Dear Survivor,

If you’re going to Paris, you’ll need a heavy jet. Your Survival Guy prefers Bombardier’s Global Express 7500. With only a handful to choose from, you’ll be in rarified air, literally—because when you’re cruising at altitude tens of thousands of feet up, the advanced air pressurization system makes it feel like you’re only at 4,000. Great for extra-long trips (and even not-so-long ones). Remember, it’s the small things in life that matter most. You’ll want to hit the ground running, not bogged down with a head cold.

Then there are the 15-windows (per side), soft leather club chairs, and thick carpeting that make you feel like you’re in your living room about to settle in with your favorite show. Not that you need entertainment tonight. There’s plenty to see inside and out. The windows are huge. And a quick tour of the cockpit guided by the first in command gives you a look at the latest in avionics and makes you wonder, “So what do you guys do?”

Now I’m Your Survival Guy, not Dale Carnegie, but if you want to win friends and influence people, you might want to figure out how to get 18 of your closest friends and/or family on this bird. If you plan on sleeping, you’re looking at a much smaller number, but you get the point—the math can work for your next business or bucket list trip.

You’re almost disappointed when it’s time to wake up and land. But Paris calls. At least you’re well rested.

GNMA, L’Ami Louis, and You

I want you to go to the most controversial restaurant in all of Paris. But first, a bit of business. As you know, Your Survival Guy isn’t big on selling positions. My default position is to hold forever.

With that said, it doesn’t mean I operate with my head in the sand, far from it. There are times when selling for tax purposes makes sense—to realize a loss and get back into something similar. That’s a move that could make sense for you if you hold Vanguard GNMA at a loss in a taxable account. If you hold it in an IRA, then stick it out. If you want to talk, let me know.

How about a balanced portfolio? When so called experts say a balanced portfolio doesn’t work anymore, they’re doing investors a real disservice. Bonds are far from dead. Don’t let perfect timing get in the way of earning some attractive yields.

My favorite meal in Paris? Glad you asked. L’Ami Louis. It’s one of the hardest reservations in town. But if you get in, it’s like you’ve been transported back in time—you’re part of the club. Just don’t forget you’re not necessarily in charge. And don’t be put off if you’re greeted with a stern yell across the small dining room, “Reservation?” as if you’ve stumbled in not knowing where you are.

And when it’s time to place your order, don’t be put off if Louis puts two hands on the table and says: “I’m ready.” Be ready. Or ask for more time. But don’t be quiet about it.

What to order? Anything. But the endless basket of overflowing toasted bread is decided for you. It’s up to you whether to dip it into your boiling escargot garlic and butter, smother it with foie gras, or simply smear it with butter.

The chicken is presented tableside and quickly whisked away to the kitchen for serving/preparation. The salad is simple and delicious. The garlic potatoes are out of this world, and the wine list is as thick as a family picture album. Don’t be afraid to ask your new friend (I hope) for help navigating that monster. You’re part of the club. Bon Appetit!

An email from you reads: “We are currently sailing down the coast of NC and will cross over into SC on the ICW [Intracoastal Waterway] later today. Weather is great, and making good progress heading south for the winter.”

Monsieur Get Your Money Cookin’

Is history a reliable guide? Let me tell you a story. On our research trip to Paris, we spent time on the left bank staying at Hotel & Spa D’Aubusson. At the morning buffet, it could have been easy to go for the morning pastries but using a bit (I said a bit) of self-control, I opted for the soft-boiled egg. Simple. Easy.

The following week in Beaune, I did the same, but when I hit the shell, raw egg oozed all over my hands and onto the table. A fellow guest did the same, and later we learned you need to cook the eggs yourself. “The hot water is right there sir,” I was startled to learn. Duh. I’m still getting used to self-checkout at the grocery store. Lesson learned.

When something as simple as a soft-boiled egg throws you a curve, you see how even a simple task like setting interest rates becomes a problem. Not that setting interest rates should be hard. It should be simple. Set it and forget it. Rates shouldn’t be over or undercooked. But that’s too easy.

If you have a pile of cash: set it and forget it for three to five years. You’re not looking for the “perfect” when close enough will be just fine. For example, if you’re wondering if you should wait before deploying because “interest rates are going up,” remember how certain your nephew was last Thanksgiving about the stock market.

Look at the yields below, and don’t beat yourself up about the timing. Get your money cookin’ and deal with the yields as they come. This doesn’t have to be messy. Let’s talk.

In Paris: A Sunday Lunch to Love

OK, where is Your Survival Guy’s favorite lunch in Paris? Glad you asked. Answer: the next one. But, seriously, what makes a great lunch, great? One measure is when you’re back home, you want to replicate some of those flavors and memories that made it special.

La Fontaine de Mars is where we eat Sunday lunch. We own their pink and red checkered cloth napkins as a reminder—when they’re draped over our kitchen island, everyone knows we’re in for a special time. Yes, it’s possible to be in Paris from the comfort of your home. I take that trip often.

Walking to La Fontaine de Mars from Le Bristol, you’re on my favorite boulevard in all of Paris, Avenue Montaigne. It’s where friends like Louis, Gucci, Ralph, Chloe, Celine, Georgio, and Valentino hang out—often with lines outside their houses.

Walking by L’Avenue, you’re at the place to be seen and a short walk to Plaza Athenee with its red awnings, and sun-kissed diners behind the hedges barely visible, looking over their sunglasses to check on their Rolls, Bentley, Porsche, and/or Ferrari—not to check on them but to see if you are and hopefully taking a selfie (Note to Your Survival Guy: Get some self-respect).

Then you’re at the scrum crossing Pont de l’Alma over La Seine. The Eiffel Tower looms high above to your right as you descend into a classic tree lined neighborhood in the 7th. And before you know it, you’re at La Fontaine de Mars, where you see well-dressed couples who look like they’ve been coming here every Sunday since the 50s. You see young families enjoying the best part of Sunday—no thoughts of Monday yet.

The waiter leans the blackboard on the end of your table and runs through today’s specials. (There’re specials on the menu, too, one for each day of the week). It’s hard to go wrong with piping hot escargot, the seabass and kalamata olives over mashed potatoes, washed down with some champagne and Brouilly. Bon Appetit.

The table is yours for as long as you want. It’s your Sunday matinee. There’s no schedule. That’s what Mondays are for. It’s time to relax. You’re in Paris.

Survive and Thrive this Month.

Warm regards,

“Your Survival Guy”

- If someone forwarded this to you, and you want to learn more about Your Survival Guy, read about me here.

- If you would like to contact me and receive a response, please email me at ejsmith@yoursurvivalguy.com.

- Would you like to receive an email alert letting you know when Survive and Thrive is published each month? You can subscribe to my free email here.

P.S. Happy November. Hope you made it a good month. When stocks are up 14% for the month, it’s hard not to. Why? Because it was the best month for the Dow Jones Industrial Average since January 1976, the same month Queen’s Bohemian Rhapsody topped the charts. That’s a lot of months in between then and now.

What does that mean to Your Survival Guy? Not much. Because when prices are untethered, it’s a perfect time to remain focused on being an investor, not a speculator. In other words, to be paid dividends to invest in stocks.

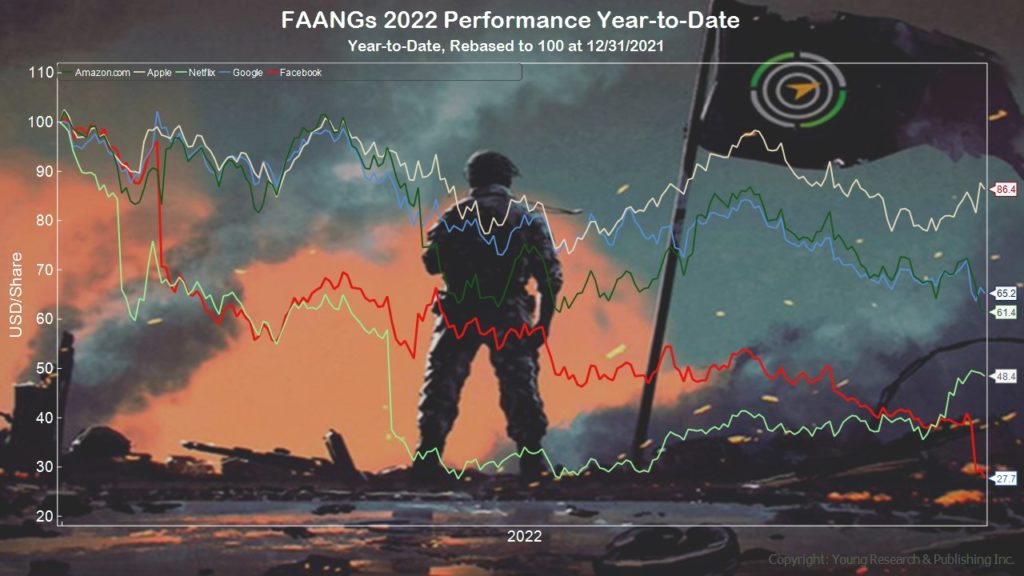

Look at what’s happening to the FAANG storyline, and you see what I mean.

This isn’t a game. Investing isn’t supposed to be fun. When it comes to being able to stick with your portfolio through thick and thin, it’s oftentimes your bonds that help you get that done. Sure, prices are down, but as I said above, I’m not in it for short-term prices—I’m in it for the interest.

You can sink your teeth into these yields with two-year Treasuries yielding 4.5%. Yes, rates have jumped that high, that fast, over the last three months—the most since 1994 (and 1984 for 10-year Treasuries).

In times like these, you need to get out of debt and get your investment house in order. This is no time to sit around and wait for something to “look” good. Let’s talk.

P.P.S. Your Survival Guy returned home from work recently (yes, going to the office is still a thing) to: “The heat isn’t working upstairs.”

I’ll let you guess who said it, considering we’re now empty nesters. If our dog could talk, his eyes were saying, “You might want to go back to work.” On the coldest day of the year (so far), it was the second time we turned on the heat or tried to this year.

Which brings me to another note to self: “When the AC wasn’t working a couple of months ago, maybe that was a good time to get the heating system checked out. Just saying.”

Look, I’m Your Survival Guy. I’m trying to help. In times like these, when everything seems to take longer than it used to, I suggest planning for the worst and hoping for the best. Because we know hope is not a strategy to live by.

P.P.P.S. Your Survival Guy’s way to wealth is about winning the slow and steady race. It’s about showing up. It’s about doing your job. It’s about saving ’til it hurts and working as long as you can. And then—after a lifetime of work, saving, and investing (not speculating)—you can stop and think for a second and ask yourself: “How in the heck did I save all this money?”

Columnist Andy Kessler writes an outstanding (depressing) piece in The Wall Street Journal, “The Decline of Work.” He writes about the value of work and refers to Mike Rowe—of Dirty Jobs fame—about the value of getting a job and working. It doesn’t matter what you do, just work.

From Kessler:

Advice from Mike Rowe: “Stop looking for the ‘right’ career, and start looking for a job. Any job. Forget about what you like. Focus on what’s available. Get yourself hired. Show up early. Stay late. Volunteer for the scut work. Become indispensable.” He’s right—and build human capital. A job already has a purpose. And please don’t ask for pet-bereavement benefits.

Compounding work experiences is your key to incremental growth. Some might call it on-the-job training. Let’s go.

Download this post as a PDF by clicking here.