Investors who loaded up on S&P 500 index funds are beginning to understand the truth behind the S&P 500. Big component companies like Disney, Netflix, Salesforce.com, and Twitter are fueling a sell off. That’s not to mention Apple, where a sell off has erased over 6% since the beginning of the year, when Apple was worth as much as McDonald’s, Walmart, AT&T, Philip Morris, Berkshire Hathaway, Proctor & Gamble, JP Morgan Chase, Starbucks, Boeing, Deere, and American Express combined.

The number of securities at 52-week lows each day is higher than normal. That’s a bad sign. Gunjan Banerji and Peter Santilli report in The Wall Street Journal:

More than 220 U.S.-listed companies with market capitalizations above $10 billion are down at least 20% from their highs. While some have bounced from their lows, many remain in bear-market territory. They include S&P 500 behemoths like Walt Disney Co. , Netflix Inc. NFLX -2.48% , Salesforce.com Inc. and Twitter Inc. TWTR -2.65%

The tech-heavy Nasdaq Composite has been particularly turbulent. Around 39% of the stocks in the index have at least halved from their highs, according to Jason Goepfert at Sundial Capital Research, while the index is roughly 7% off its peak. At no other point since at least 1999—around the dot-com bubble—have so many Nasdaq stocks fallen that far while the index was this close to its high, Mr. Goepfert said.

The selloff in many individual stocks highlights how shaky the stock market’s 2022 has been. U.S. stocks last week posted a second-straight weekly decline, dragging the S&P 500 and Nasdaq down 2.2% and 4.8%, respectively, to start the year. Some stocks and sectors have moved even more dramatically.

“There’s been a lot of disruption and divergence between winners and losers,” said Ilya Feygin, a managing director at WallachBeth Capital.

Many investors have been positioning for the Federal Reserve’s shift to raising interest rates this year. That has sent Treasury yields to the highest level since 2020, while bond prices have tumbled, rippling across the market.

A turning point, traders said, was when the Federal Reserve in November warned of tighter monetary policy ahead, abandoning the notion that the current bout of inflation would be short-lived. That triggered a selloff in shares of speculative growth companies that had been popular in early 2021.

Investors have continued to re-evaluate those companies, alongside other tech stocks, in the new year. For example, Cathie Wood’s flagship fund, the ARK Innovation ETF, has lost 15% this year and is down around 50% from its 52-week high, or in a bear market.

Action Line: You’ve known for some time that the S&P 500 was teetering on the gains of a few big firms and that an alternative is a portfolio of individual stocks. If you need help building an investment plan, I would love to talk with you.

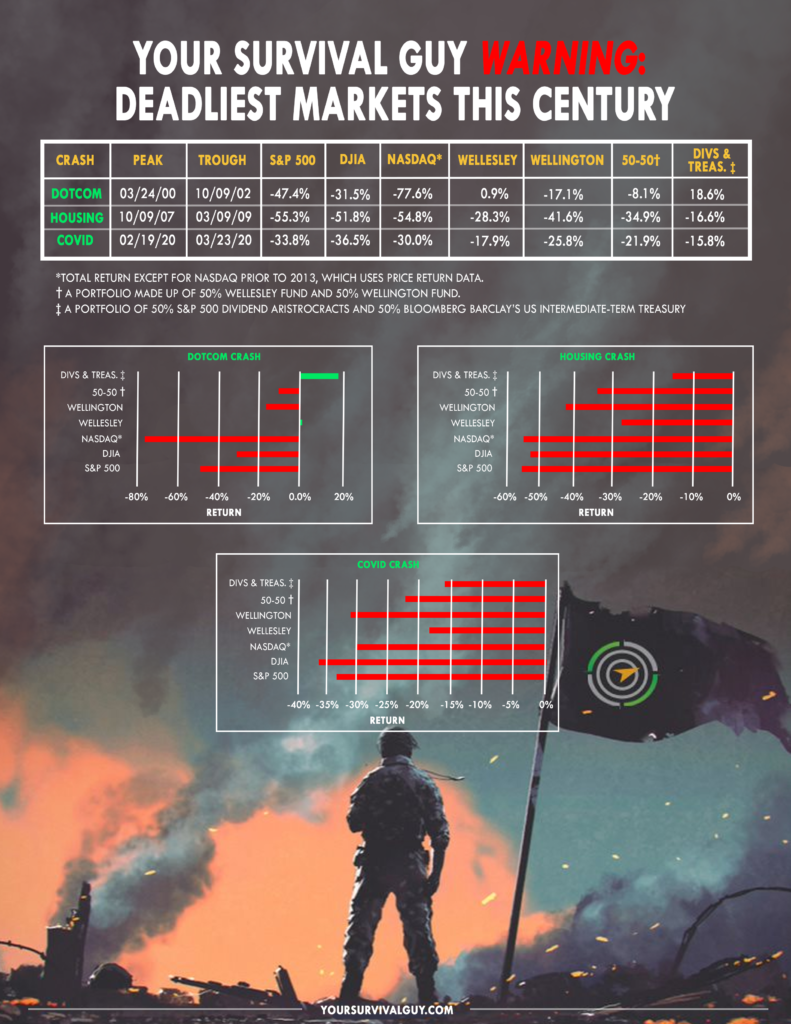

If investors aren’t careful, the near-term future could end up showing up on Your Survival Guy’s list of Deadliest Markets This Century.