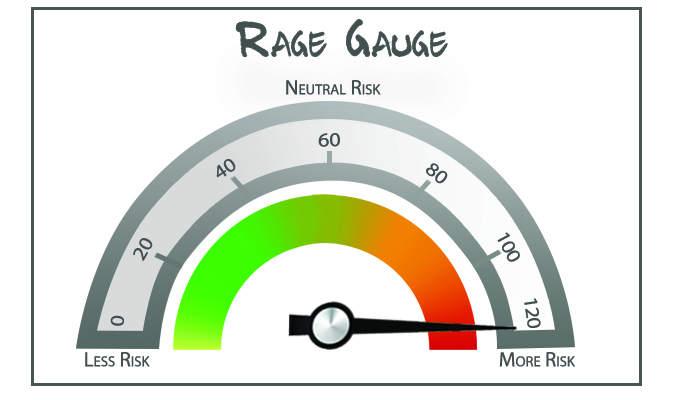

You think Americans are feeling elevated risk? You wouldn’t know it by looking at the stock market. But how are you doing on a local level? Are you taking small steps every day to secure your situation? You don’t have to change your world in a day. Focus on what’s right in front of you. That’s what’s most important. Here are some thoughts looking out at my backyard:

- Are you seeing local prices higher or lower? Here, the price for food at the grocery store is up, while remaining pretty steady at restaurants.

- What isn’t going up is the yield you’re earning on the S&P 500. Yields are near all-time lows, with P/Es near all-time highs, making your reward for taking on risk scant.

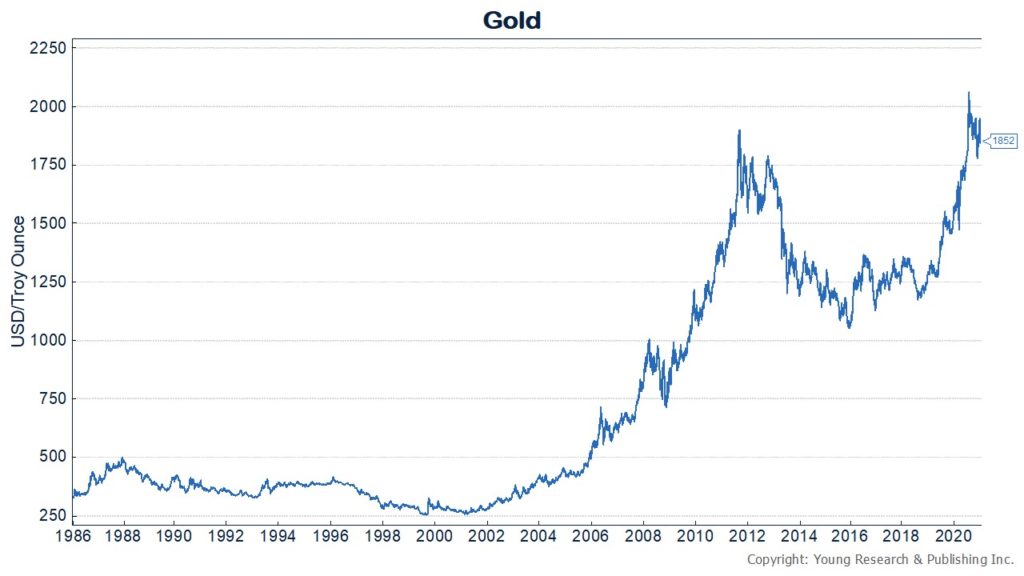

- With prices heading higher, and loads of easy Fed money in the system, Americans are rightly looking for alternatives. Gold prices are only slightly off their record highs.

- Do you have debt? It’s like an anchor around your neck. It’s ok while you’re on the boat, but try swimming with it. That’s what it feels like carrying debt during deflationary times.

- Value stocks. Yes. Imagine you own a wonderful business with pricing power. Now put that into your portfolio. That’s one way you fight inflation.

- Bonds. Yes. Imagine you’re a company. Your capital structure requires by law that your bondholders get paid first. Now imagine you own both stocks and bonds, and you see how you’ll live to fight another day in times of trouble by owning bonds.

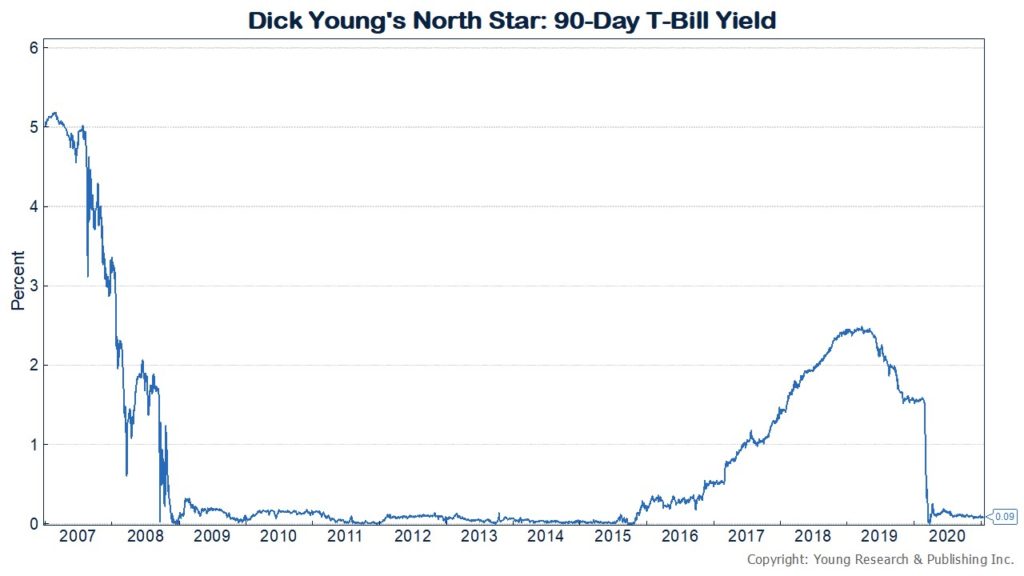

- You should find help picking the right bonds. Yields on Dick Young’s North Star, the 90-Day T-Bill, are at basement levels. America’s savers are being stripped of their wealth by inflation and artificially low interest rates in order to finance the massive fiscal stimulus bills.

- There’s nothing wrong with making money slowly from your investments.

- You spent a lifetime making money slowly with your work (unless you hit an IPO lottery).

- If you’re amazed at the amount of money you control, you know exactly what I’m saying. Fortunes can be made slowly.

- And fortunes can be lost in the blink of an eye. Don’t let that be you. Be patient.

Action Line: Make sure your financial house is in order. It’s the most important thing you control today. I believe in you. You can do this.

My RAGE Gauge remains maxed out this month as Americans feel the risk.

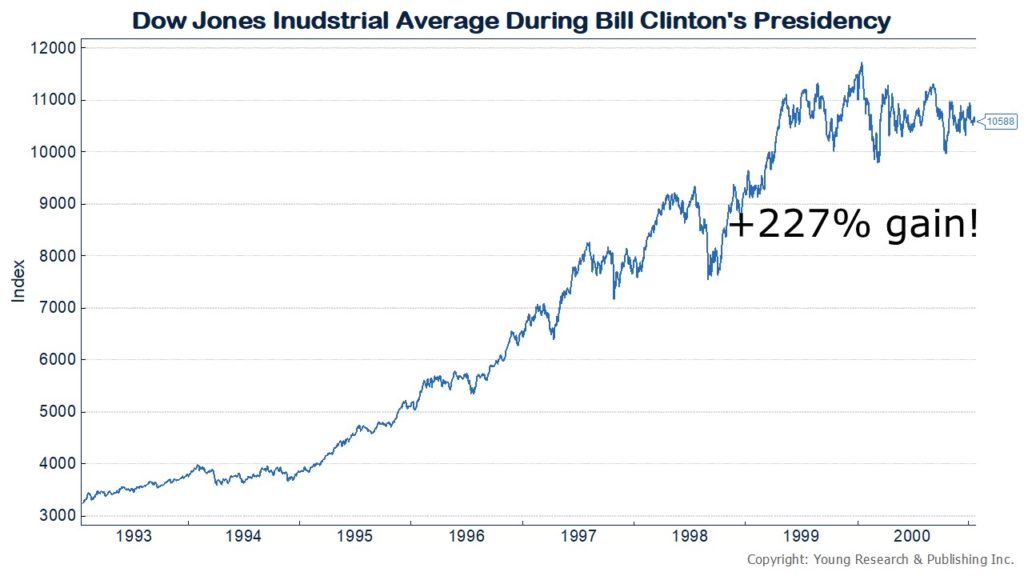

P.S. Dick Young recently wrote to investors that the stock market is about money flows, not politics. He continued:

Has America endured a more disgraced sitting president than Democrat Bill Clinton or first family than Bill and Hillary? Perhaps not.

Well you might be surprised to know that your IRA sprouted like fresh green weeds during the disgraceful decade of the nineties. Check out my chart below.

Americans have a great history of remaining optimistic, even though the Washington elite can and do act, for extended periods, like thorough fools.