“Hey, Survival Guy, what have you done for me lately?” you ask.

“Good question.”

Let’s refresh our memories. One of the more important tasks of an investor is to protect what one makes. You know how it goes. Rule #1: don’t lose money. Rule #2: don’t forget rule #1.

As another wise man said, then there’s rule #6: “Don’t lose money.” When asked about rules one through five said, “There are no other rules.”

See how fun this can be?

As we get older, we learn the rules. One way or another, we learn the rules. I’d put the school of hard knocks up against Harvard any day of the week. Because one of investing’s more powerful lessons is not how to beat the market but how to avoid the temptation to “throw a little money” at something.

Remember, you don’t need to compound huge percentages to make big money. Interest on interest can and does work miracles. Look at my favored money markets, paying around five percent. You can double your money in less than 15 years for basically doing nothing. What’s wrong with that?

How about stocks? I want you to be paid to invest. At some point, the market may look like scorched earth. Everyone thinks they’ll be able to get out in time. Good luck with that. We’ve seen this movie before.

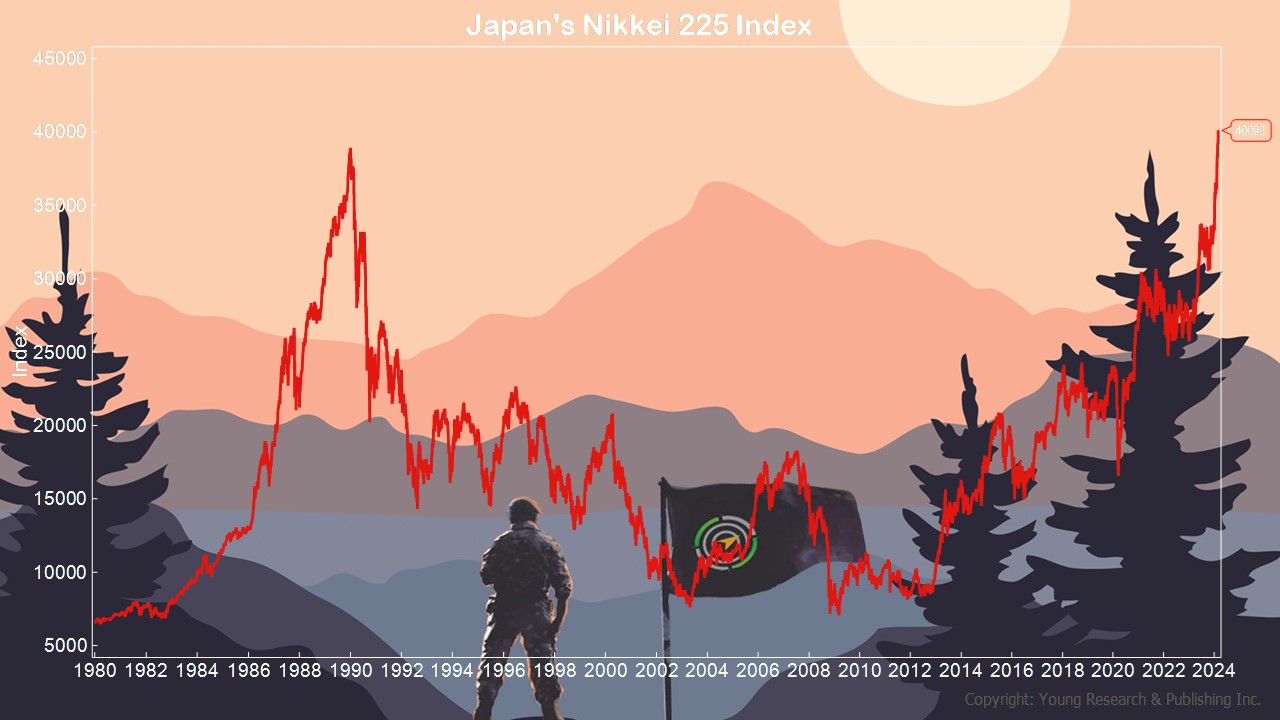

Look at what’s happened to Japan’s stock market. It’s taken decades to finally get back to where it was in 1989. Do you remember “Rising Sun” with Sean Connery and Wesley Snipes? That was a different time. After the bubble burst, investors wanted nothing to do with Japan’s stock market. Then, slowly, they came back because they were able to share in the profits. They got some dividend religion. That’s investing.

Action Line: Stick with me. We’ll get through this together. When you’re ready to talk, let’s talk.