Are you tired of the election yet? It’s been years, not months, that many of us have been waiting for this moment. There will be winners, and there will be losers. Your Survival Guy has concerns about the future, and you know that to be true from our daily chats. If you’re new, then welcome, and I hope you’re getting the intelligence you need from your trusted advisor. Let’s dig into this.

Election Surprise #1: Interest Rates Are Going Up.

I know, I know the Federal Reserve meets this week, and all the talk is about how they’re going to cut rates. I expect the same. But remember, the Fed controls a narrow corner of the yield curve, and based on recent Treasury bids, investors are saying, “Show me the money.”

You and I know the level of debt the government has accumulated, and it is not a Democrat or Republican problem, it is an American problem. America does not control the world. Its reputation is not what it used to be, as I experienced on my recent trip to Paris. And there’s fierce competition to replace the dollar as the world’s reserve currency.

Look at the debris, junk, and debt you see every day and ask yourself: who is going to clean it up—who will fund it? It seems to me we are in for either more money printing, a reduction in government services, higher taxes, demand for higher yields for Treasury bonds, and/or all of the above.

It’s why I don’t want you to be in the interest rate prediction business. I want you to take advantage of cash on cash at Fidelity Investments and more opportunities in fixed income as they continue to appear in the months ahead.

Election Surprise #2: Scores of Municipal Bonds Will Be Underwater

I do not like municipal bonds. There I said it. Let your cousin know. Because too often, investors lick their chops buying juicy tax-free municipals without a single thought about the finances of the issuer.

You know from my study on Your Survival Guy’s Super States the financial divergence from one border to another. When I think about fixed income investing, I think about return of assets, not return on said assets. I do not think of municipal bonds.

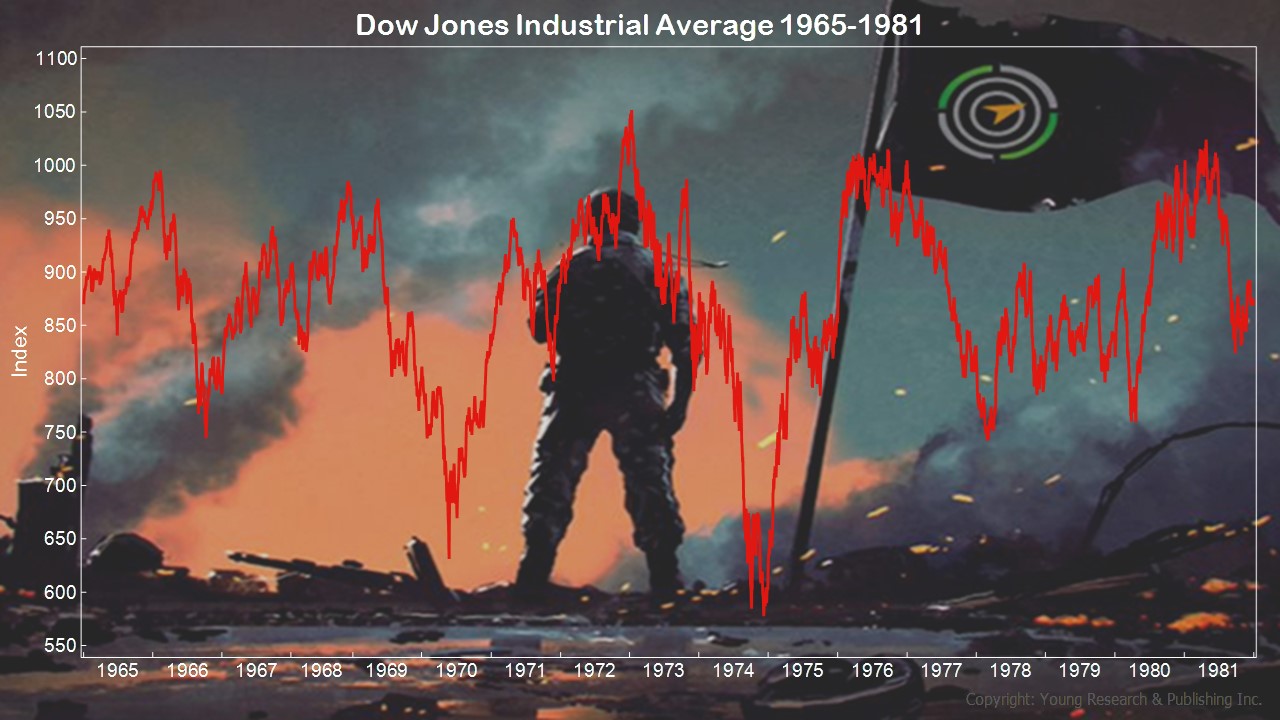

Election Surprise #3: Market Volatility Will Ruin Peace of Mind

Look at my chart below and see how long stocks can stay in a funk. It happens and it can be most of a retirement for those stuck in it. It’s why I want you to be paid to be invested in this market with a dividend centric portfolio. It may be a rough road ahead for those living and dying on prices. Prices are qualitative. Income is quantitative. Take the money and stick with your plan.

Election Surprise #4: Do Not Forget About the Opportunities in AI

Yes, fortunes may be made and lost with AI, but let’s not ignore the potential game-changing opportunities ahead. You know from here, here, here, my concerns about top-heavy index funds. The big names comprise an overweighted proportion of index funds as money is passively thrown at them.

For you, I want you in a more disciplined investment plan where you’re not just throwing money at an index. And let’s not forget the need for energy as I describe here, here, and here.

Action Line: I hope you’re having financial planning discussions with your advisor. If not, you can reach me here: ejsmith@yoursurvivalguy.com. I look forward to hearing from you.