What’s most disturbing about a black swan event is how it affects the rest of us. What will this non-bailout, bailout of Silicon Valley Bank and Signature usher in? Will we have a new way of banking where the Fed gets to call the shots? Will digital dollars be their way to control us?

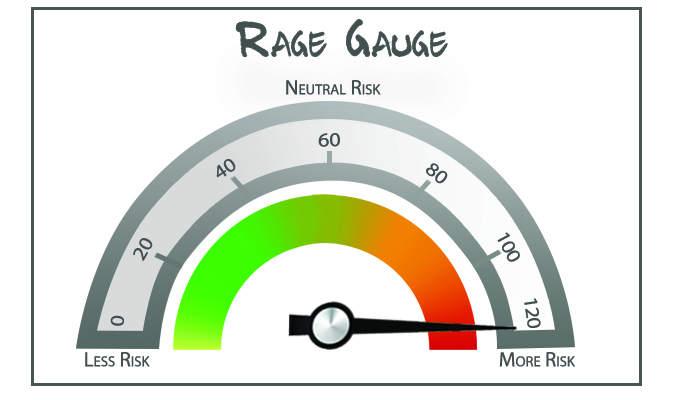

Risk perception is once again pegged to the maximum on my RAGE Gauge. Is it any wonder? War in Europe, inflation at home, the potential for a rerun of the global banking crisis that happened in 2008 and was supposed to be a “once in a century” event. And the government wants you to believe that digitization of your money would be a great idea. You can’t take your money out of the bank when you can’t convert it to cash.

Because it’s times like these when those in power usher in change in the name of following “the science.” Will this give them the extra inch they need to tell us that currency digitization is for our “protection?” One thing’s for sure, we’re not going back to the way life was.

Sitting in my cave, it never ceases to amaze Your Survival Guy how the so-called pros handle other people’s money. I can see this from my unique vantage point. I don’t look to beat the other guy. I don’t look first for return on assets. I look first and foremost to return of assets. That’s the real work.

And yet every single time, it’s the hubris of the “smartest guys in the room” that were supposed to know what they were doing that gets them caught. No one knows their risk tolerance until the losses rain down and they scurry for cover.

Rather than let them work through the mess they created, we have yet another government backstop. What could go wrong? The experts want to save you? Protect you? Please. If there were ever a moment for the installation of more control in the name of “protecting you,” this is it. Stay tuned.

I’ve been warning about man-made disasters for years. Get your money to safety.

When the Black Swan Swoops In for You

A word of caution, dear investor, about money market funds: they’re not all created equal. In fact, when it comes to your lazy cash, you want to treat it with kid gloves. There’s a reason it’s on your couch. The world’s a dangerous place.

Yes, you want to get it into the big wide world to do something productive with its life. But you also don’t want it coming home one day saying: “I gambled, and I owe Mr. Big $20k. Can you help?”

Back when the financial crisis unfolded, Lehman Brothers failed, panic set in, and money markets “broke the buck” (trading below a net asset value of $1). But it was the leveraged stuff offering crazy rates that took it on the chin.

A lot has changed since then, but has it? It doesn’t take much to be sold by some broker looking to get your business promising “risk free” rates well above reality. Sure, they might work out in times like these, but what happens when the black swan swoops in for an easy meal?

Your Survival Guy cares about you. Risk is a four-letter word I avoid like the plague.

Action Line: When you’re ready to talk, let me know.

P.S. Safety First: I like the Fidelity Treasury Money Market (FZFXX) as a core money market.