How do you build a Super State? The most important step is to make the needs of Main Street businesses and citizens your top priority. Ronald Reagan did that when he was governor of California and created what may have been America’s greatest success story. But what happened? Now, people are leaving California in droves. Radical progressives have taken over the state’s government and put it on a downward spiraling trajectory that leaves middle-class Americans behind. It’s the destruction of a Super State in front of America’s eyes. The latest effort by California’s government to destroy Reagan’s legacy and to harm its citizens is an effort to place additional taxes on the Internet in order to “save” local journalism. Jared Walczak and Benjamin Patrick explain at The Tax Foundation:

As far as euphemisms go, California’s proposed “data extraction mitigation fee” is impressive, as (1) it’s a tax rather than a fee, and (2) it’s not intended to mitigate what it taxes. The proposal is one of two measures under consideration in California, along with the Journalism Preservation Act, that would tax tech companies to fund local journalism.

The data extraction mitigation fee is modeled after Maryland’s digital advertising tax, which has been mired in litigation since its inception and is very likely unconstitutional and in conflict with federal law, though it may take another year or two for the legal process to play out. The Journalism Preservation Act, which has its own constitutional challenges, mirrors a Canadian law taxing links to media outlets, which has been extremely unsuccessful if one’s metric is supporting local journalism rather than stopping major tech companies from linking to local media.

In a surprise action, both bills cleared the California Senate with the requisite supermajority vote last week. SB 1327, the digital advertising tax, now heads to the Assembly, and AB 886, the link tax, returns there for consideration in its amended form.

Under SB 1327, California would impose a 7.25 percent gross receipts tax on in-state digital advertising, applied to companies with worldwide revenue of $2.5 billion or more. The tax would be imposed on advertising networks and platforms, from search engines to social media networks to streaming platforms, though much of the burden would be borne by those advertising through those services. In other words, the entity remitting tax might be a large corporation based in Mountain View or Menlo Park, but the business bearing the brunt might be the café in Carmel-by-the-Sea that advertises with them.

These days, 77 percent of US business advertising is digital, and most online advertising—for businesses of all sizes, from multinational corporations to local antique shops—takes place on networks run by corporations that would be subject to the new tax. Because most advertising networks and platforms would be affected equally, we should expect most of the cost to be borne by businesses placing ads, not the large corporations selling the advertising space.

This is just the latest effort by California to harm small businesses. Recently the state chose to endanger its entire fast food industry with a $20 minimum wage.

So what does it take to build a Super State today? Arkansas Governor Sarah Huckabee Sanders and the state’s legislature are working hard to undo years of bad management in the Bill Clinton years and afterward to make the Natural State one of America’s best. Joseph Johns explains at the Tax Foundation:

Arkansas Governor Sarah Huckabee Sanders (R) recently called a brief special legislative session to enact the fourth round of reductions to the Natural State’s individual and corporate income taxes. Legislators also passed a modest property tax reform proposal.

The individual and corporate tax cut package in question, HB 1001, reduced the top marginal individual income tax rate from 4.4 percent to 3.9 percent, effective tax year 2024. Arkansas also reduced its top corporate income tax rate from 4.8 percent to 4.3 percent. The most recent round of tax rate reductions is estimated to save Arkansas taxpayers over half a billion dollars this year alone. HB 1002 benefits Arkansas homeowners by increasing the Homestead Property Tax Credit from $425 to $500. This small change is expected to save a collective $46 million in calendar year 2025 and beyond.

He continues:

These reforms focus on rates without changing the overall structure of the tax code, but they still improve the state’s performance on the Tax Foundation’s State Business Tax Climate Index, a measure of tax competitiveness. The Index compares the state and local tax policy preferences of all 50 states and the District of Columbia using five distinct tax types and over 126 unique variables. The two most relevant portions for this purpose include the individual income tax and the corporate income tax subindices. Arkansas currently ranks 38th in the overall rankings, while placing 37th and 28th in its individual and corporate subindex rankings, respectively.

After the passage of HB 1001, Arkansas will improve its overall ranking one place to 37th nationwide. Arkansas will also gain two places in the individual income tax subindex and rank 35th, while improving four places in the corporate income tax subindex, entering the top half of all states at 24th place. These are notable gains and reflect policymakers’ efforts to enhance tax competitiveness—efforts that could, in the future, be complemented by reducing reliance on several outdated and non-neutral taxes and tax provisions.

Since 2015, Arkansas has made great strides in reducing the burden on families and businesses. That year, Arkansas’ top marginal individual income tax rate was 6.9 percent. The rate is now 3 percentage points lower. Likewise, Arkansas’ top corporate income tax rate was 6.5 percent in tax year 2015 but now stands at the second lowest among its neighboring states at 4.3 percent.

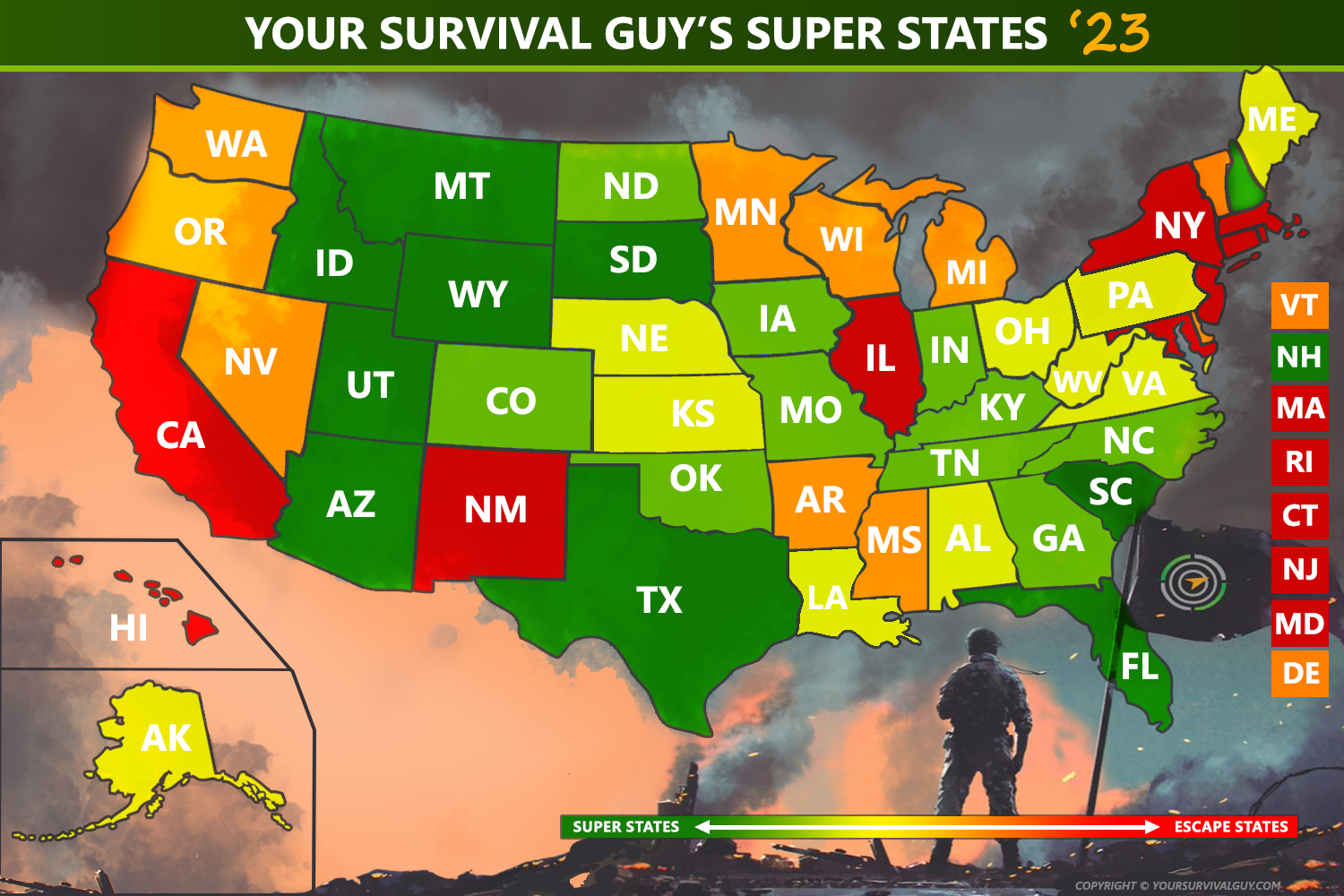

Action Line: Read that last paragraph again. The important words are “reducing the burden on families and businesses.” States shouldn’t burden families and businesses, they should enable them to achieve their goals. That means getting out of Americans’ way. If you’re looking for a better America, begin your search with Your Survival Guy’s 2024 Super States. And no matter what state you’re living in, I want to help you achieve your goals. Click here to subscribe to my free monthly Survive & Thrive letter.