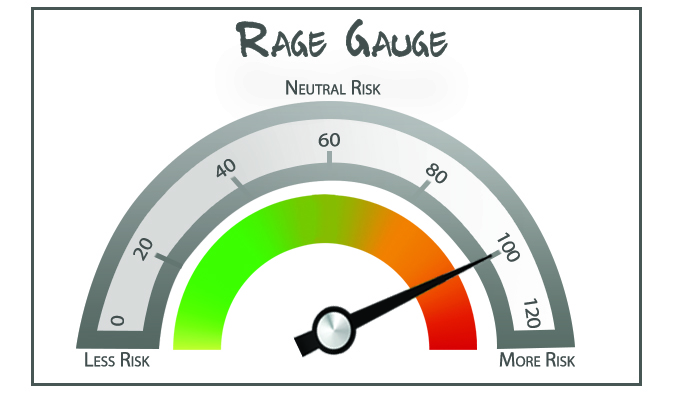

Your Survival Guy’s October Rage Gauge is in and it’s not pretty. What did you expect me to say? The stock market is on a Fed induced sugar high, American voters are on edge about the election and the overall direction of the country, gold is at a record high, and gun sales had their first two-month increase since 2021.

Your Survival Guy’s October Rage Gauge is in and it’s not pretty. What did you expect me to say? The stock market is on a Fed induced sugar high, American voters are on edge about the election and the overall direction of the country, gold is at a record high, and gun sales had their first two-month increase since 2021.

Americans are not stupid. They know they’re being lied to about the state of the country, the true level of inflation, and the breakdown of law and order in the cities that is slowly creeping into your neck of the woods. Big business is getting the message, too. Pepsi realizes American consumers will not fall for the shrinkflation trick of fewer chips for the same price.

While Your Survival Guy is still in Paris, I can tell you the Chinese are not, a fact which you can see by the stock price of LVMH. Luxury sales by the world leader LVMH and its stock price do not bode well for lesser competitors.

Your Survival Guy’s boots-on-the-ground perspective at the luxury boutiques on L’Avenue Montaigne and Rue Saint-Honoré is this: They pay huge rents, spend a fortune promoting new lines seasons into the future, hoping it all works out. This is not your consumer staple business—luxury consumers don’t know what they want or what they desire until it’s created for them.

About 70% of the global luxury goods business is generated by the U.S., Europe, and China. Back in 2000 China was one percent. Today it’s a third. Growth is not coming from tapped out Chinese consumers. And prices can only be increased so much when consumer pennies are being pinched by inflation.

Look at Warren Buffett’s favorite market valuation metric and keep in mind it is a market cap weighted index, meaning the big stocks have the biggest impact. We may be nearing peak passive indexing. Imagine the amount of selling that will occur when Baby Boomers need to fund their retirements.

Now is the time to look at your fixed income and lock in yields that are still attractive. Do not let the perfect get in the way of the good—a good income stream for you. Too often investors invest according to today’s headlines and miss the boat. The tragedy is they didn’t take advantage of the opportunities right in front of them. Don’t let that be you.

P.S. Here’s more from my trip to France.

Read more about my adventures in Paris here.