Don’t look now, but many of the nation’s states are in deep financial trouble. Pensions around the country have been underfunded, and Ohio is one of the worst offenders. By 2037, there’s only a 25% chance Ohio’s fire fighters and police officers will have their pensions fulfilled by the current system. Economists Erick Elder and David Mitchell have detailed the poor condition of Ohio’s pension system in a detailed report. The Mercatus Center outlines their work, saying:

Ohio’s largest pension plans are at risk of falling significantly short on their obligations to hundreds of thousands of Ohioans. In fact, Ohio ranks ahead of only Mississippi in terms of the level of unfunded liabilities relative to the size of the state’s income.

Despite having assets of more than $150 billion, some estimates show that Ohio needs to increase pension funding by at least $275 billion to be fully funded—that’s almost $25,000 per Ohio citizen. If lawmakers fail to make the decision about how to close the gap now, future generations will bear the burden of higher taxes, reduced government services, or even reduced benefits.

Using Ohio government data, economists Erick M. Elder and David Mitchell ran 100,000 simulations of likely investment returns for each pension. They find that Ohio’s pensions have sufficient assets to pay promised benefits in the next five years, but the probability that assets will be sufficient declines very rapidly thereafter.

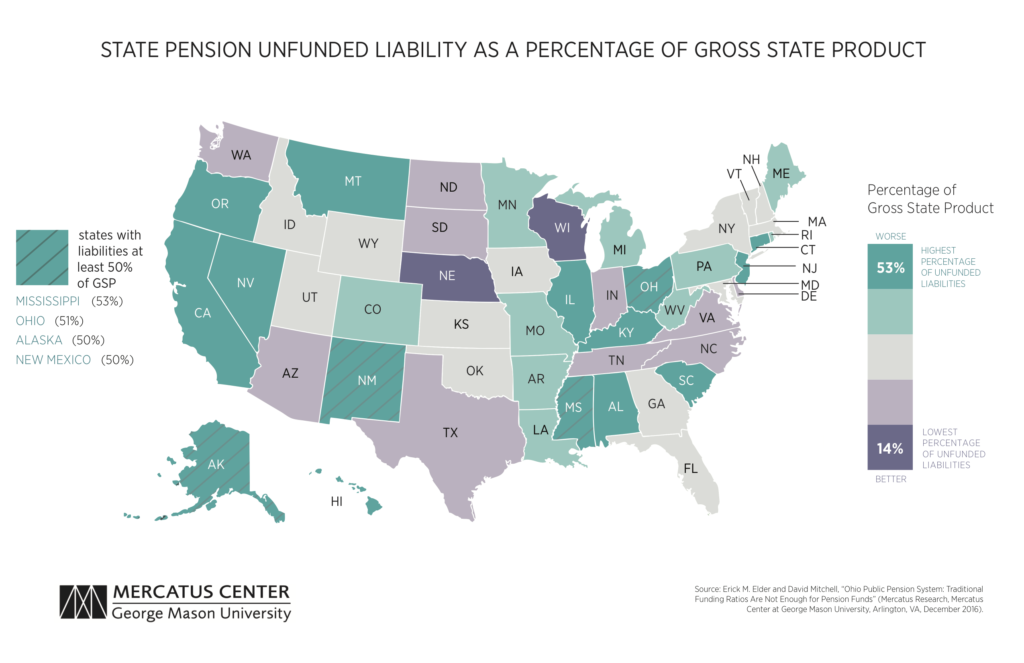

Is your state in a similar fix? Check out the map below, created by the Mercatus Center, to see if you live in a state with pension Armageddon on its way.

Read Elder and Mitchell’s full report below.

[gview file=”https://www.richardcyoung.com/wp-content/uploads/2017/01/mercatus-elder-ohio-public-pension-v2.pdf” width=”100%”]