.

Governors like Chris Sununu of New Hampshire and Ron DeSantis of Florida understand this, and they are welcoming Americans home with arms wide open. If you don’t have a freedom state to escape to, it’s time you find one.

What a Way to Make a Living

Your Survival Guy recently kicked off his “What a Way to Make a Living” series, and it’s not about Dolly Parton’s “9 to 5.” Because let’s not forget that before work, there’s that long, early morning commute into a big, blob city, only to do it again in reverse at five, and maybe get home by seven? Then feed the kids. I hope those days are over. Because the megatrend of living where you work and working where you live is here to stay.

Your Survival Guy’s focus is on you. How can you improve your life and that of your family? I talk with hundreds of investors like you every month and can tell you there is a key to their happiness. Sure, being close to family and friends helps, but the key is having enough money to make it all work. Without money, you don’t have your ticket to freedom—the freedom you truly deserve.

Luckily for you and the next generation, retirement, and work will be whatever you want it to be. The groundswell of possibilities is massive—it will help eliminate the long, hard slog of enduring so many commuting hours a day to get to your job. Sure, it’s going to take some thought to figure it out. And it might not be as lucrative (at first, that is). But with some thought and care, I believe you can have the retirement life of your dreams.

Your Survival Guy didn’t start off successful. When I lived in Everett, MA, it was exhausting commuting 30 to 60 minutes to and from Boston, working at the World Trade Center at Fidelity Investments. Then, after saving my money, I moved to Watertown, MA, shaved a few minutes off the commute and watched most of my savings disappear to rent. It was when my team got moved to the suburbs of Marlborough, MA, that a light went off, and I asked: “Self? Why are you paying all this money in rent?”

All of a sudden, Your Survival Guy’s real estate arbitrage became doable. I could replace my high-cost rent with a mortgage and live where I worked—an impossibility in high-cost Boston. Literally, overnight, my life changed. I bought a three-family, rented out the top two floors, and moved into the three-bedroom first floor with two roommates and never looked back. I’ve been in the ownership society ever since.

The American Dream is alive and well if you have a plan. Yes, you can live where you work and work where you live. Stay tuned. More to come: What a Way to Make a Living.

Survive and Thrive this Month.

Warm regards,

E.J.,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

- You can also follow me on Gab, MeWe, and Gettr.

P.S. In my conversations with you, you’re telling me without saying a word that you’re weary. You’re exasperated. And you’re excited to vote the bums out in November. But it’s a long time between now and then—and what is Trump going to do? Does he even like DeSantis?

In my conversations with you, you’re telling me about your water situation. You have well water. You’re looking for a water filter if things break down. You know I like the Zero Water filter and own a Berkey water filter system. Can you improve your water situation? Find out with my special report, Emergency Water Storage: How Much, Containers, Purification & More.

How did we get here? How did we get here with the narrowest of margins? Where we’re at the mercy of #bareshelvesbiden, Fauci-ism, corporate elites, and “the science” that’s anything but. And do we get an “I’m sorry” from spokeswoman Psaki? Hardly. It’s a smug blame game like #NEVERapologize— just scurry away.

What if there’s a landslide in November? Do you really think our problems are behind us? That the political virus is stamped out for good? Regardless of who’s in office, the twin-headed deep state/corporate elites will meet in Davos. This is how the GREAT RESET works. They’re still around, with or without our votes.

When you think about the carnage at the expense of MAIN STREET—all the small businesses that went out of business never to return—it’s devastating. They’re DEAD. Maybe they rise again. But that’s no thanks to the way they were MURDERED by LOCKDOWNS—through no fault of their own.

And how about the “Ivy” Towers of the university class—where the college experience is anything but? What are they learning? That we’re the problem, and that at some point this masked generation is coming for US? Because how they’re being taught is HOW NOT TO BE FLEXIBLE—end of discussion. NO BOOSTER, no admittance after winter break. I wish it were as simple as RED state vs. BLUE state, but it’s not.

When there’s no compassion for YOU, there will be fractures. You cannot have a country of 50-states when half the population doesn’t believe in its foundational document. It’s a REPUBLIC of ideas—not a popularity contest—but that’s exactly what’s being demanded.

P.P.S. When was the last time you rented a U-Haul? You know those big moving vans, not a pickup truck for weekend projects. I’m guessing it was to move a son or daughter or perhaps your family. I’ve rented a big moving van twice in my lifetime, and both were big moves.

The first time was moving from Boston to the suburbs when I was working at Fidelity Investments and bought a multi-family. The second was when we moved into our home in Newport, RI. Typically, when you rent big moving vans, it’s a big, big, deal. You’re leaving one life behind for a new one. It’s not like the flocks of snowbirds departing from Boston’s Logan airport for Miami at the first sign of frost. This is M-O-V-I-N-G.

And because of Covid, you leave the city. You look for places where you can afford a house, a yard, and a dog. That math doesn’t work in cities, and it certainly doesn’t work in many of the blue-state city burbs like San Fran or NYC. And in places like Chicago, no one wants to teach the kids anyway, at least not in person. What’s the point?

It’s Movin’ Time.

Check out this WSJ article The Great Pandemic Migration, II – WSJ

Data keep piling up on where Americans are moving, and the pattern is clear. In the second year of the pandemic, people continued to ditch the coasts and Great Lakes in favor of less dense, more affordable climes.

That’s the finding of the latest National Movers Study, released Monday by moving company United Van Lines. The survey ranks the states that drew large shares of move-ins in 2021, with a corresponding list of the biggest losers.

The largest net gain belonged to Vermont, where 74% of moves were inbound. The rest of the top five includes South Dakota (69%), South Carolina (63%), West Virginia (63%) and Florida (62%).

One common theme is affordability. West Virginia, South Dakota and South Carolina all placed in the bottom third of states by median home price, according to the index site World Population Review. Nearly half of the moves into Vermont and Florida that the survey captured were among households earning more than $150,000 a year, likely relocating from pricey spots in the Northeast.

New Jersey was the biggest loser for the fourth consecutive year, with 71% of its moves heading out. Next on the departures list were Illinois (67%), New York (63%), Connecticut (60%) and California (59%). The trend here is easy to spot. The states Americans left in droves are among the most expensive in the country. Home costs are high in part because of zoning and regulations. These states also have some of the highest tax burdens.

The popularity of the Sunbelt is often chalked up to nicer weather, but that can’t account for the trend toward Idaho, the Great Plains and western New England. No matter the weather, the top states for movers have more open spaces compared with the states that lost residents. This low density often corresponds to lower crime as well as greater resistance to pandemic lockdowns.

Americans vote with their feet, as well as their wallets and ballots. They are sending a message to high-tax, ill-governed states.

P.P.P.S. Investors who loaded up on S&P 500 index funds are beginning to understand the truth behind the S&P 500. Big component companies like Disney, Netflix, Salesforce.com, and Twitter are fueling a sell off. That’s not to mention Apple, where a sell off has erased over 6% since the beginning of the year, when Apple was worth as much as McDonald’s, Walmart, AT&T, Philip Morris, Berkshire Hathaway, Proctor & Gamble, JP Morgan Chase, Starbucks, Boeing, Deere, and American Express combined.

The number of securities at 52-week lows each day is higher than normal. That’s a bad sign. Gunjan Banerji and Peter Santilli report in The Wall Street Journal:

More than 220 U.S.-listed companies with market capitalizations above $10 billion are down at least 20% from their highs. While some have bounced from their lows, many remain in bear-market territory. They include S&P 500 behemoths like Walt Disney Co. , Netflix Inc. NFLX -2.48% , Salesforce.com Inc. and Twitter Inc. TWTR -2.65%

The tech-heavy Nasdaq Composite has been particularly turbulent. Around 39% of the stocks in the index have at least halved from their highs, according to Jason Goepfert at Sundial Capital Research, while the index is roughly 7% off its peak. At no other point since at least 1999—around the dot-com bubble—have so many Nasdaq stocks fallen that far while the index was this close to its high, Mr. Goepfert said.

The selloff in many individual stocks highlights how shaky the stock market’s 2022 has been. U.S. stocks last week posted a second-straight weekly decline, dragging the S&P 500 and Nasdaq down 2.2% and 4.8%, respectively, to start the year. Some stocks and sectors have moved even more dramatically.

“There’s been a lot of disruption and divergence between winners and losers,” said Ilya Feygin, a managing director at WallachBeth Capital.

Many investors have been positioning for the Federal Reserve’s shift to raising interest rates this year. That has sent Treasury yields to the highest level since 2020, while bond prices have tumbled, rippling across the market.

A turning point, traders said, was when the Federal Reserve in November warned of tighter monetary policy ahead, abandoning the notion that the current bout of inflation would be short-lived. That triggered a selloff in shares of speculative growth companies that had been popular in early 2021.

Investors have continued to re-evaluate those companies, alongside other tech stocks, in the new year. For example, Cathie Wood’s flagship fund, the ARK Innovation ETF, has lost 15% this year and is down around 50% from its 52-week high, or in a bear market.

You’ve known for some time that the S&P 500 was teetering on the gains of a few big firms and that an alternative is a portfolio of individual stocks. If you need help building an investment plan, I would love to talk with you.

Download this post as a PDF by clicking here.