Dear Survivor,

A few years ago, at a Cato event, Your Survival Guy and Gal had the great pleasure of sharing a table with billionaire investor Jeff Yass, among others. All was going swimmingly until the keynote speaker, investor Ken Fisher, took to the podium and told the room his net worth was more than everyone else’s combined.

Way to ingratiate yourself with the room, right?

During the Q and A, Fisher made some comment that he was one of the most successful people in the history of America. Yass took issue with that and when Fisher asked him to name someone more important said, “For starters, Thomas Jefferson.” Fisher’s comment about his net worth and self-importance could not have been more off-base.

Which brings me to Jeff Yass and his excellent editorial recently in the WSJ. In his piece, he explains how the investing class gets blindsided by inflation.

Plain and simple, inflation is a monetary event. Those living paycheck to paycheck see it monthly, while the investing class doesn’t. They see their increase in prices as wealth. That’s a mistake.

Because many in the investing class believe they’re wealthier and live life accordingly. But a portfolio that was $1 million and is now $1.2 million is not a product of productivity gains, it’s from inflation. It will cost the wealthy investor $200k or more over a lifetime for vacations to Paris, second home repairs, country clubs, and home remodeling, to name a few.

“Hey, Survival Guy, what’s your point?”

Instead of looking at portfolio prices and their wealth, they may want to consider taking a disciplined approach to their spending habits.

Here’s an exercise for you: Once a year, grab a napkin, jot down what 4% of your portfolio is, and don’t spend a nickel more than that. And if you can save that extra cash in good years when “prices” are higher, then do it. Better yet, buy an eclectic mix of Your Survival Guy-type stocks—those that are the bedrock of the economy and tend to be dividend-centric.

Is the 60/40 Balanced Portfolio Model Broken?

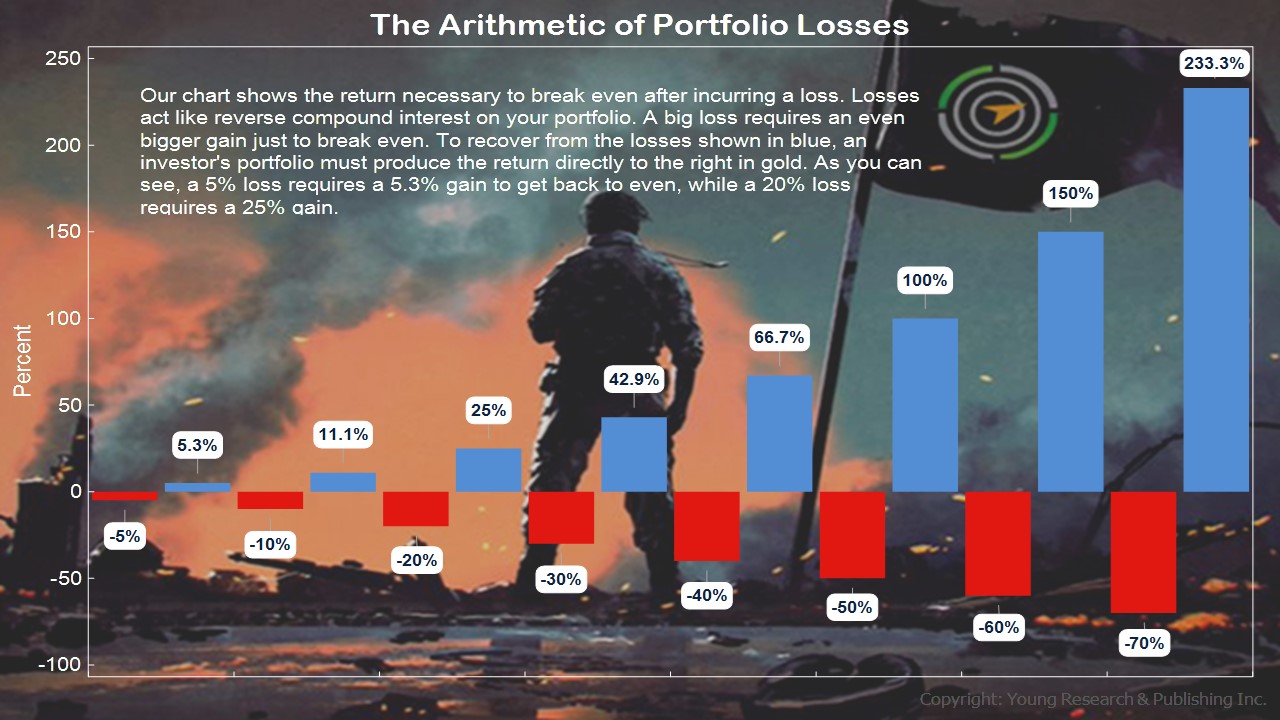

You may have read the recent WSJ article on the perils of the 60/40 portfolio model, where 60% is stocks and 40% is bonds. Don’t believe it. Because what the article fails to mention is the arithmetic of losses and the emotionalism of investing. But first, let’s get into your spending habits.

Spending is one of the more difficult tasks an investor faces, and if interest rates decline, it doesn’t make it any easier to do. One exercise you want to do is to keep track of your spending. Understand your monthly, yearly, and three-to-five-year costs. This is not rocket science; it just gives you a better feel of what you spend money on, and yet it can also be a moving target.

Back to the WSJ article for a minute. What the article doesn’t get into is how long-term investors like Warren Buffett can hold 90% of their assets in stocks. News flash: WB’s 10% in cash or bonds is larger than the entire portfolio of the one percent of the one percent. He’s got some wiggle room. But for Main Street investors, it’s the anchor to windward of bonds that helps them get through disastrous stock corrections.

As Ben Graham advised, investors should have a 70-30 mix of stocks-bonds or somewhere in between, but not less. Because when stocks fall, someone is selling and putting downward pressure on prices. But if you have income coming in from dividends and interest, you may be able to ride out the storm better than the investor who owns 90% in stocks.

Remember, the emotional side of price declines in stocks can make investors uneasy and create momentum in the wrong direction. A balanced portfolio can help weather the ups and downs of stocks.

Investing in a World of “Big Bets”

We live in a world of big bets. You can’t watch a sporting event without being bombarded with advertisements for ways to bet on it. You can’t read about investing without ads on this “winning” strategy or that one. And this isn’t about the “kids” because Baby Boomers are buying bonds in one account while trading options in another. They’re what I call the Jekyll and Hyde investors. And they’re everywhere.

I get it. It’s hard to be “safe” with your money. Yes, you know how hard it was to make it, but “look at the opportunities out there,” you say to yourself. You subscribe to this system or that, and before you know it, you’re trading with the stars. That is until a once-in-a-generation Black Swan comes swooping in, and the investor begins losing money, like always. “It’s not my fault,” he says, usually adding an excuse to justify the losses.

Your Survival Guy works too hard for his money to play these games. I have a front-row seat to the psychology of the investor. I know exactly how it all played out many times before this century, and like a broken record, it will play again and again—and again. No one learns because they feel like they have the magic touch or that, this time, it’s different. It never is.

I want investing to be boring. I want investors to embrace the income generated by my balanced strategy, similar to the bond and stock approach taken by the Vanguard Wellesley fund. I am not a fan of the Jekyll and Hyde approach, where one side could be completely wiped out.

Work with an advisor to help you craft an individual mix of stocks and bonds. If you can’t, then my next best choice is a Wellesley-style balanced fund, not the Jekyll and Hyde strategies we hear so much about or, more often, don’t hear about because nobody tells you about their losses. Let’s talk.

Survive and Thrive this month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. The Fed is in the inflation business. Look at the value of your dollars in gold today. In 1942, a dollar was worth 1/35th of an ounce of gold. Today, a dollar is worth 1/2465th of an ounce of gold.

Since gold-dollar convertibility was ended in 1971, the value of the dollar has fallen by 87%. Americans born in 1971 still have years of work ahead of them before retirement. They have worked their entire lives while watching the value of the dollars they saved eroded by bad fiscal and monetary policy.

P.P.S. Your Survival Guy has a couple fireside chat-type stories for you. Instead of being by the fireside, though, this one occurred in my family room recently, like they often do, between Dick Young and me.

I was telling Dick about a new client who is joining us and how it had been 23 years since he and I last spoke. I was 29 at the time, a few years into my tenure working with Dick and Matt. The prospective client and I had some great conversations, but in the end, the timing wasn’t right. Now it is.

“Survival Guy,” Dick said. “They join you when they’re ready. I’ve always told you that, right?”

“Absolutely”

“We’re in the relationship business,” he said. “We don’t put pressure on prospective clients. We’ve never been about the hard sell. That’s not us. We keep them informed about our way of thinking, and when a connection is made, it’s made. It’s that simple.”

“I hear you,” I said. “It’s true.”

This prospective, soon-to-be client kept in touch with us through the years by reading Richard C. Young’s Intelligence Report and then www.richardcyoung.com. “My favorite pieces are on Ron Paul, and I find what you guys are putting out there helpful and a nice way to keep in touch with your thinking,” he said.

Which reminded me of a conversation I had a few years ago with a client commenting on www.richardcyoung.com. “Can you guess who my favorite author is?” he asked as I waited for the compliment. “Debbie.”

My second story for you today is what Dick and I talked about next. Inflation. “Survival Guy,” he said, “your clients are facing inflation many multiples higher than what the government is reporting. If they see something they like that brings value to their lives, tell them don’t wait until prices come down. That’s not happening. They need to buy what’s valuable to them now, not tomorrow.”

There you have it.

Stick with Your Survival Guy and the Youngs. You have all the time in the world to make the right decisions for your family. This is not a race. Too often, investors are looking for the home run today, only to strike out tomorrow. Breathe in, breathe out, move on, and you’ll be just fine.

P.P.P.S. Why invest with us when you can simply buy an index fund with your savings? Good question. When costs are low, why not buy cheap funds? It’s worked out well so far, right? The problem is it may not last forever, and a downturn may not happen on your schedule.

That’s one reason I like individual stocks. With them, you may have more control. Another is that stock commissions are basically free, which levels the playing field.

You can see how the index fund has become a commodity, with everyone jumping in the same boat. A forced buying strategy, regardless of anything else other than it must be bought because it’s in the index. But what happens when Baby Boomers start selling to fund their retirement?

When I think about this strategy, it makes me think of one phrase: Time is running out.

When the S&P 500 gets top-heavy, you need to have time on your side if a big correction comes your way, especially in retirement. Because in retirement, you no longer have all the time in the world. Buying an index fund when you’re young may work wonders, but maybe not when you’re in retirement. Many will have to wait and see.

Look at the top names in the S&P 500, and you can see how much weight they carry in percentage terms. As a market cap weighted index, it’s the big dogs that row the boat. But what happens if they fall overboard?

A more equally weighted approach in constructing a diversified portfolio can help you avoid sector weighting risk. This isn’t a casino. It’s your retirement. When you’re ready to talk, let’s talk. But only if you’re serious.

Download this post as a PDF by clicking here.