You may have read about my client Dr. Lee earlier this week, how we’ve been working together for 16 years, and the story behind the homemade “Thank You EJ” sign in the picture. I want you to read his response to my post and share it with everyone whose financial security you care about.

Part of my effort on your behalf is to help you avoid inertia, get into the compounding game, and always be prepared for the worst. Always think about your risks first and realize the success you and your family deserve. It’s that simple.

Here’s what he wrote:

Well said. Hope people listen. It’s not Rocket Science. Simple. Start early follow the Young philosophy and stay the course. Einstein‘s 8th wonder of the world will do the rest for you. Lee

That eighth wonder of the world is compound interest. The best way to begin understanding the power of compound interest is to consider saving for your grandchild. Back in July, I wrote about such a scenario:

The short answer is, early. The earlier you can start saving for your grandchild, the greater the impact you’ll have on their life.

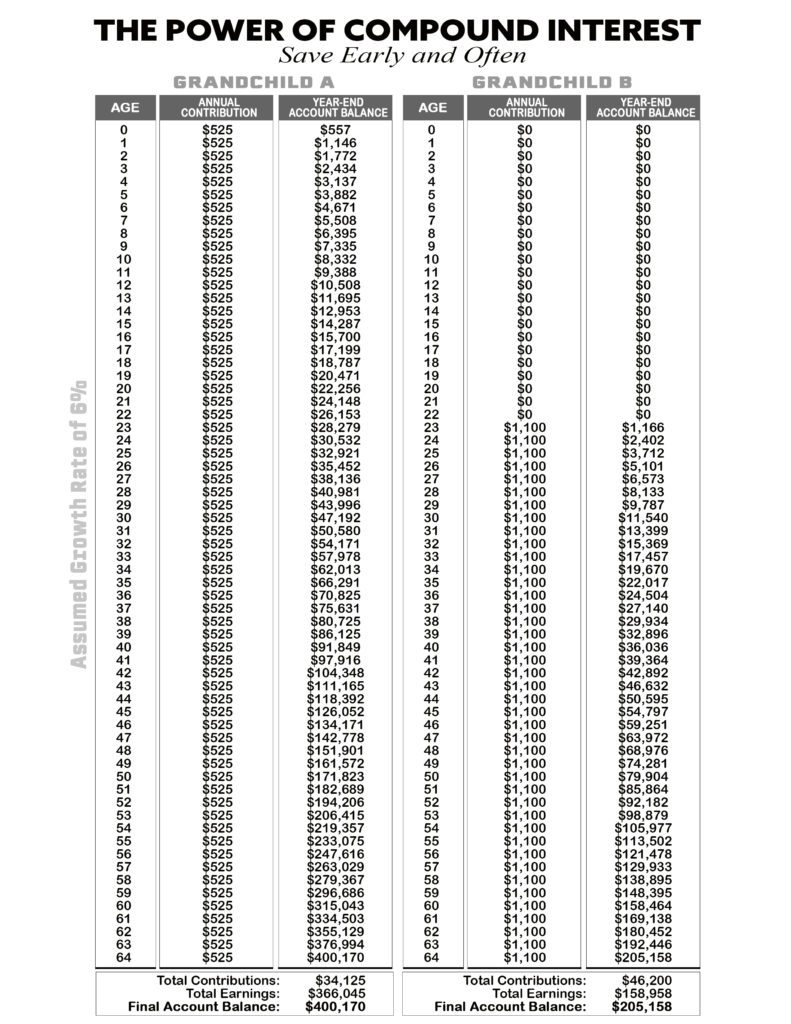

Take a trip with me. Let’s say you help a grandchild get into the savings game when they’re born by contributing $525 per year to an account you establish for them. (I favor UGMAs for this purpose). You diligently save each year for her first 21 years.

Then when she turns 22, she continues along the same path, saving $525 on her own each year until she’s 64.

Look at my table below to compare her success to someone who begins his investment savings at age 22 at double the savings rate of your granddaughter, saving $1,100 each year. Even though he’s saving twice as much each year, when he turns 64 he’ll have half as much as your granddaughter simply because you helped put time on her side with your early generosity (I’ve used a long-term expectation for stocks of 6% growth per year).

So, how do you save money for your grandchild? Easy, put time on their side.

You must be the one to harness the power of compound interest by saving early and often.