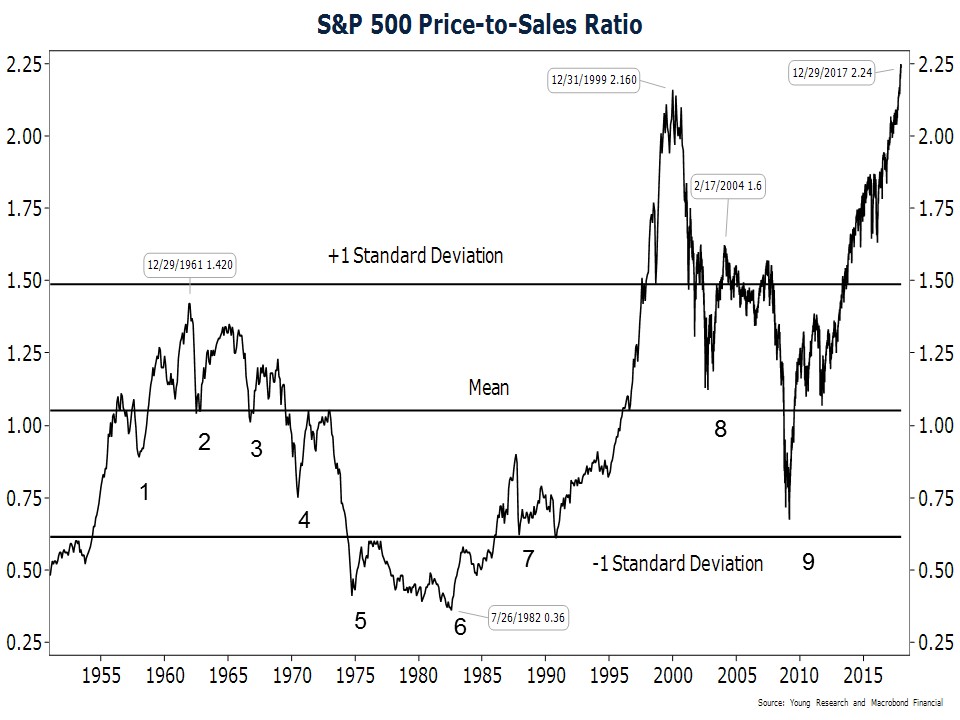

Securities valuations are at the highest levels they’ve ever been. You can see on my price-to-sales ratio chart of the S&P 500 that valuations are higher today than they were during even the dotcom era.

While stocks are valued at record levels, the situation in fixed income markets isn’t any better. With such high valuations for stocks and bonds, there is nowhere to go for pension funds looking for bargains. Despite the expensive markets, pension funds are still buying assets. Heather Gillers reports in The Wall Street Journal:

In the public pension world, the willingness to chase expensive assets is the product of the core challenge most funds face—how to fulfill their mounting obligations to workers and retirees.

Decades of low government contributions, overly optimistic assumptions, overpromises on benefits and two recessions have left them with deep funding holes at a time when retirees are accelerating cash outflows. Estimates of their current combined funding shortfall vary from $1.6 trillion to $4 trillion.

The goal of most pension funds is to pay for future benefits by earning 7% to 8% a year. After the 2008 financial crisis, many funds tried to hit those marks by lowering their holdings of bonds as interest rates dropped, and by turning to real estate, commodities, hedge funds and private-equity holdings.

Efforts to diversify holdings into riskier assets by pension funds is a symptom of the refusal to adjust return expectations for reality. Both corporations and governments prefer to spend their money on other priorities, so by estimating higher returns for pension funds, they allow themselves to under-fund their pension obligations. I have written many times in the past (here and here for starters) that this practice increases the risk to pensioners who rely on reasonable management of their funds to secure their retirements.

Whatever pension funds buy for their members in 2018, hopefully it will reflect reasonable return expectations.