Dear Survivor,

What’s most disturbing about a black swan event is how it affects the rest of us. What will this non-bailout, bailout of Silicon Valley Bank and Signature usher in? Will we have a new way of banking where the Fed gets to call the shots? Will digital dollars be their way to control us?

Because it’s times like these when those in power usher in change in the name of following “the science.” Will this give them the extra inch they need to tell us that currency digitization is for our “protection?” One thing’s for sure, we’re not going back to the way life was.

Sitting in my cave, it never ceases to amaze Your Survival Guy how the so-called pros handle other people’s money. I can see this from my unique vantage point. I don’t look to beat the other guy. I don’t look first for return on assets. I look first and foremost to return of assets. That’s the real work.

And yet every single time, it’s the hubris of the “smartest guys in the room” that were supposed to know what they were doing that gets them caught. No one knows their risk tolerance until the losses rain down and they scurry for cover.

Rather than let them work through the mess they created, we have yet another government backstop. What could go wrong? The experts want to save you? Protect you? Please. If there were ever a moment for the installation of more control in the name of “protecting you,” this is it. Stay tuned.

BEWARE: The Road to Digital Currencies

With everything going on in the banking world, is it any wonder Your Survival Guy likes doing business with Fidelity? It’s a non-bank, non-publicly traded company.

Banks are under enormous government pressure to consolidate, while publicly traded brokerages are pressured to meet quarterly earnings. It’s a bad one-two punch. Look at Charles Schwab, for example. It has a banking division and is publicly traded. Its stock is down over 30% year to date.

Fidelity is not a bank. It’s privately held. It’s a family-run business.

What could possibly go wrong now that all depositors are (implicitly) insured by the government? Select banks are forced to merge with other “select” banks. One gets assets for a song, and the remaining banks pay the bill. It’s like having dinner with your college buddies, and then half of them skip out on the bill. Solid banks are punished for running a tight ship.

If you have money in a bank above the FDIC-insured level, does it even matter now? The road’s been paved for the surviving banks to become digital currency messengers for the almighty government.

Another crisis (or this one) could usher in massive consolidation into the too-big-to-fail megabanks. We already know the government is in the boardrooms there.

Do not waste time predicting what the Fed will do next. I can certainly see them cutting rates to shore up balance sheets and reduce the pressure to pay depositors—if there are any left.

Times like these are the perfect opportunity for things considered crazy to become the norm.

Is Vanguard Voting Against Your Political Beliefs?

You’re not supposed to talk about religion or politics in the investment business. Your Survival Guy broke that rule on day one. I’ve always felt it’s important to know who you’re dealing with. The big firms try to play it right down the middle. They try to please everyone and no one at the same time. They don’t talk politics. Until now. And not on purpose. Let me explain.

When the mutual fund industry rode index fees down to zero, they became victims of their own success. Suddenly, they needed a new way to skin the cat.

Imagine the conference room discussions.

“Bob, we need to get our fees higher,” Frank said.

“I hear you, Frank, but how?” Bob said.

“What if we come up with a product that ‘makes the world a better place’? You know something investors can brag about at cocktail parties, brag about how they’re saving the environment, in a socially acceptable way, with the right government?” Frank said.

“Brilliant! We’ll call it ESG,” Bob said.

And voila.

Leadership became so enamored with their new mousetrap that they decided to vote their shareholders’ shares according to their new ESG religion. And literally, overnight, Blackrock and Vanguard became the king and queen of ESG—voting their politics with your money regardless of what mutual fund you were in—including the mothership index funds.

Your Survival Guy, by law, is required to act as your fiduciary—to act solely in your best interest. So are they. But are they? Through ESG, the king and queen are leading the political charge and going to the bank.

Investors, finally, are waking up to the ESG boondoggle and realizing their money is being voted for things they might not want to support.

ESG is a Trojan Horse. It’s a way to collect higher fees. The mutual fund is broken. They’re voting their politics with your money. Investors are waking up.

When Is the Best Time for You to Do This?

“Life’s short,” my grandfather would say. “You’re only here for a visit.”

He didn’t say it to me. I was too young when he passed away. He said it to my dad, who just turned 79.

My grandfather would also ask my dad when he was starting out in business, “Do you know when the best time is to plant a tree?”

And that got passed down to me.

I never liked that one.

“Yesterday,” I’d respond, feeling the pressure of not doing whatever it was I was supposed to do yesterday.

“That’s right. Do you know when the next best day is to plant a tree?”

“Today,” I’d say, feeling like, what’s the point now? It’s too late.

“My father always said, ‘Don’t waste time. You’re only here for a visit.’”

…

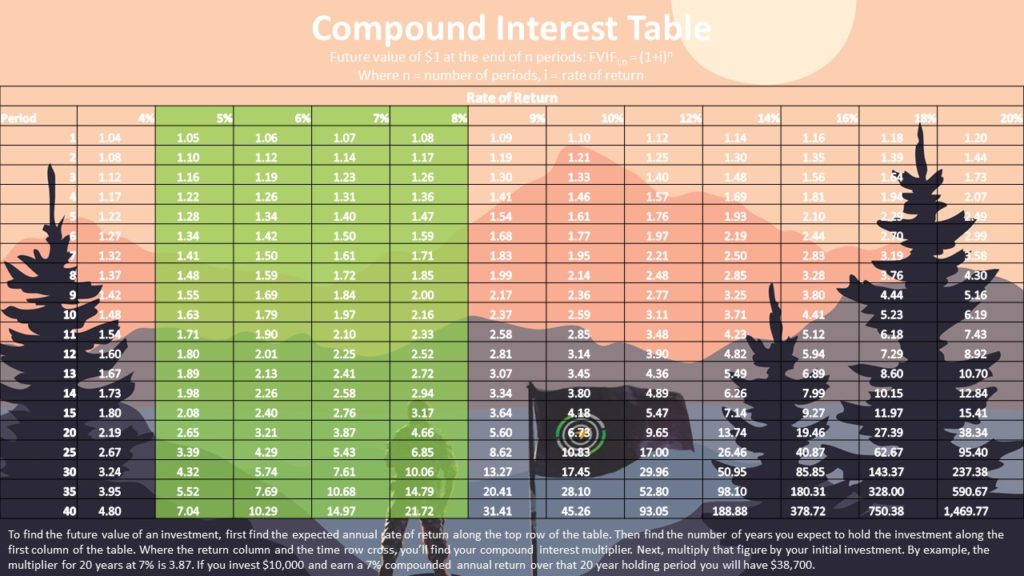

Harnessing time. Interest on interest. Compounding money. Putting one foot in front of the other. Being the early bird. Getting the worm. Planting trees and letting them grow. It’s not as easy as it sounds. In fact, it can feel downright mean.

It’s hard seeing it all through when day after day you’re just trying to survive, eating a bowl of Cheerios in water.

You’re investing in yourself.

…

Then, one day, you wake up and say, “Self, I’ve got a boatload of money. What am I going to do with it?” That’s when you realize life is short, you can’t make it all back if you lose it—you don’t have that kind of time. You need help.

…

I was talking with a prospective client yesterday. He said, “Survival Guy, I’ve got investments all over the place. You name it. Real estate, investment accounts, a farm. Now I need help.”

“I went to a major firm’s website,” he said. “This chat bot box pops up. Says I’m number 29 in line. I call your company, and I’m talking with the Survival Guy.”

“Look,” he said. “I don’t need to chat on the line. I need help, and I’ve been reading your father-in-law’s and now your stuff for a long time. How do we get started?”

Is that an improvement? Chatting with a bot about your life’s savings? Some services are worth the price of admission. You know when the best time to call Your Survival Guy was. Let’s talk.

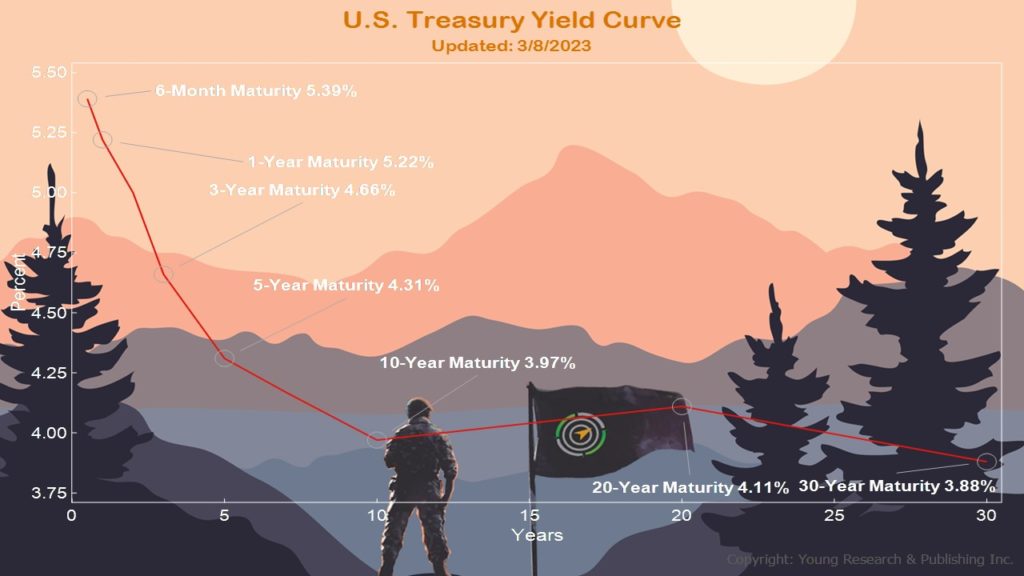

Put your good-for-nothing cash to work. I like the Fidelity Treasury Money Market (FZFXX) as a core money market.

Survive and Thrive this Month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. Did you catch the Sunday New York Times article on the supper clubs in Palm Beach? Look, Your Survival Guy loves Palm Beach, especially lunch at the Brazilian Court, but a supper club? Sounds expensive. But wait a second. When I started running the numbers, I thought, “Self, it could actually work.” That is, if it’s the right one.

You don’t have to be an uber-wealthy billionaire to have a nice life. Look for more supper clubs to show up, especially away from super high tax states. Welcome to Florida.

OK, you really can’t make up these headlines. Pension funds rethinking private equity investments, for example, because the prices are getting killed. It reads: “Some Public Pension Funds Are Pulling Back on Private Equity.” This stuff is like trying to price your daughter’s wedding or estimate construction costs. It’s near impossible.

And yet here we have the “administrators” of pensions giving money to the “billionaires” who manage it for the benefit of your high school teacher. Listen, the further you get from your money, the more you need to watch it.

Today, public servants on a typical pension—not the crazy ones in Chicago—are faced with nosebleed inflation on a fixed income. There is no inflation adjustment that can keep pace. It’s why I always recommend you work for as long as you can to keep control of your income.

What’s going on with your lazy cash? Not to throw stones, but if you have an account at Charles Schwab bank, make sure your cash is getting the return it deserves. If you’re not paying attention, you might realize your cash is getting paid a pittance while being lent for a song. Pay attention.

Not to be outdone are the king and queen of ESG, Blackrock and Vanguard. Here you have management voting their politics with your money. Wouldn’t it be nice if you could trust your manager to simply be a fiduciary? It’s a complicated world out there. Keep it simple.

In a conversation with a customer yesterday, we came up with an investment plan to transition some equity into investment-grade bonds. The yields I’m seeing today are good. But don’t reach for yield. Another headline: “Credit Suisse Bond-Wipeout Threatens $250 Billion Market.” Junk bonds are no place for Your Survival Guy.

When the “smartest” guys in the room run the bank and the “smartest” guys in government come to the rescue, what could possibly go wrong?

Stick with Your Survival Guy. Focus on return of assets, not return on them, and you might have enough for that supper club.

P.P.S. You know I’m not interested in predictions. Yes, I hope the Bruins make it to the Stanley Cup and win it all. But I’m not betting my life’s savings on it. And most sports fans aren’t that reckless with their money. But when it comes to money and investing, the stories are crazy.

It’s not unusual to hear horror-thons about betting the ranch on what turned out to be the next best thing. You know the stories as well as I do. And as Your Survival Guy, you should know by now I’m more interested in the return of assets rather than the return on said assets.

Investing. This isn’t a game. It’s hard to work to save and invest and to one day say, “Hey, I’ve got some assets to tend to,” like they’re your flock of sheep. Your Survival Guy is just fine hiding in my cave with a nightly fireside discussion about staying safe and keeping out of the fray.

I’m just fine letting others think they’re having all the fun. I’m busy prepping for the storm when the black swan comes swooping in.

P.P.P.S. Being disciplined is tough. It often entails doing stuff you don’t want to do. Exercise and eating right are at the top of the list. Your career and saving money? Yup. Compounding money? Check. But what about retirement investing? Yes. Most definitely. But here’s the kicker. After years of doing what’s right, you’d think it would get a little easier. It doesn’t.

When it comes to money and taking care of it like you would a loved one, it doesn’t get easier with age. It gets tougher and tougher.

The pre-retirement years are brutal. “Will we have enough to live on for the rest of our lives?”

The retirement years are even more difficult. “How will we recover from the losses?”

And on and on it goes. “How will we handle our estate?”

That last one’s a kicker. In my experience, the closer you are with your family, the easier estate planning becomes. It’s really that simple. Giving away money when no one gets along is a complete nightmare.

No one can ever afford to lose money. Treat your money like a loved one, and you’ll understand how vital it is to keep it safe. And don’t believe the huckster telling you about a great new scheme and how “This time it’s different.” It’s usually not.

P.P.P.P.S. Happy Monday from New England. Your Survival Guy’s thin blood is adjusting to the cold, having just returned from a tropical island getaway to Key West. I’m here to report that the Conch Republic is alive and well. And notice it’s not a democracy. The Republic is where you go to get that neighborhood walkability without all the sensibilities.

Tops on our list are lunches at Louie’s Backyard and the Thirsty Mermaid. Say hi to Patty at Louie’s and Ionela and Ava at Thirsty, and enjoy your cheeseburgers in paradise. Both are fab. And be sure to hit the waterfront at the Half Shell Raw Bar to see our friends for some oysters and beer. And not in any particular order.

Dinner at Antonia’s is the one reason we hit Duval Street at night to be greeted by friends TK, Bismark, Nicole, and Stephanie. Your Survival Guy’s favorite yellowtail with lemon and capers is here. And when you want the best black grouper with wasabi mashed potatoes, it’s Café Marquesa for you.

Not to be missed is Onlywood Grill for our favorite Italian outdoor dining, thanks to owner David Cremascoli, Layla, Rob, and Guiseppe.

And if you need one more reason to hit Duval, go for the fried (whole) fish at 915 and, of course, say hi to our friend Jenny.

Most don’t go to Key West to golf. But we do. It’s a tough course. It’s tougher when F-18s and F-35s practice carrier landings nearby. Try not to be distracted. Stay down on your wedges.

Shopping? Yes, but of course. Say hi to Meredith at Besame Mucho in Bahama Village after lunching with the roosters at Blue Heaven. Archeo for Gabbeh rugs and jewels. Say hi to Tanya at Vignette. And, of course, Claude, Joe, and Will at Assortment.

Want to see the island from a new perspective? Go on a jet ski tour. Walk the street with an iced con leche and pan cubano from Coffee Queen Coffee. Get your Cuban mix sandwich from the Restaurant Store or Five Brothers. And your bagels with lox at Goldman’s. Sunday pastries at Old Town Bakery.

Our mornings start at Date and Thyme for a coconut latte, egg wrap, green juice, and any other “health” food you need to keep you going.

If you time your trip just right, take a walk down memory lane for a live concert at the intimate Coffee Butler Amphitheater to catch Little Feat and the Jerry Garcia Band. Old Dominion is in town in a couple weeks.

And yes, it’s hard to beat the views from your beachside table at Latitudes on Sunset Key.

Want to go deep sea fishing for sailfish? Talk with Brice Barr, captain of the Double Down. Flats fishing? Call Capt. Ryan Erickson. Bring your “A” game to both endeavors.

And if you must hit the town at night, get your Panama Jack hat from Stephanie at La Rubia. Cheers!

When you’re ready to plan your trip, let me know.

Download this post as a PDF by clicking here.