Is it the end of the road for Connecticut’s high-tax experiment? Nutmeggers, especially the well heeled, are fleeing Connecticut for lower tax states like Florida. In the last five years alone 27,400 have left for the Sunshine State. The Wall Street Journal editors explain how the state’s progressive politicians must now bribe big businesses to stay in the state, and how they are considering bribing college students to do the same.

Is it the end of the road for Connecticut’s high-tax experiment? Nutmeggers, especially the well heeled, are fleeing Connecticut for lower tax states like Florida. In the last five years alone 27,400 have left for the Sunshine State. The Wall Street Journal editors explain how the state’s progressive politicians must now bribe big businesses to stay in the state, and how they are considering bribing college students to do the same.

After losing General Electric to Boston last year, Mr. Malloy bribed the hedge funds Bridgewater and AQR Capital with $57 million in taxpayer subsidies not to leave the state. Other beneficiaries of the Governor’s corporate welfare include Cigna , NBC Sports, ESPN andCharter Communications .

Democratic legislators have now taken the subsidy idea one step further by proposing a tax credit averaging $1,200 for grads of Connecticut colleges who live in the state as well as those of out-of-state schools who move to the state within two years of earning their degree. Democrats say the tax credit would cost the state $6 million each year assuming only 10% of eligible college grads sign on.

As the the rich and the educated are bribed to stay, one wonders just how progressive the state’s taxation system really is when the only people paying their full share will soon be the poorest.

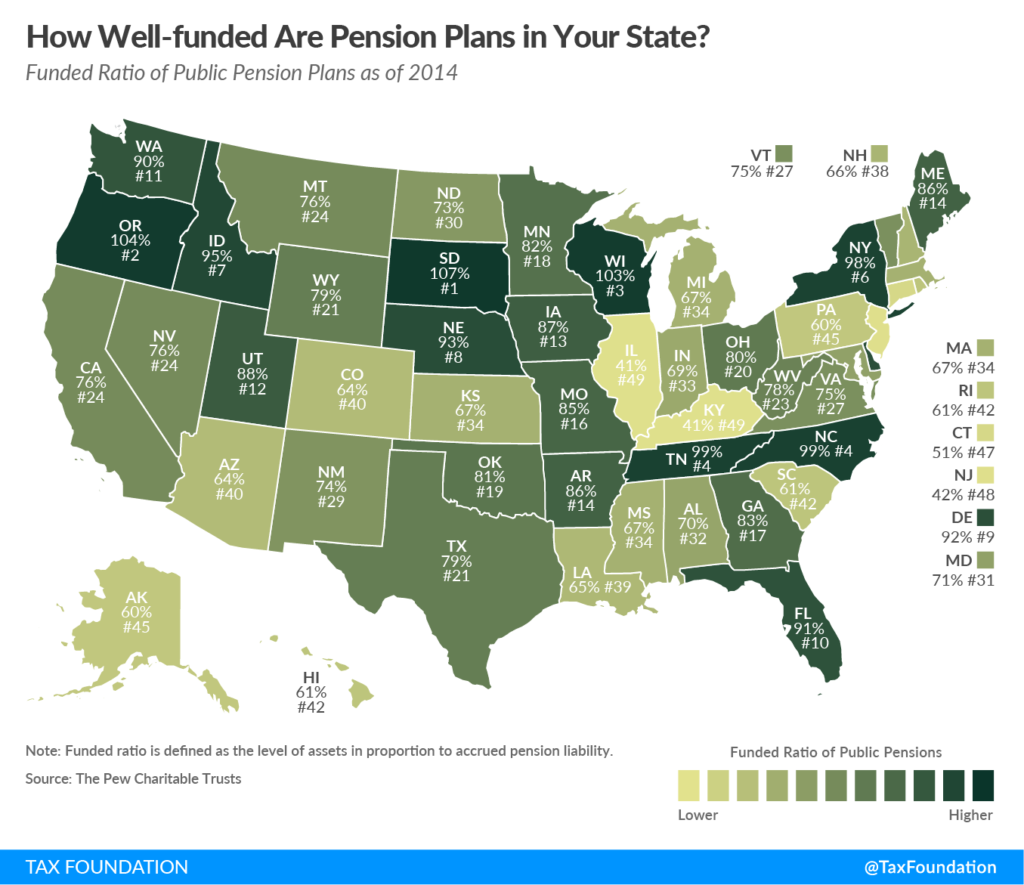

Of course Connecticut has legitimate reasons to worry about its tax revenue stream. The state has racked up a serious bill to its pension fund in unfunded obligations.

E.J. Smith - Your Survival Guy

Latest posts by E.J. Smith - Your Survival Guy (see all)

- Emptying the Post Election Trash: Winners and Losers - November 7, 2024

- Thanks for the Memories President Biden - November 7, 2024

- What Can Americans Expect from Trump on Taxes? - November 7, 2024

- Congratulations President-Elect Trump: It Was the Economy… - November 6, 2024

- Congratulations to New Hampshire Governor-Elect Kelly Ayotte - November 6, 2024