In his first issue of Richard C. Young’s Intelligence Report, Dick wrote, “Hugh Johnson is known worldwide as an expert and writer on gardening and wine. In Connoisseur’s June/85 issue Michael and Ariane Batterberry wrote about Johnson’s ability to communicate to his readers saying he ‘never pontificates,’ and that Johnson feels ‘once inflamed by a subject, the wise outsider will write a book about it before he learns too much and becomes an insider, so entangled in arcana that he can no longer strike through the nub of things.”

“I hope my Intelligence Report will achieve Johnson’s worthy goal of clarity and ease of understanding,” Dick wrote, and advised that you, “Take a pen and circle the items you find of most interest this month. You’ll be able to refer back to your highlights for easy future reference.”

Thanks to technology, with a few keystrokes, I have every word Dick Young ever wrote in Richard C. Young’s Intelligence Report at my fingertips. Within seconds, I can rewind to the year 1985, fast forward to 2003, and study passages that are just as relevant to today as when they were written.

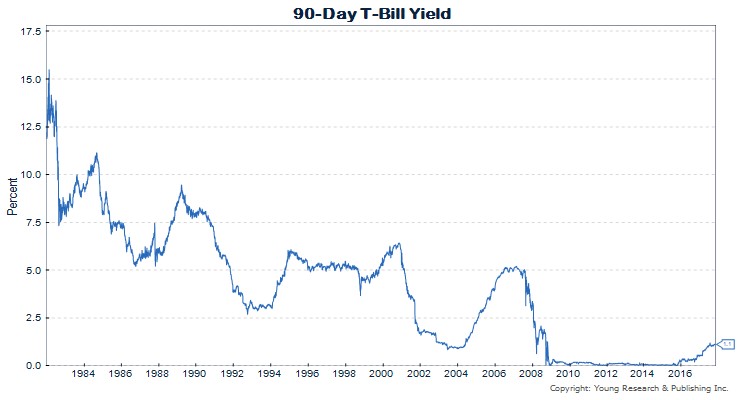

From “Dick Young’s North Star” section, in the February 2003 issue of Intelligence Report, he wrote: “I want to be real clear here. When the risk-free rate of return is a) negative in real terms and b) below 4% in nominal terms, red flags are flying. There is a regular and dangerous tendency to overreach and overstep with inappropriate and risky investments when investors cannot get a decent return on 90-day T-bills [see chart below]. Never forget what I’m telling you here on T-bill yields. The 90-day T-bill rate is the conservative investor’s North Star. It is certainly mine.”

You don’t need to know much about history to remember what happened in 2007 and to appreciate what Dick was telling investors. He wasn’t pontificating. He was describing the dangers at that specific moment in time.

Today, the risk-free rate is a) negative and b) below 4% in nominal terms. Red flags are flying. And like a broken-record, you are seeing investors pile into inappropriate and risky investments because they can’t get a decent return on 90-day T-bills. Index funds and ETFs that mimic perhaps the largest “managed” index in the world, the S&P 500 as I wrote to you here and here, are partying like its 1999. Investors have gotten so entangled in trading this formula or that stock option—they can no longer strike through the nub of things.

Don’t ever forget: “The 90-day T-bill rate is the conservative investor’s North Star.” It is certainly mine.

Originally posted October 30, 2017.