You have the unique ability to understand your financial situation if you can take emotion out of the equation. But unless you have an investment counselor you speak with regularly, that’s a hard ask. We all get a little uptight when it comes to our money. I’m here to help you breathe a little deeper and to gain some much-needed focus.

Here are my top five boxes for you to check as a mental exercise for goal setting. You’ll know which ones apply to you.

☐ You’re out of debt. You own your home. You and I know homeownership is an expensive endeavor. The cash goes out the front door, literally, for maintenance and property taxes, nevermind mortgage payments. Get rid of the mortgage or do a refi to a 10 or 15-year.

☐ Emergency Cash. Get some. Only you know the amount that helps you sleep well at night.

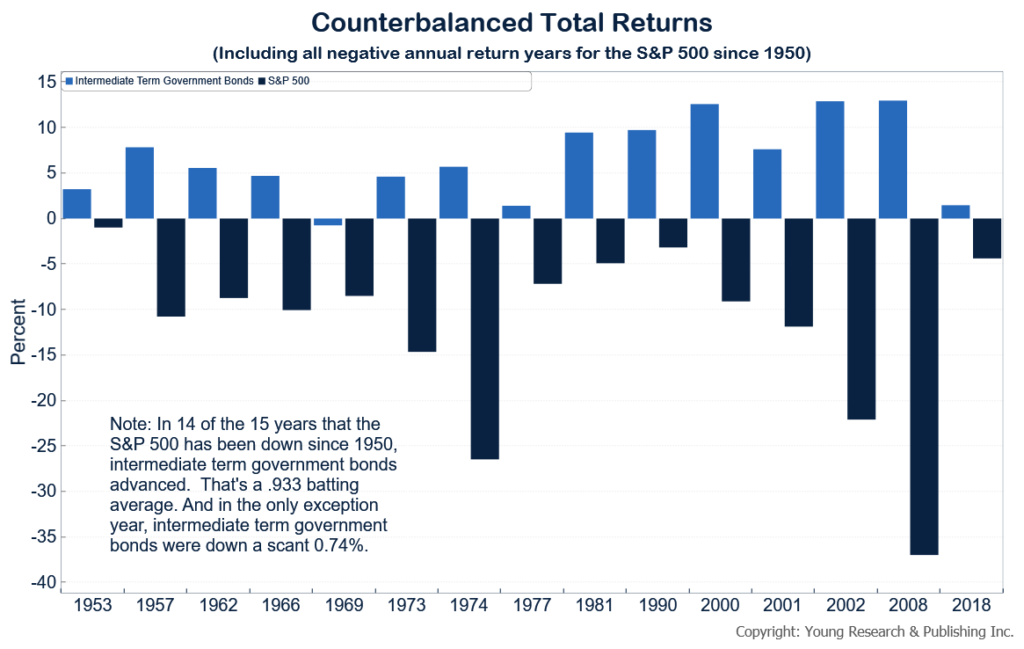

☐ Bonds. Don’t believe the bubble hype. Get some. Bonds are a counterbalance for times like these. I prefer you own bonds directly, not through mutual funds or ETFs.

☐ Stocks. No indexing or speculation. Don’t invest to sell at a higher price to some sucker. Invest for earnings and dividends and let the price take care of itself. Trust me, it works.

☐ Gold. I like it. Own some, but remember it’s an expensive asset to own. It’s like a house without expenses or a mortgage, and you don’t need it for shelter. Don’t bet the ranch on it.

Your Action Plan: Make a back-of-a-napkin review of your financial situation. It doesn’t have to be complicated. The hardest part is getting the piece of paper out and writing things down. You can do this. Sign up for my weekly email and I’ll help you beat your toughest foe—your own inertia.