Is your Vanguard Wellington fund’s outlook, OK? In a word, yes. But what does that mean for investors in the fund? You know from parts I and II, you can have your cake and eat it too. In other words, you can keep your Wellington and transfer it to Fidelity Investments.

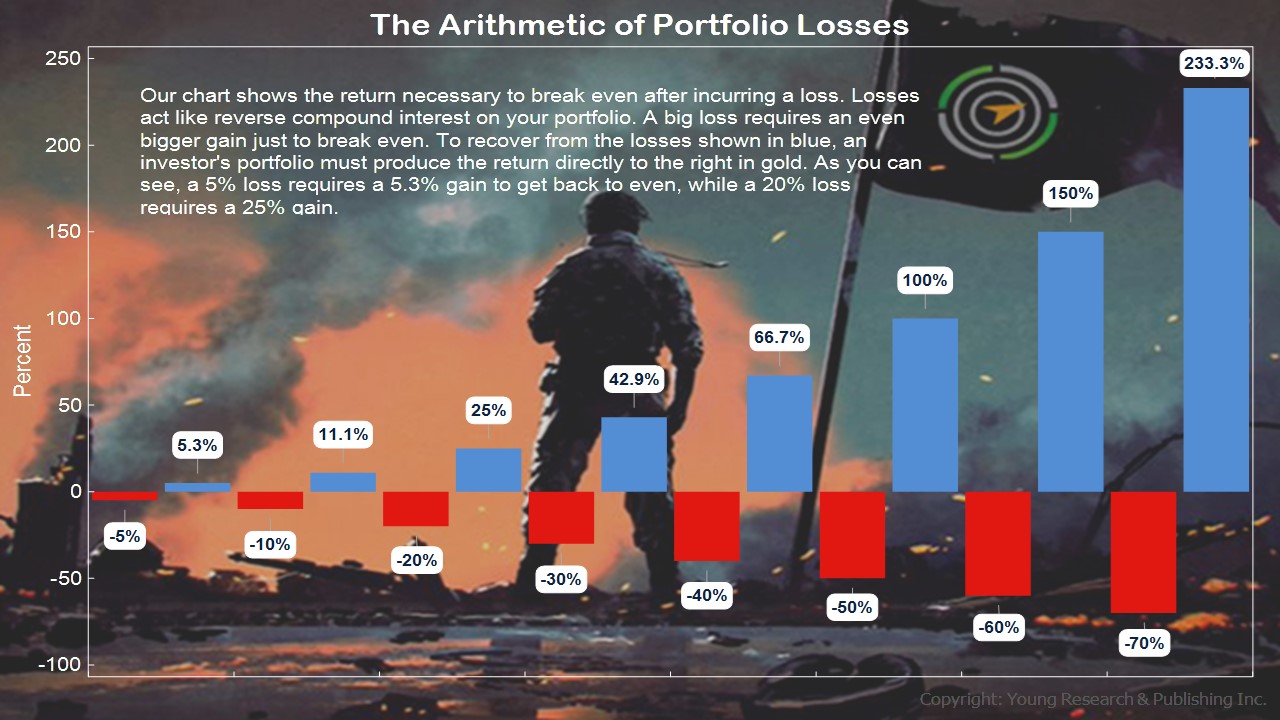

But let’s step aside for a moment and consider how investors sell at the worst of times because they can’t handle losing money. When they capitulate and throw in the towel, it’s more about how much money they can’t stand to lose. It has nothing to do with the future. And, of course, history shows these are the times to be buyers, not sellers.

The beauty of the Vanguard Wellington fund is its balanced approach. It’s a mix of around 40% in bonds and around 60% in stocks. What history shows is the balanced approach helps lessen the wild swings in stocks. When it comes to your retirement life, you do not want to be worried about your money. “How much did we lose today?” asks your spouse. This is not a question I want you to receive.

Being worried about anything is a terrible emotion. I don’t want you to be worried about your money. If investors focused more on their downside protection than on how much they need from the market, I believe they would be less worried. They would live within their means and not hope for miracles from the market. But they tend to learn the hard way.

Action Line: Focus on your downside protection. Save ‘til it hurts. Work for as long as you can. And live within your means. Simple, yet hard for many to do. If you want to talk, let’s talk. But only if you’re serious.

Read the entire series here.