What is the currency of AI and the digital future? It’s power. Electricity is necessary for data centers, whether they’re running chips from AMD or Nvidia. They all run on power. The cheaper the electricity, the more profitable the companies running them. That’s why, with its mix of cheap power and cheap land with access to that power, Texas is witnessing an explosion of data center construction and investment. Madison Iszler of the San Antonio Express-News explains why so many data centers are choosing Texas, writing:

Texas is attractive because the cost of power here is relatively low compared with other parts of the country — a huge incentive because data centers are such power hogs — and it’s easy to get to from both coasts, Bernet said.

Weather, topography and proximity to airports, dams and water towers are other factors. The likelihood of hurricanes, ice storms and other natural disasters is fairly slim in San Antonio, Dallas and Austin. Houston sees more hazardous weather from hurricanes, but some companies headquartered there want to be near their facilities.

There’s also ample land, which is increasingly important as companies build larger centers, but whether that acreage has power infrastructure is key.

“It’s not the availability of land but availability of land that has the power and can get the power in a timely manner,” said Chris Herrmann, senior vice president with CBRE’s Data Solutions group. “In the Austin and San Antonio markets, in the D-FW market, there are large chunks that a lot of developers and operators are looking at. They can be had — the land is there. But the question is, how quickly can power be delivered? That’s really the name of the game right now.”

That’s put pressure on utilities. CPS Energy is gearing up for a tenfold increase in demand from data centers that are expected to consume more than 3,300 megawatts by 2033 — enough to power more than 650,000 homes.

Texas’s fast growth has put it in second place for data center inventory after Virginia. Iszler continues:

North Texas now ranks second among U.S. markets by inventory of data centers, according to commercial real estate services firm CBRE, with a 173.1 percent increase in the second half of 2023, which pushed its total to 565.3 megawatts. That put it behind northern Virginia — the world’s data center capital — but ahead of Silicon Valley, Chicago and Phoenix.

Among secondary markets, the Austin-San Antonio area came in second with 162.2 megawatts, up 7.5 percent from the second half of 2022. It lags central Washington but has more inventory than Southern California, Seattle and Houston, the latter of which ranked fifth with 134.1 megawatts.

The vacancy rate was 7.4 percent in Dallas-Fort Worth, 1.8 percent in Austin- San Antonio and 19.7 percent in Houston in the last six months of 2023, an indication that most of what’s being built is already leased and any pockets of space that open up are quickly being taken.

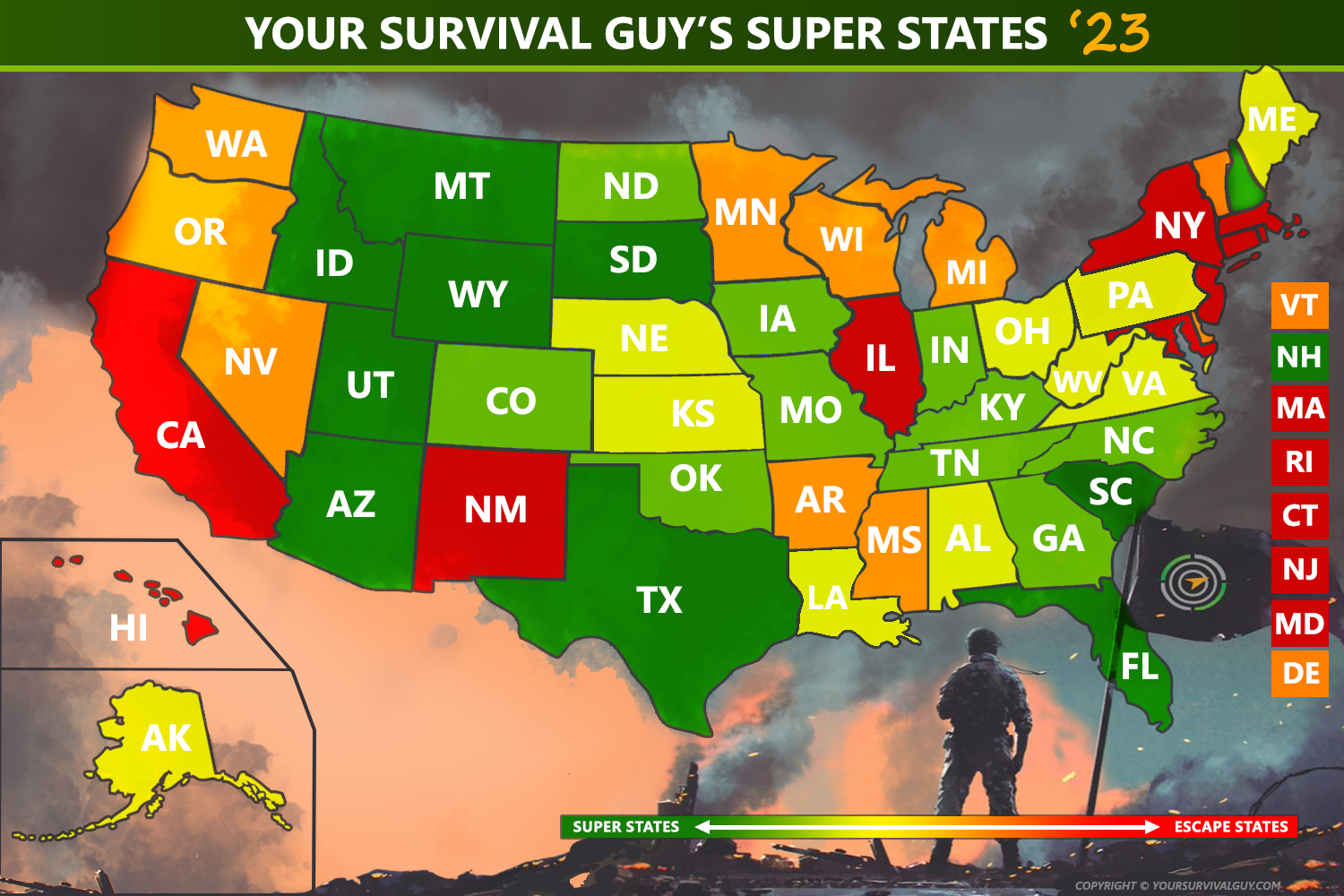

Action Line: Businesses go where they are treated best. Politicians in Texas have created an environment that benefits data centers with the resources they need at competitive prices. If you’re looking for a better America for your business, start your search with Your Survival Guy’s 2024 Super States. You’ll see that Texas is one of my Top 10, among other states that put residents and businesses ahead of the personal goals of politicians. Click here to subscribe to my free monthly Survive & Thrive letter.