Dear Survivor,

Our dog Louis passed away on April 17th. He was thirteen. When he was a puppy, our kids were in elementary school.

“Hi, Mom,” one said. “We’re home.” That was our cue to release him from around the corner to meet them for the first time. And that was the beginning of Louis doing almost everything with us.

Trips to the grocery store. Riding shotgun to pick up burgers, pawing at me to share a fry. Walking the beaches and going on hikes. Long car rides to New Hampshire in the back with the kids watching them unwrap their sandwiches. And kayaking down the Saco River, which he preferred to swim.

When we swam off the boat in Newport, he jumped right in after us because he thought we were drowning. He’d splash at our shoulders as we sank with laughter. He’d sit on the bow, growling at nearby moorings. His eyesight was excellent (more on that in a minute).

We realized we needed more discipline. We found a trainer with German Shepherds and rescue dogs. It was basic training for Louis and for us. The video updates looked like he was part of the pack.

Even as a puppy, he was punching above his weight. Two Thanksgiving eves were spent at the New Hampshire vet getting him stitched up. Going off to the dog park made us tense until he came home wagging his tail—thankfully incident free—wiggling his way into us: “Who’s ready for a walk?” his bark would imply, never seeming to tire.

About his eyesight. When the TV was on, he would quietly pay attention, watching and waiting for dogs or horses to appear. Then, when they did, he’d fly out of nowhere, running at the TV, crashing into the piano bench. Imagine dinner and Downton Abbey begins.

Why do we put ourselves through this? Knowing they’ll be gone in the blink of an eye. Because we would do it all over again.

When Louis was sick, we watched In Restless Dreams: The Music of Paul Simon. In “The Boxer,” the cannon fire sound is the resonance of an empty elevator shaft, an emptiness we feel today. Louis fought to be with us until he couldn’t anymore. He was our good boy right to the end. We love and miss him so much.

The Hardest Part About Losing Our Dog Louis

The hardest part about losing our dog Louis is how losing him brought back feelings for others we’ve lost. That feeling of loss resurfaces. That and the quiet. The house is quiet. It’s missing a life that was literally just there. Certain times of the day are harder than others. The mornings and coming home from work are tough. It’s jarring when daily rituals stop.

“Will you get another?” I’m asked.

Time will tell. It hurts to lose.

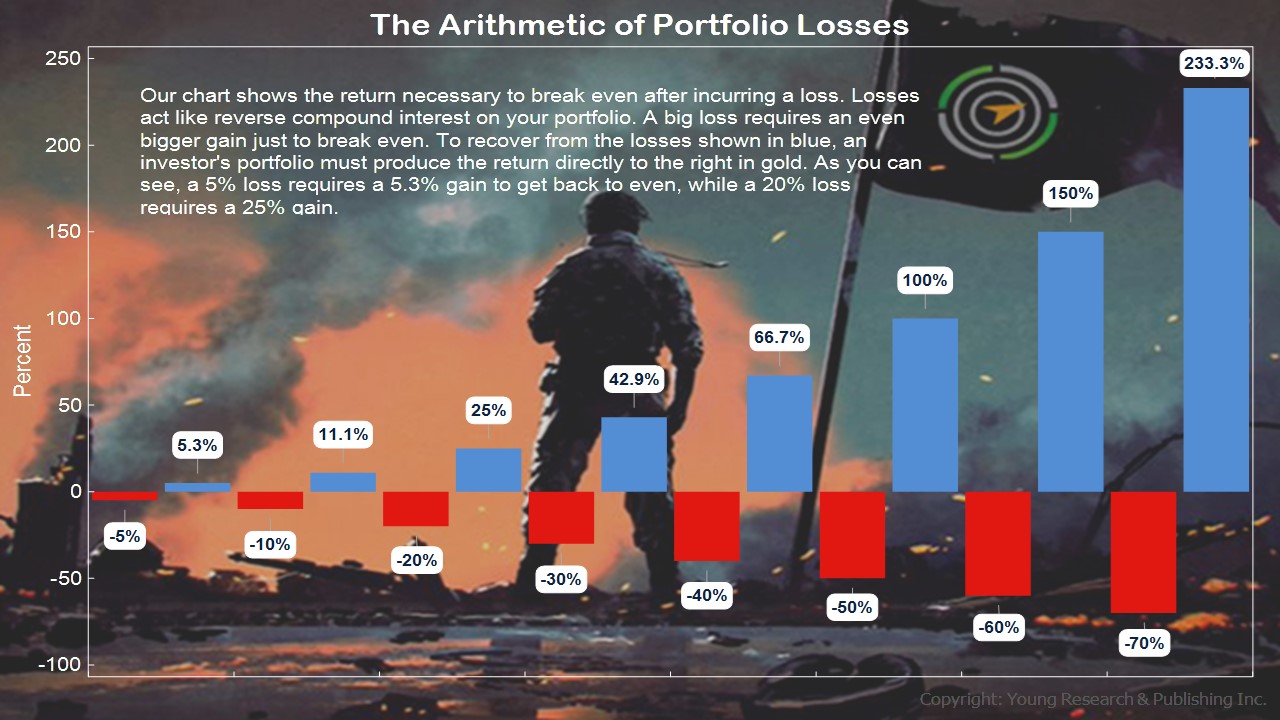

It hurts to lose anything, money included. There are memories that go along with those dollars you earned. I remember cutting lawns and scooping ice cream. I can’t work those wages again. They’re gone. But I have the memories and the lessons.

But remember this: there’s no such thing as “Oh, you can afford to lose. You have plenty of money.” It’s like saying I’m OK losing our dog Louis. That’s not how life works. A loss is a loss.

It’s why losing money is twice as painful as making it. And loss is one of life’s tragedies.

Most investors learn the pain of losing money the hard way. Don’t lose money. Don’t mistreat precious memories. Those days are gone. But you can keep them forever.

“What Do You Do If the Market Crashes?”

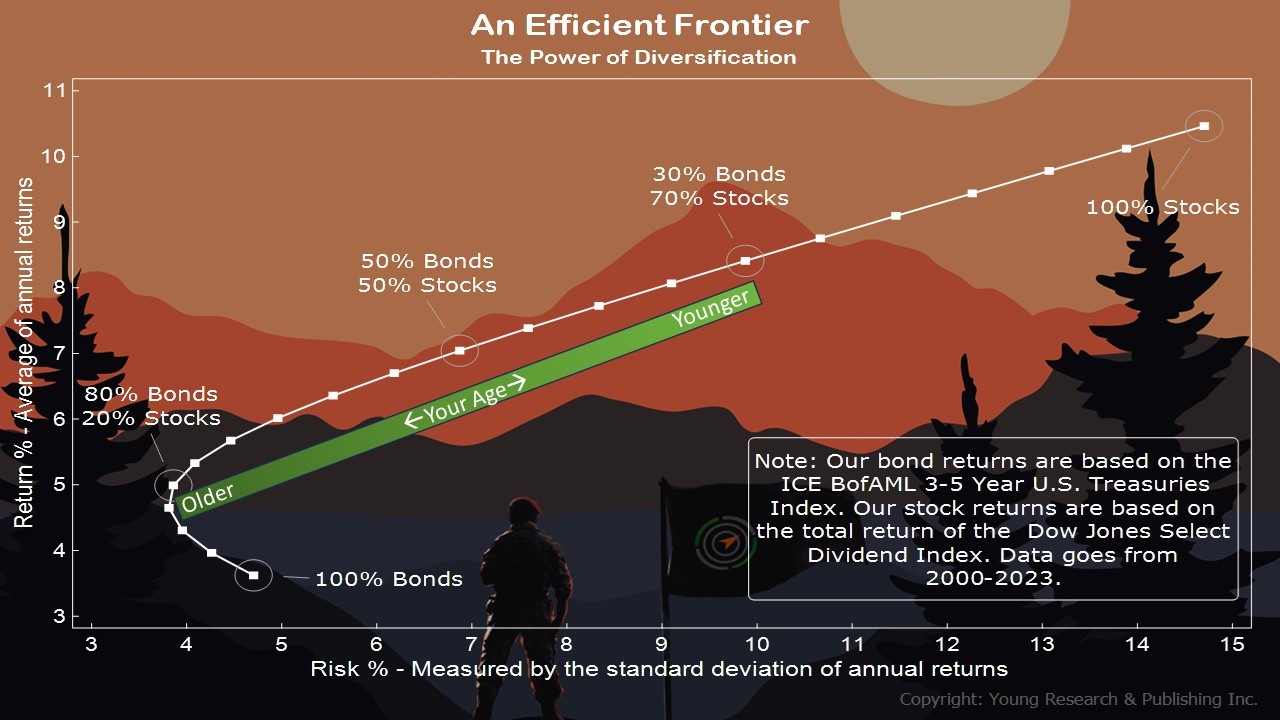

“What do you do if the market crashes?” a new client asked me recently. “Good question,” I said. “I get that one a lot.” And it’s one of the reasons I’ve been writing to you, valued reader, on my efficient frontier study.

The efficient frontier is a visual expression of my phrase, “It’s not what you invest in, but how you invest that matters most.” In other words, in a diversified mix of stocks and bonds, what was the risk and reward?

How does Your Survival Guy get through tough markets? I listen to those who guide me with their decades of experience, like my father-in-law Dick Young and the late Jack Bogle, who said: “Don’t just do something, stand there.” Easier said than done, especially in your retirement life when you no longer receive a paycheck, and you feel like you’re on a tightrope crossing the Grand Canyon.

Figuring out how you’re going to survive after your working years is scary stuff. During your career, you were a hunter and a gatherer of sorts, working, working, working every day. Those skills, being aggressive for example, aren’t always the skills that bring investment success in retirement, where it’s the wisdom of what not to do that may prevail over the spinning, trading, and hunting.

Imagine sitting around a campfire in your retirement life after a most memorable day. Your kids and grandkids are gathered around, telling stories about the highlights from the day. As you begin to speak, everyone gets quiet. You didn’t sign up to be the “wise man” but whether you like it or not, what you say will be remembered.

Why not practice what you preach?

Putting your tribe in a position of strength from one generation to the next—passing on wealth requires, as my father-in-law says, an investment plan. One that centers on “diversification and patience built upon a foundation of value and compound interest.”

Look at the horizon, your efficient frontier. Do you see your path? Live the simple yet sophisticated life you so richly deserve. “Do. Or do not. There is no try,” a wise man once said.

The Efficient Frontier, created by Harry Markowitz in 1952, measures the efficient diversification of investments that delivers the highest level of return at the lowest possible risk. Investors must consider the trade-offs between risk and reward in their portfolios. You can see on the chart above an efficient frontier line representing risk vs. reward for a portfolio allocated between different proportions of stocks and bonds using data back to 2000.

On the vertical axis is the return earned by the portfolios, and along the horizontal axis is a measure of how much risk was taken to earn those returns. As you can see by comparing the portfolio of 80% bonds and 20% stocks to the portfolio of just bonds, as portfolios take on a small number of stocks, the benefit of diversification lowers risk and increases reward. Anything above the line is unachievable because no portfolios earning those returns are available at the corresponding risk levels. And any portfolios that fall below the line can be outperformed with the same amount of risk or have their returns matched with less risk.

But to achieve higher returns along the line, investors adding more stocks to their portfolios are taking on ever greater amounts of risk. A portfolio of 100% stocks boasts a standard deviation of over 14%. Be aware of the risk in your portfolio and manage it wisely.

When you’re ready to talk, let’s talk.

Survive and Thrive this month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. Control is behind a lot of the problems in the world. But you have more control than you think. You, unlike a government statistic, don’t need to buy the basket of goods the Feds use to measure inflation. You are a value hunter. You seek out good deals and live to talk about them because what’s more fun than talking about a good deal?

When the government comes out with inflation stats, you and I know we’re at nosebleed levels already. It’s not like prices are going to fall. Now that we’re at this point, steady increases are just piling onto already too-high prices. But as an inflation fighter, you can invest in areas you spend your money on, like utilities/energy, for example.

How about your home? Most of you tell me you own your home, your cars, and have no debt. You’re happy living within your means, and you pay off your credit cards monthly. When it comes to your investments, you know the perils of trying to beat the market or ride this hot stock or that one. You know your risk tolerance is closer to intolerance. That’s something many unfortunate investors realize too late.

But here’s the kicker. You have to live. You need to take those trips. Spend some money. Because beating yourself up over inflation is simply not thinking outside the box. You know how to be creative with your spending, so do it. Just make sure you’re doing what you can about how you invest. It’s not so much about what you invest in, but how.

P.P.S. “Is your retirement life a mess? Then call 1-800-get-HELP.” No, this is not a commercial promising to change your life. This is about my conversations with you.

Let’s take last weekend for example. Your Survival Guy was tired of pulling into my garage and looking at the mess it had become and did something about it. That was a Saturday. It was raining. What else was I going to do? One fellow northeasterner commenting to me on all the rain said animals are lining up two by two in his garage.

So, I got to work. And when it was done, I felt good. And when I pull into the garage it’s satisfying seeing everything in its proper place. We’ll see how long it lasts.

In my conversations with you, we talk about how much you miss Richard C. Young’s Intelligence Report. It was how you kept your financial life in order every month. By reading IR you were making it a good month. It was satisfying. It had an opening that got you moving forward, like compound interest, as you built your knowledge from one catchy sub-head to the other. Then you had the charts and Monster Master List to compare with other stuff you’d been reading.

When tax time comes around, we sit and think about our financial life. Are we as organized as we could be? Do we have our income stream dialed in? Is it tax-efficient? When should we take social security? Is the new RMD age 73? (Yes). And every year, promises are made to be better organized for next year.

In my conversations with you, you’ve made some major moves; selling businesses, organizing estates, and studying my efficient frontiers. Creating trusts and assigning trustees, talking with adult children, and developing a plan.

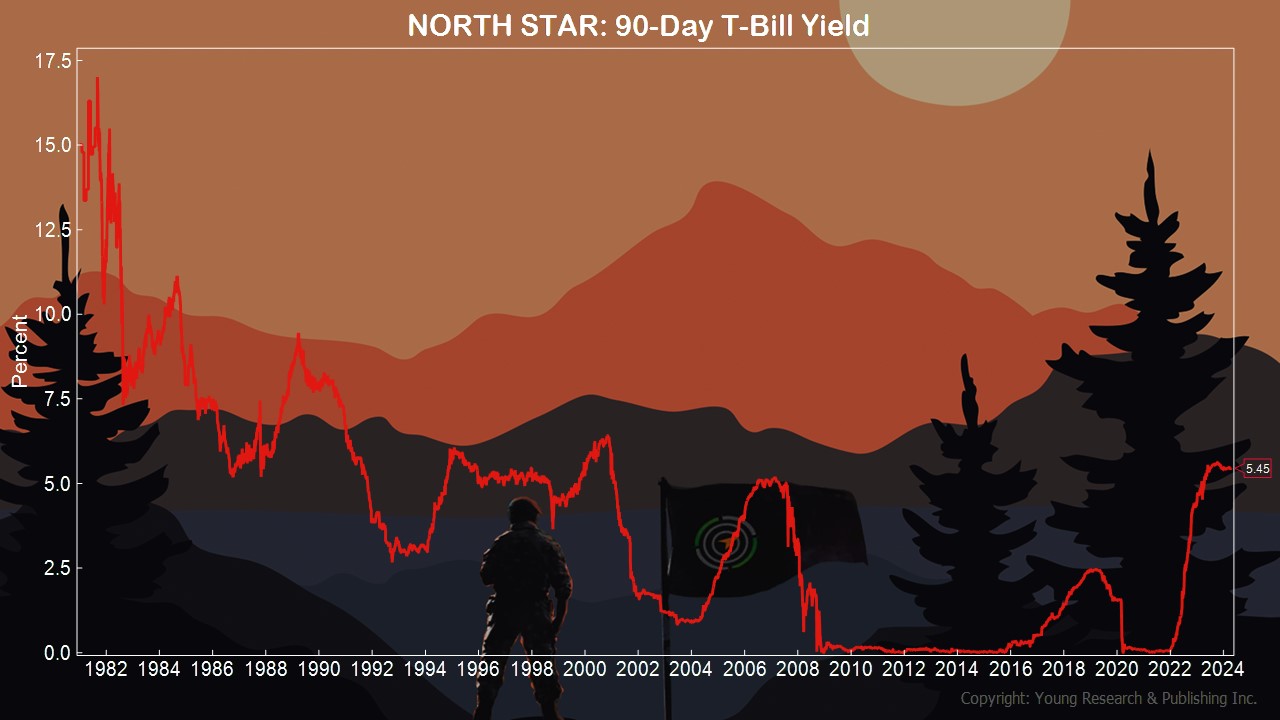

In times like these, it’s nice to have a safe haven like T-Bills to park your money in until the tax man comes calling. We don’t just talk about money, though, because, like Intelligence Report, we usually open with stories about “how you’re livin’?” Which is what makes all the harder stuff more palatable.

P.P.P.S. My clients tell me, “That’s why I hired you.” They say it when I explain why we’re buying or selling certain positions. “That’s why I hired you.”

One of my long-time doctor clients tells me, “I do what I do. You do what you do.” When he says to me, “I’ll leave that to you,” I know he’s thinking, “That’s why I hired you.”

Now, Your Survival Guy is no doctor. I can’t fix your teeth, hips, or knees. But I do specialize in pain relief. Because amazingly, with a few investment tweaks here and there, I may help bring back your beautiful smile or put a jump in your step.

Sometimes, we don’t even know miracles are being performed. It’s easy to get off track. Getting back to who you are is what life is all about. No one likes losing money. No one likes pain. But it’s a common refrain I hear when reviewing prospective client portfolios: “I don’t know why I bought that one.”

I do. Because it’s hard to feel like you’re missing out on the next big thing, and when you talk to a broker (not a fiduciary) to buy it, there’s a lot of nodding and “Yes ok, sounds good.”

Portfolios are littered with “can’t miss opportunities” that did miss. That’s why one of the more important things your fiduciary can do for you is tell you “No.” We don’t like hearing “No.” But hearing the word “No” or a gentler “I don’t love the idea” can avoid one saying: “Send lawyers, guns, and money.”

Often, it’s what you don’t do that keeps you in the game. When you’re ready to talk, let’s talk.

Download this post as a PDF by clicking here.