With tax bills due and family gathering for Easter, it’s money talk that’s on the table. Unexpected tax bills from mutual funds that lost money are never fun. Headline statements about the banking disaster are going to come up. But is anyone paying attention to how this could lead to digital currencies?

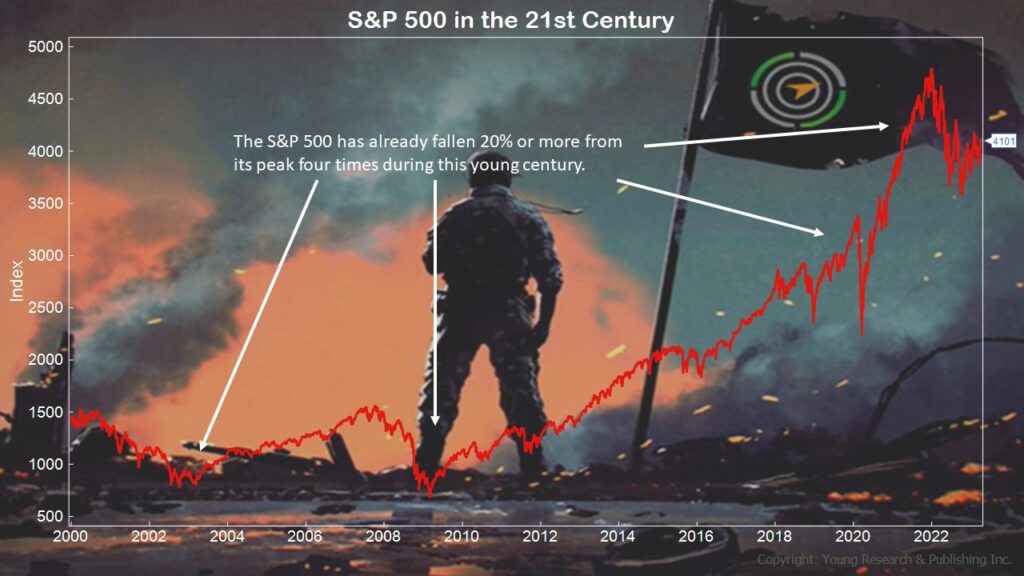

It’s easy to shrug off the subject of money. But sometimes some honest advice is what’s needed. When “Mr. Smart Guy” starts talking about ChatGPT, you don’t have to go along for the ride. Be nice, of course. But it might be worthwhile noting stocks have already been down 20% four times this century. And that’s not even getting into the areas that got destroyed.

A point worth making is that most of the worst investing disasters are man-made. Yes, I’m talking about too big to fail, monetary excess, zero percent rates, etc. But I’m also talking about the individual investor who learns he’s the black swan’s prey far too late. It happens over and over again. If the investor was simply focused on keeping what he made, he’d avoid a lot of heartache.

But being a Prudent Investor sounds boring, especially around the dinner table. But it’s not boring when you become a fairly rich man. When you have some money to do what you want to do. Then it can be fun.

Action Line: Most investors realize their risk tolerance too late. Someone needs to set the family straight. If you need someone to stand by you, I’m here.