If you haven’t constructed your bond portfolio yet, then what are you waiting for? Once you’re in your 50s, the time has come to own some bonds. Consider bonds your anchor to windward.

Determining how much you, not your neighbor, needs in bonds is a most personal equation. Only you and your spouse and hopefully your advisor know the right mix for you. Period.

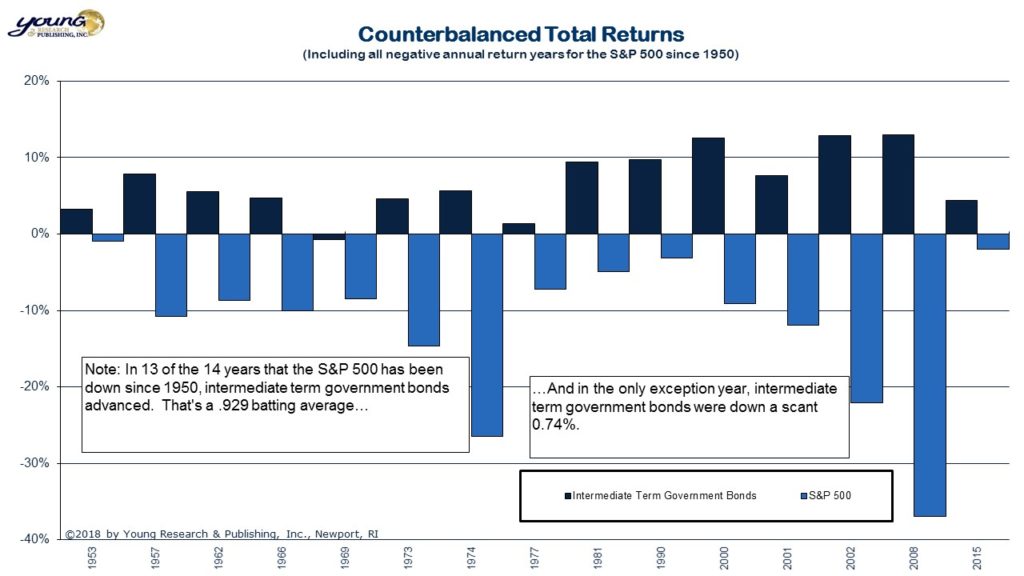

Unfortunately, those well into their golden years who put off bonds paid a devastating price in the two stock market crashes so far this century. So what are you waiting for? Imagine how you’ll feel in the third stock market crash this century. Understand the value of counterbalancing and you’ll be on your way to long-term investments success.

Michael Wursthorn and Daniel Kruger write in The Wall Street Journal that Americans are increasing their purchases of bond funds. They write:

Those sentiments helped drive more than $80 billion of inflows into taxable bond funds in the first half of the year, outpacing the roughly $60 billion that was pulled from U.S. stocks over the same period, according to Morningstar’s data. At the same time, asset managers including investment giant BlackRock Inc. have recently reported a substantial slowdown in inflows. Money coming into passive funds that track the market dropped 44% through the first half of 2018, Morningstar said.

Short-term bond yields have become more attractive in the meantime. As the Federal Reserve has continued its campaign to raise interest rates, the yield on the two-year U.S. Treasury note recently rose to 2.655%, versus the S&P 500’s dividend yield of 1.9%—the widest disparity since the 2008 financial crisis, according to State Street Global Advisors.

“Risk-adjusted returns on stocks versus Treasurys are not as compelling as they have been,” said Brian Nick, chief investment strategist at Nuveen.

Read more here.

Originally posted on July 26, 2018.