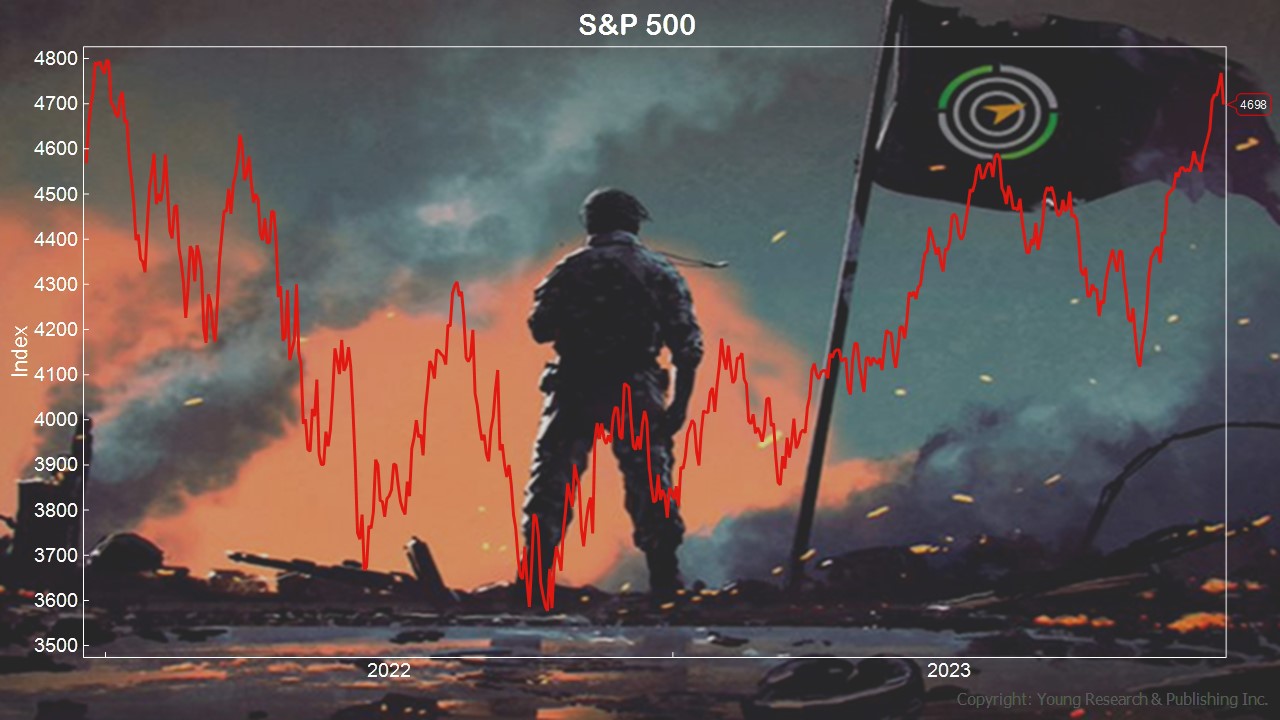

In a “What have you done for me lately?” world, it’s easy for investors to see this year’s returns on the S&P 500 and compare their performance. That’s short-sighted. Because if we look over the last two years, for example, the S&P 500 has basically returned to where it was this time in 2021. What’s lost on many is that a dividend-centric approach offered a way to be paid while the market price spun its wheels.

Now then, what’s not often discussed is how many investors bailed out of stocks on the way down and missed the rebound, and in their frustration, are now asking, “Why am I missing the boat?” Well, if they had gone into the whole thing with a plan and stuck to it, maybe they wouldn’t find themselves in such a tizzy.

As Your Survival Guy sees it, we are perhaps in the best environment we’ve seen in a generation. The best environment that is, for one who seeks dividends and interest—the balanced investor—those for whom I write. Yes, I like what I see in bonds, and yes, I like the long-term prospects for the dividend-centric stock investor who has the temperament to get through tough markets.

Action Line: When you’re interested in a plan, let me know. I’m here for you.

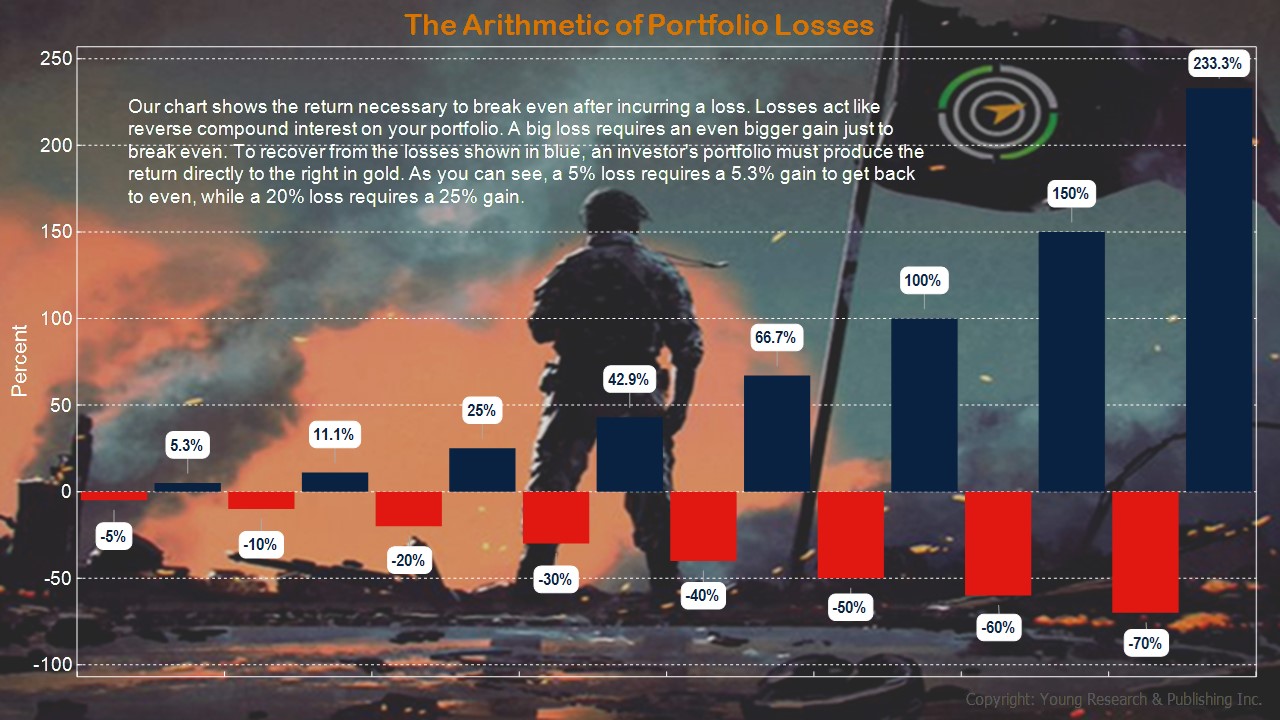

P.S. Remember, it’s not necessarily how much you make but how much you keep. The arithmetic of losses is not as simple as one plus one.