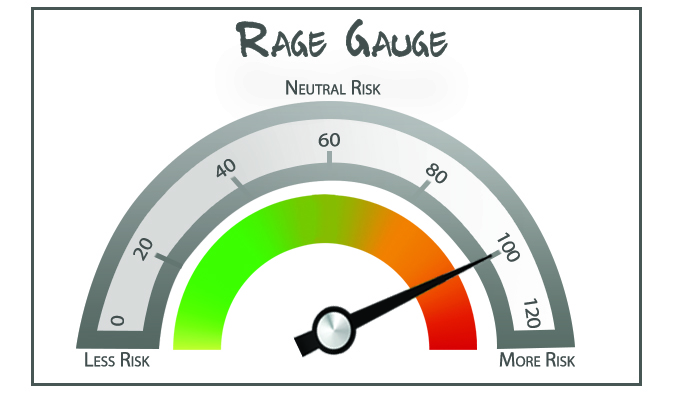

OK, Your Survival Guy’s January RAGE Gauge is in, and it’s not pretty. What did you expect me to say? It’s beautiful. Really great. It’s a winner. Who doesn’t like winners? Yes, I’m excited about the change at the White House. But when you’re investing your money in your retirement or near retirement, you need to take emotion out of the mix.

As my father-in-law Dick Young says, “Survival Guy, remind your clients about ‘diversification and patience built on a foundation of value and compound interest.’” And it’s patience we have needed to endure the Obama/Biden years.

You know we have a long history with Fidelity going back to the days when Ned Johnson II held the reins of the family company. It’s still family-run. Fidelity is not a publicly traded company under pressure from Wall Street to meet arbitrary earnings expectations. Today, Johnson’s daughter Abigail is at the helm.

Transparency and the Commission Omission

This week, in my conversations with you, you asked me about an article in The WSJ by the excellent financial columnist Jason Zweig (On my desk is Ben Graham’s The Intelligent Investor with commentary by Zweig. Get the spiral edition so you can lay it flat on your desk). You can read his column here.

Zweig speaks with an investment advisor who custodies client assets with Fidelity and is surprised to discover the advisor has been pressured to invest in Fidelity funds to generate more revenue for them. I can tell you this has not been my experience with Fidelity.

As the industry races to zero fees, I think we’re going to hear more examples of this. There’s always a cost somewhere. The industry is no longer for the little guys who will be kicked out if they’re not big enough.

There was a time, not that long ago, when commissions for a single stock purchase reached the hundreds of dollars. Now they’re mostly free. If Fidelity is going to be the leader in the industry, this is a perfect opportunity for it to come up with a model that works for Fidelity and its customers. But it needs to be transparent. Customers need to know what’s going on, especially today, where nothing is a secret.

Cash Isn’t an Investment

Shifting gears, I wrote to you last week about Fidelity moving to FCASH as its cash sweep account for brokerage accounts and no longer allowing money markets as a default (this doesn’t apply to IRAs). I’ve always viewed money markets as investment decisions like stocks or bonds. Money markets are not meant to be a default for all the cash flowing into and out of accounts. We’ve been lucky to have the option, but it’s not why they exist.

Back in 2008, several money markets “broke the buck.” In other words, they went down in value. That’s what investments can do. Plenty of investors out there loaded up on more “aggressive” money markets to reach for yield. When the money markets broke the buck, (pennies on the dollar), they were up in arms. It happens. It’s called investing.

Move your FCASH to your favored money market monthly. Yes, it’s another step but it was never supposed to be used as cash.

Action Line: When you’re ready to talk about Fidelity and your money, let’s talk. But only if you’re serious. Email me at ejsmith@yoursurvivalguy.com.