Anyone who tells you politics has nothing to do with investing is simply not paying attention. In this winter of political polarization—a deep freeze—politics matter.

Case in point. Look at Vanguard GNMA.

For most of 2018, Vanguard GNMA has been sledding from a peak of $10.45 in January.

Guess when the trough, or bottom was hit? November 6th the day of the midterm elections.

Since then, as you’ve witnessed, stocks have been twitching like a desperate squirrel working through that last nut for the winter.

Not Vanguard GNMA. It has been steady, up close to two-percent, closing at $10.19 since the midterms. Yesterday, when stocks lost 500 points, Vanguard GNMA made money.

Yes, it’s difficult to stick to an investment plan when everyone around you is a desperate squirrel. Their chewing can drive you crazy.

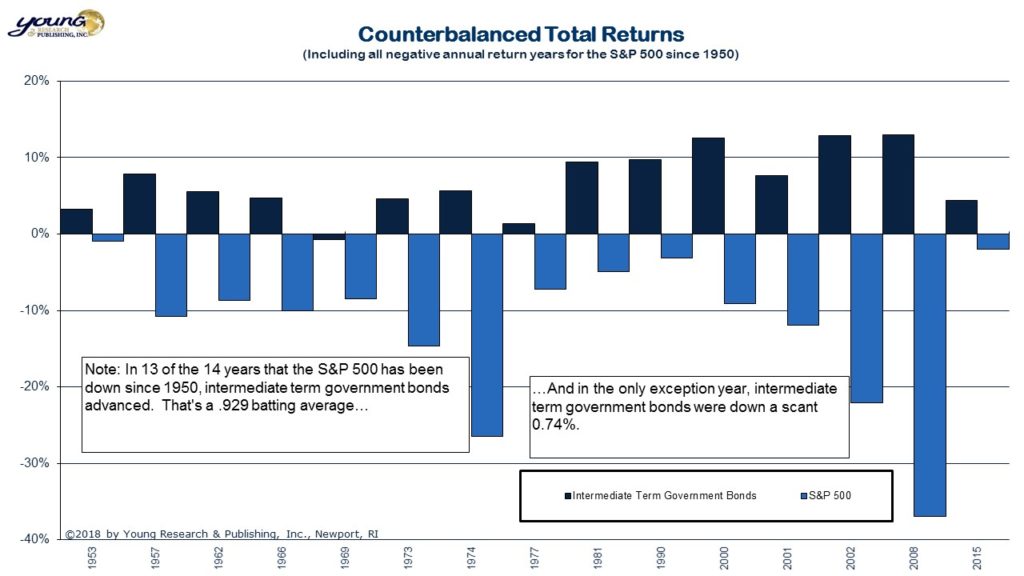

But, it’s better to take a deep breath and be happy you understand the principles of counterbalancing. Because the happiness you have from keeping your money far outweighs the desperation of making it and then losing it.

P.S. Investing well is a seven-day-a-week pursuit. Click here to read my father in law, Dick Young’s philosophy of working seven days a week to make money and investing seven days a week to keep it. You’ll be glad you did.