Dear Survivor,

Your Survival Guy received some Christmas emails asking about a certain economist’s stock market prediction that the bubble’s about to burst.

My take? Why ruin Christmas? Maybe he’s right, maybe he’s wrong. What I know for sure is he’s in the business of selling books and making headlines. That’s not acting like a fiduciary.

I remember back in 1998 when this same economist wrote a book calling for the roaring 2000s. The roar turned out to be the sound from investors pummeled by the tech bust a few years later.

Then he called for, in 2004, another boom to come, taking a pass on the most recent foul ball. That boom turned out to be shrapnel from the housing crisis that ruined investors for a generation.

Not to lose stride, the same Mr. Nostradamus called for the 2010s to be a bust instead of the Fed-fueled boom that occurred. Another boat missed. Do you see the trend?

Now, he’s calling for a stock market bust. You know what they say about a broken clock.

If investors simply came up with a plan all those years ago and stuck with it, they wouldn’t have to worry about whether we’re going to see a boom or a bust.

Your Survival Guy’s been invested and operated as a fiduciary all through the years of this prediction and that. And I’m here to write; I’m still working side by side with you, dear readers.

When a prognosticator is in the business of selling books and headlines, be careful to check your emotions at the door.

Big Bets: Wellesley Fund vs. Jekyll and Hyde

We live in a world of big bets. You can’t watch a sporting event without being bombarded with advertisements for ways to bet on it. You can’t read about investing without ads on this “winning” strategy or that one. And this isn’t about the “kids” because Baby Boomers are buying bonds in one account while trading options in another. They’re what I call the Jekyll and Hyde investors. And they’re everywhere.

I get it. It’s hard to be “safe” with your money. Yes, you know how hard it was to make it, but “look at the opportunities out there,” you say to yourself. You subscribe to this system or that, and before you know it, you’re trading with the stars. That is until a once-in-a-generation Black Swan comes swooping in, and the investor begins losing money, like always. “It’s not my fault,” he says, usually adding an excuse to justify the losses.

Your Survival Guy works too hard for his money to play these games. I have a front-row seat to the psychology of the investor. I know exactly how it all played out many times before this century, and like a broken record, it will play again and again—and again. No one learns because they feel like they have the magic touch or that, this time, it’s different. It never is.

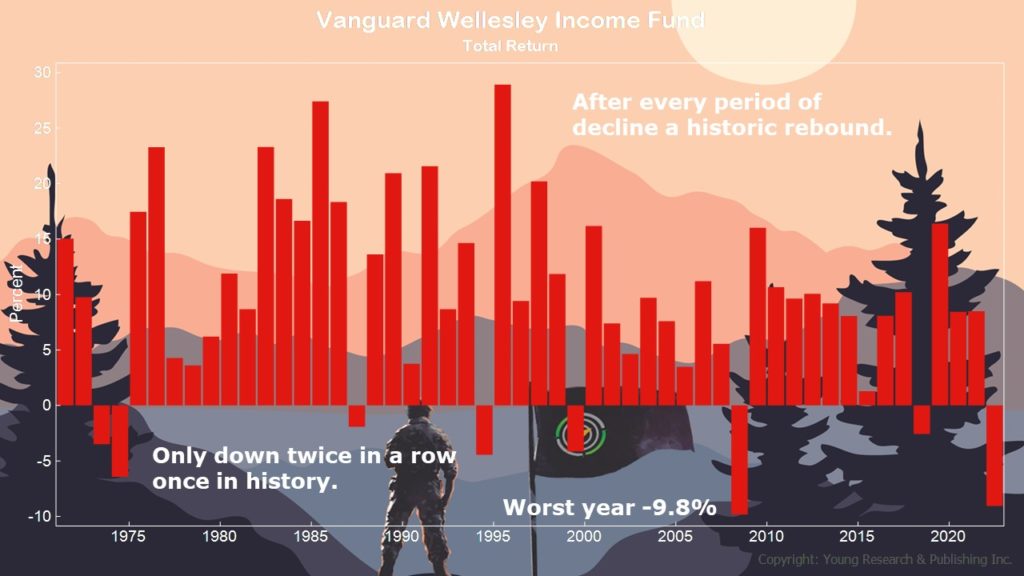

I want investing to be boring. I want investors to embrace the income generated by my balanced strategy, similar to the bond and stock approach taken by the Vanguard Wellesley fund. I am not a fan of the Jekyll and Hyde approach, where one side could be completely wiped out.

Work with an advisor to help you craft an individual mix of stocks and bonds. If you can’t, then my next best choice is a Wellesley-style balanced fund, not the Jekyll and Hyde strategies we hear so much about or, more often, don’t hear about because nobody tells you about their losses.

“Take Cover! Get Out of the Market!”

In my conversations and emails with you, you tell me about the many predictions being made for next year. As I wrote above, one economist, who seems to be wrong at every turn, is calling for a major correction next year—predicting the stock market bubble will burst. Another manager up in Boston is calling for one, too, and has been for a while.

I’m not looking to pile on with criticism. But you may have heard another hedge fund guy on Fox talk about commercial real estate “opportunities” as if he’s talking up his book to dig out from losses. Whether it’s his book, a real book, or the company’s book, everyone’s got an opinion to sell with the hubris to boot.

When institutional players offer advice to buy, hold, or sell (a rarity), they always seem to be investing in some form of 60-40 stocks to bonds. Grabbing headlines is an injustice to readers because the message comes across as “take cover! Get out of the market!” Which is not what many are doing who actually manage money. The authors? Well, they can say whatever they want. They’re not in the trenches side by side with you. No boots on the ground, so to speak.

The greatest tool you have as an investor is not what you invest in but how you invest. Do you have the Top 10 Investing Habits of the Fairly Wealthy, and do you know the Top 10 Investing Mistakes to Avoid? Successful investing, as my father-in-law Dick Young reminds me, is about “temperament, Survival Guy. You either have it, or you don’t.”

Know thyself, dear reader. If you need a plan, I want to help. You don’t have to go it alone. When you’re ready to walk this road together, I’m here.

Survive and Thrive this month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. Your Survival Guy and Gal recently spent some time in Key West, our home away from home. On one hot sunny afternoon, we decided it was five o’clock somewhere and strolled down to Schooner Wharf for some barbequed shrimp, oysters, and beer. We could have stayed all night, but dinner was at six.

With not a lot of time to spare, we decided to take a shortcut and walk through the cemetery. If you’ve been, you know it’s high ground (if you can consider anything high ground in KW), and the sunsets are amazing. The full moon made it especially eerie. “Let’s pick up the pace,” Your Survival Guy thought to himself, passing a tombstone I imagined read, “I Told You I Was Sick.”

Approaching the exit, my fears came true. The gate was closed. Wrapped in chains, we were trapped like rats with nowhere to go. Your Survival Gal suggested we jump the fence. Self-preservation kicked in, and Your Survival Guy, dear friends, realized he might be left behind. “We can’t make it over,” I said. “I can,” she said.

Walking together, thankfully, back to the main entrance, it hit us. When we first arrived, we saw a guy scurrying around, it turned out, to lock the place up. (I wonder if he was laughing to himself). Thanks for the heads up. And sure enough, the main gate was locked up tight for the night. “Hold this,” Your Survival Gal said. And before I knew it, she was under the fence like a Nave SEAL—a move not possible by most down on Duval Street.

That’s when Your Survival Guy’s self-preservation kicked in again, and somehow I made it under, stood up, and read “Gates Close at Six.”

At least we had a good story to tell our new friends at the bar. Cheers.

Do as a say, not as I…

P.P.S. The pressures of the holidays are building. Don’t let this infiltrate your investments by making moves you may regret. Don’t buy mutual funds right before a distribution you may owe taxes on next year.

But do consider making moves where you might benefit from spreading tax obligations over several years.

It’s also a good time to consider topping up contributions to tax-deferred accounts. Morningstar’s Julie Virta reminds readers:

For many workers, access to a 401(k) or similar account is one of the easiest ways to save for the future, while also getting a break on current- or future-year taxes. Most plans allow for tax-deferred contributions, while some also allow for after-tax contributions through a Roth account. The earnings on the former accrue on a tax-deferred basis, while the latter compounds tax-free.

Of note, withdrawals from a Roth account are tax-free only if you’re over age 59½ and have held the account for at least five years. You’ll owe taxes on withdrawals from a tax-deferred account and a potential penalty if you are under age 59½.

Contribute at least enough to capture an employer’s match if one is offered. You don’t want to leave any free money on the table. Additionally, you can continue to contribute up to $22,500 for 2023, or up to $30,000 for those age 50 or older. Workers who haven’t hit that max limit — and who want to — may be able to boost contribution amounts in the last few weeks of the calendar year.

P.P.P.S. When an athlete has had a stellar career, going beyond greatness to achieve excellence, they are often inducted into their sport’s Hall of Fame at their earliest eligibility. These are called “First Ballot Inductees,” and they occupy a place even above the other Hall of Famers. Your Survival Guy is creating his own Hall of Fame, one for people who really save til it hurts. These are hard working Americans who live frugal lives and activate the power of compound interest to amass huge fortunes.

The first such individual you read about here on YourSurvivalGuy.com was Ronald Read, a gas station attendant from Vermont who amassed an $8 million fortune by the time he passed away at 92 years old. Then you read about New Hampshire odd-jobber Geoffrey Holt, who left a $3.8 million fortune to his town when he passed away, despite not owning a car or television.

Now, meet the latest inductee to the Save Til It Hurts Hall of Fame, Terry Kahn, a Veterans Administration employee from Indianapolis, who recently passed away, leaving $13 million to charity despite living a life of frugality. Martha Williams reports for the Daily Mail:

A very frugal man left a whopping $13 million to local charities after he passed away – but some organizations missed out on millions by thinking it was a scam.

Terry Kahn worked for the Veterans Administration for 30 years and quietly passed away in 2021 – with no announcement or obituary because they were too expensive.

The modest Indianapolis man left behind no immediate family – saying only to donate his money to ‘charity’ in his will, but not specifying which one.

Kahn’s attorney Dwayne Isaacs had the unique job of calling local charities and casually offering them millions of dollars.

While some charities were overwhelmed by the kindness – others were wary of the remarkable offer: ‘Probably three or four different entities that lost out because they just didn’t take my call,’ Isaacs told CBS news.

Kahn made his millions by pinching his pennies. He lived in a modest house in south Indianapolis and drove an old Honda.

The secret millionaire refused to carry a cellphone because they cost too much, he said.

His penny-saving ways paid off in the long-run because he made a huge difference for a dozen nonprofits that got to share his $13 million estate.

Is there a “secret millionaire” living on your street? Maybe it’s you. If you save til it hurts, it could be. When you want help, let’s talk.

Download this post as a PDF by clicking here.