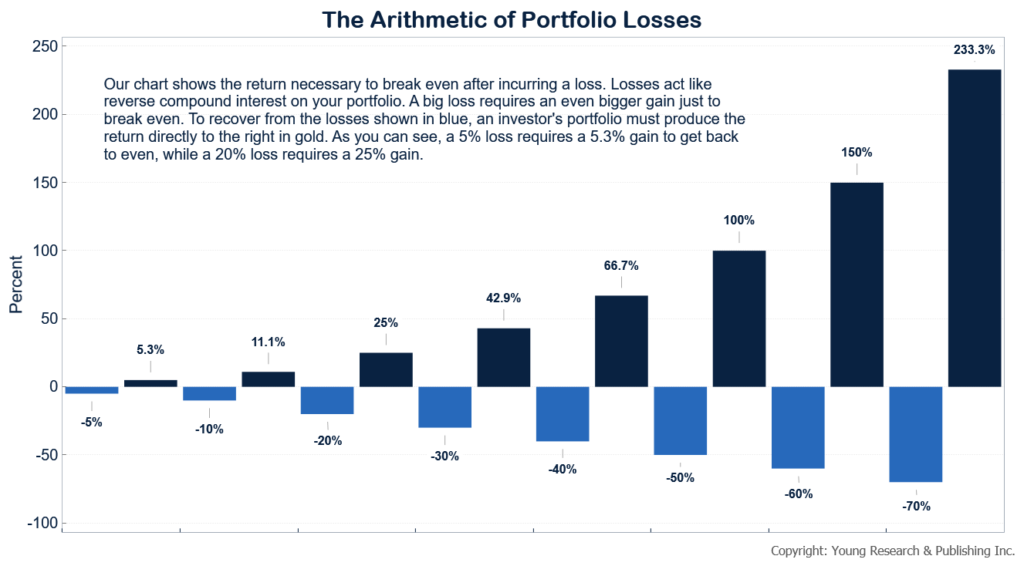

In his April 2000 issue of Dow Theory Letters, the late-great Richard Russell wrote about the arithmetic of losses noting that Nasdaq had dropped about 68% from the previous year’s peak. To get back to even, he noted, Nasdaq would have to climb more than 170%. As many of you know that didn’t happen for a long-long time.

“Note that CNBC,” explains Russell, “and many other sources continue to talk about a stock’s climb in percentages. But this can be misleading and frustrating. Example: you buy a stock for $50. In the bear market it drops to $2—you’ve lost $48 plus commissions.

Then you hear on CNBC that your stock has risen 50%. That’s fabulous, your stock is up 50%. But what does that mean? It means your stock which has dropped from $50 to $2 and now up 50%–is selling at $3. Big deal—your stock is up 50% but it’s still miles away from recovering.”

I had a constructive conversation with a client yesterday who lives in New York. We were reviewing his allocation to make sure it was right for him. We talked about the advance in some of the tech stocks and if his exposure was appropriate.

“Did he have enough in stocks?” He wondered.

We talked about that for a while.

And what it came down to was family.

Would his family be that much better off if his portfolio goes up 15% compared to 10%? Probably not. But life would change if he lost 15% or more as we’ve witnessed in some brutal stock market crashes—two already this century.

Don’t waste your time wondering what could be or could have been. Focus on your life. Focus on what you’ve made. And don’t ever forget what it feels like to lose money, because losing money changes more than your bottom line. It’s a killer.