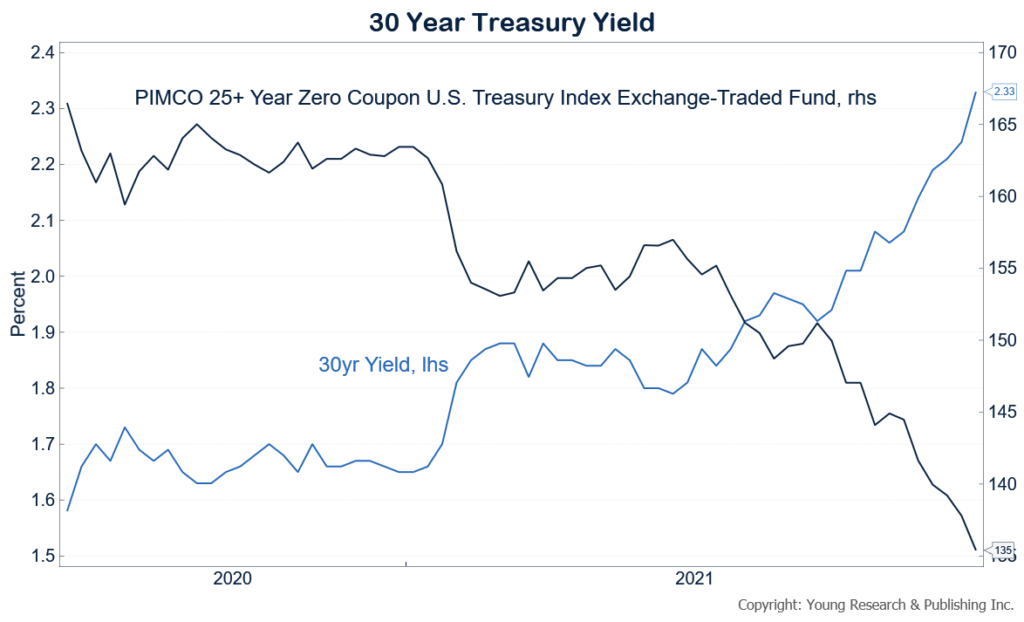

Jack be nimble, Jack be quick. Jack jumped over the…you know how it goes. As investors stomp their feet because stocks are going down (the horror), let’s not forget what’s happening to bonds. Anyone who reached for yield on the 30-year Treasury is learning about duration—basically, for every one percent increase in rates, bond prices drop, in percentage terms, by the years of maturity.

In other words, if rates go up, long-term bonds get killed by a factor many times worse than short-term bonds. It’s pretty easy to hold short-term bonds to maturity, in times like these, and handle the volatility. Not so much when you’re sticking your neck out 30-years on the curve.

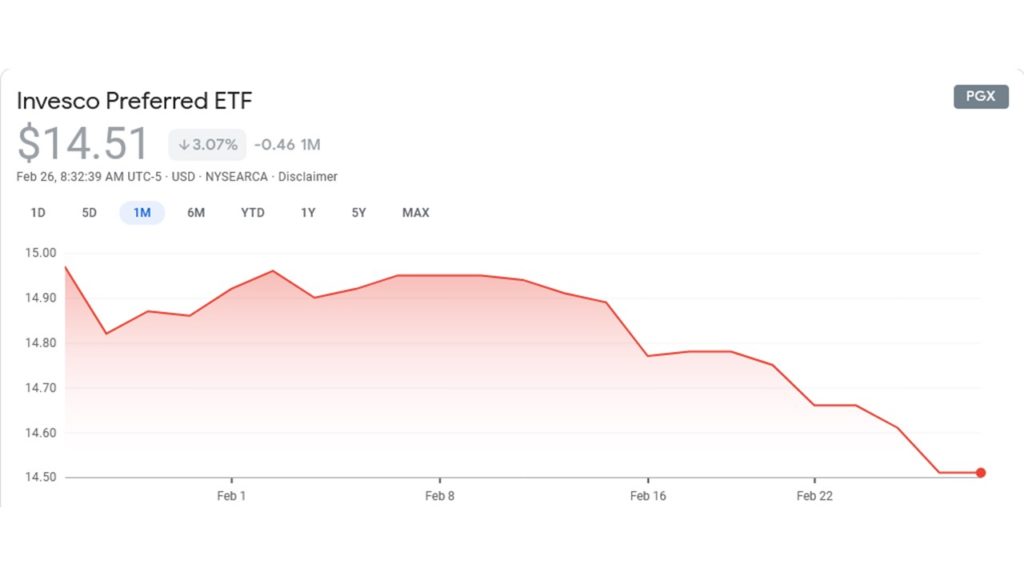

How about preferred stocks? Hey, I get why investors have been gobbling ‘em up, but let’s be real. They act like bonds, have a perpetual maturity (LONG), and get slammed when rates go up. Talk about playing with fire…

It’s why you need to become familiar with Dick Young’s North Star. This is not a good look. Adjust accordingly. RISK is HIGH.

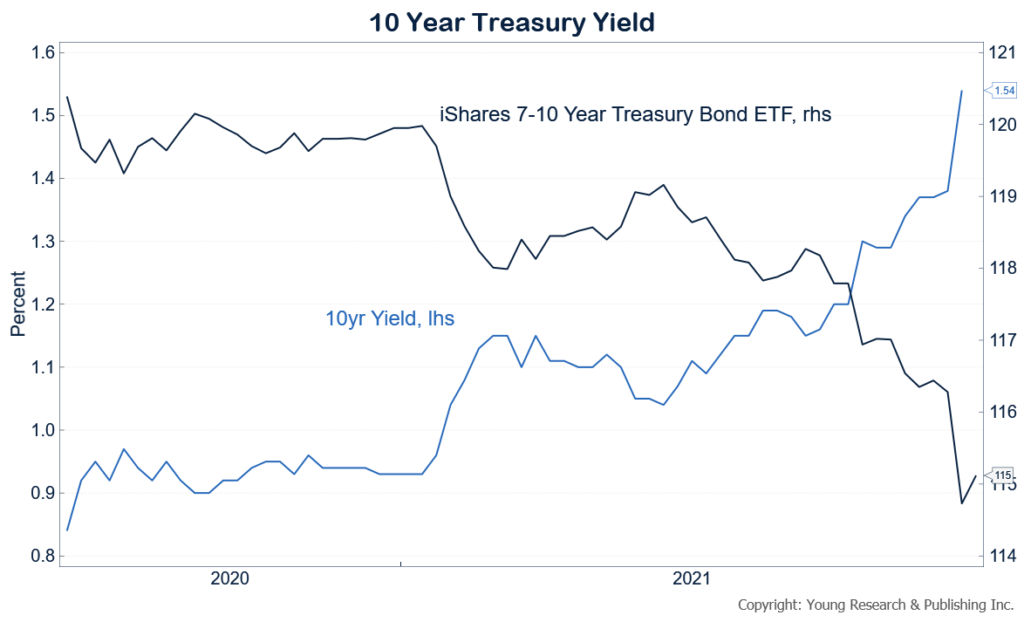

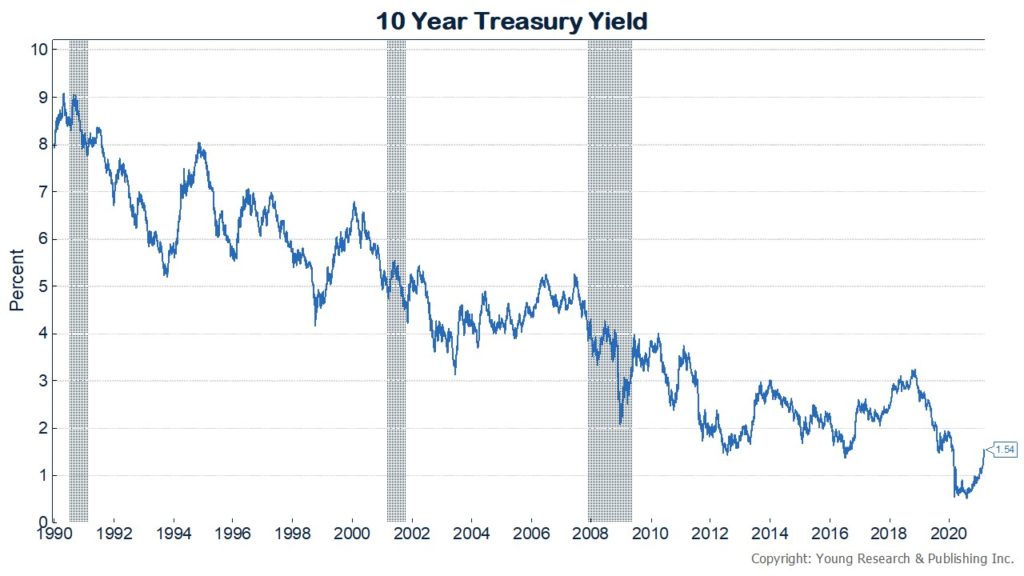

How about the belly of the yield curve? Not pretty. What are we talking about, a percent and a half on the 10-year Note? Not much of a hurdle, like jumping over a candlestick, but realtors want it LOWER. Come on.

And Century 21 isn’t alone. Big-spending big dogs (or is it lap dogs?) in D.C. demand low-interest rates to maintain their profligate spending. When I was at Babson, the hurdle rate was many times higher than today. When everyone’s reaching for yield and playing the stock market—look out.

Action Line: Never be in the interest rate prediction business. Instead think about crafting a portfolio based on your needs, not your wants. Remember, the harder you work—the harder you work. Markets don’t really care.