Will your estate be taxed when you die? Many states have phased out estate and inheritance taxes, but there are a number of them still using this punitive tax. Those states include:

- Connecticut

- Hawaii

- Illinois

- Iowa

- Kentucky

- Maine

- Maryland

- Minnesota

- Nebraska

- New Jersey

- New York

- Oregon

- Pennsylvania

- Rhode Island

- Vermont

- Washington

- and Washington, D.C.

At The Tax Foundation, Joseph Johns explains the current estate and inheritance tax situation in America and the states, writing:

In addition to the federal estate tax, with a top rate of 40 percent, 12 states and the District of Columbia impose additional estate taxes, while six states levy inheritance taxes. Maryland is the only state that imposes both an estate and an inheritance tax.

Estate taxes are paid by a decedent’s estate before assets are distributed to heirs and are thus imposed on the overall value of the estate. Inheritance taxes are remitted by the recipient of a bequest and are thus based on the amount distributed to each beneficiary.

Most estate and inheritance taxes are progressive, with the tax on a decedent’s estate or a beneficiary’s inheritance exposed to rates that increase with the total value of assets. Hawaii and Washington have the highest top marginal estate tax rate at 20 percent, assessed on estates valued at $15.49 million and $9 million, respectively. Seven other states and the District of Columbia assess a 16 percent top marginal estate tax rate on estates valued between $2 million (Massachusetts) and $10.04 million (Illinois). Connecticut is the only state with a flat estate tax rate of 12 percent. Combined with its high exemption value of $13.61 million, Connecticut has a well-structured estate tax that makes it suitable for possible reforms and eventual elimination.

Likewise, Iowa has the lowest inheritance tax rate in the nation at 2 percent, while Kentucky and New Jersey have the highest top marginal inheritance tax rate of 16 percent as of January 1, 2024.

The Tax Foundation compares the states’ estate and inheritance taxes on the map below:

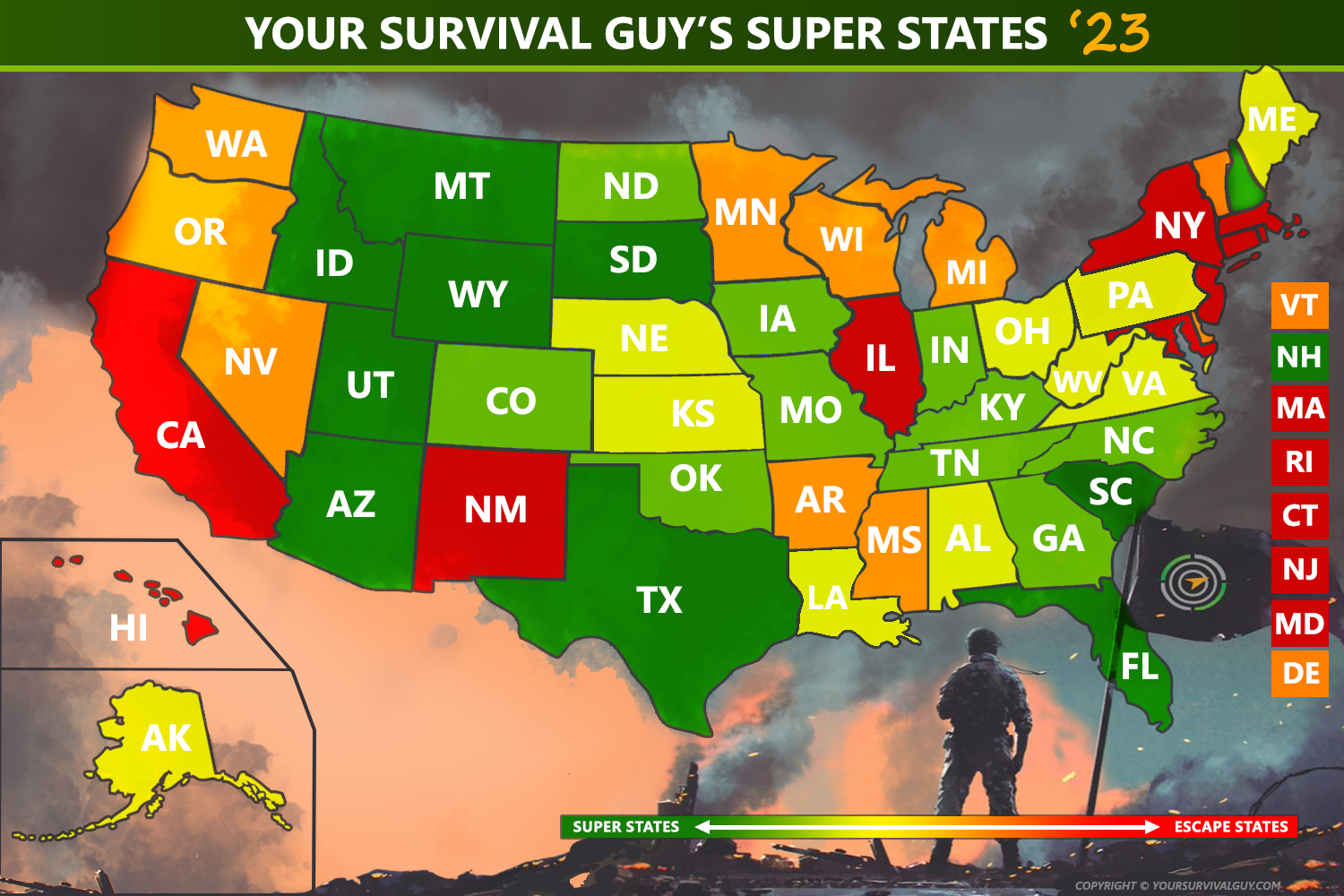

Your Survival Guy keeps a close eye on the tax schemes among the states. You should too, especially if you're looking for a better America. None of Your Survival Guy's top ten Super States have an inheritance tax or an estate tax.

Action Line: Read more about Your Survival Guy's 2024 Super States here. And click here to subscribe to my free monthly Survive & Thrive letter.