What we learned from the Federal Reserve yesterday was just how tightly the market holds on to every word from Fed Chairman Jerome Powell. No sooner did he alter his language on potential rate cuts and markets sold off, especially the speculative Nasdaq.

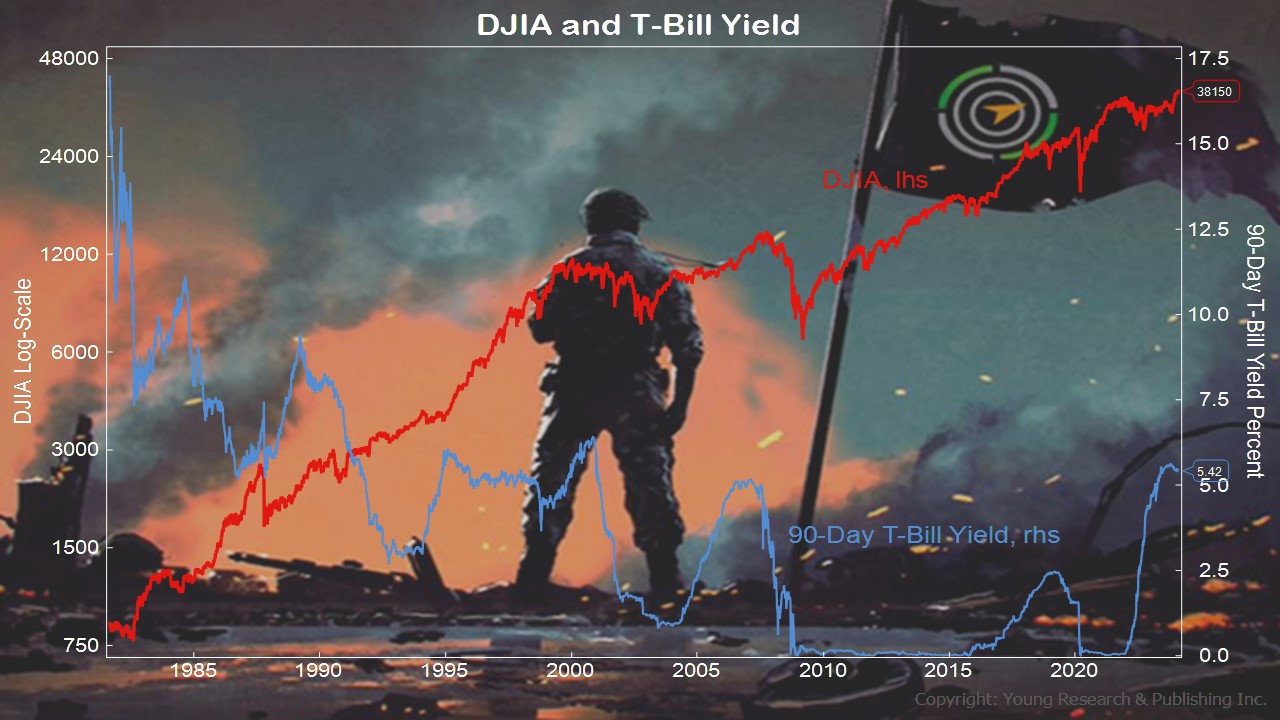

Look at the long-term path of interest rates above and the DJIA, and you can see the connection between interest rates and prices. Now we’re stuck in this no man’s land where finally fixed income investors can get some interest on their savings, and sure enough, the market has a fit.

Interest rates are hardly in need of a cut. Inflation is not under control when you consider how high it has risen. Anyone who’s gone grocery shopping, out to dinner, turned on the lights, AC, and/or heat understands how ridiculous it is to look at month-to-month changes. Prices are way too high.

This market is thin. It’s like a frozen lake where only a few can walk. That’s not a robust indicator for the future. Now is the time to get your fixed-income house in order. Get your lazy cash working and focus on building your margin of safety.

Action Line: When you’re ready to talk, let’s talk.