You heard me here, here, and here, talking to you about making a plan. I’m not referring to the glossy reports you can get just about anywhere. I’m talking about your number one investment through the years—YOU. You’re the one who’s done the heavy lifting all these years to get to where you are today. It’s been a lifetime of saving and success. There’s a lot to be proud of. Now is the time to make sure you keep what you’ve made and look for a company that’s been around the block a time or two. As my father-in-law, Dick Young, writes:

The Magic of Compound Interest

Back in 1964, I began a lifelong mission as a disciple of compound interest investing. In those earliest days, home base was Clayton Securities at 147 Milk St. in Boston’s financial district.

By 1971 I had gotten into institutional trading and research with Model, Roland & Co. on Federal Street. My first accounts were Fidelity Investments and Wellington Management.

Today, over 50 years have somehow flown by, and I am still doing business, a whole lot of it, daily with Fidelity (my family investment firm’s custodian) and Wellington (my own account’s largest positions).

Wellington, for its part, manages billions of dollars in client assets for Vanguard. In the late 80s and early 90s, my friends at Vanguard let me know that my newsletter was responsible for directing more assets Vanguard’s way than the rest of the newsletter industry combined.

Jack Bogle, the founder of Vanguard, was a friend of mine from Jack’s days at Wellington., Jack provided the key testimonial for my first book.

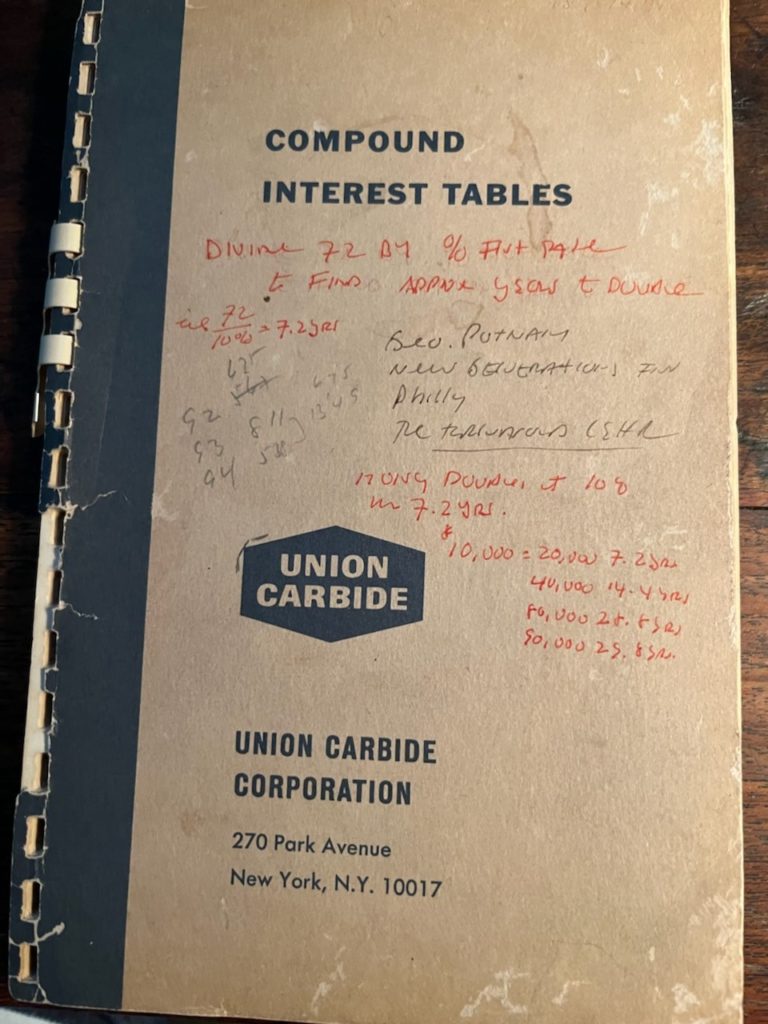

The focus and foundation for my five-decade adventure has been rooted in one little phrase: compound interest. The accompanying photo is my tattered little Union Carbide spiral booklet.

In 1992, Debbie and I bought a little pink Conch cottage in Old Town, Key West, just 90 miles from Cuba. Our son Matt has been our president since, and our daughter Becky is our chief financial officer. E.J. (Your Survival Guy), our son-in-law, after a valued internship with Fidelity, is director of client services.

I continue to research and write seven days a week on behalf of our firm’s clients. Debbie and I still live in Key West, and we do a lot of our research in the 8th arrondissement of Paris. The six-hour time difference works to our favor in getting material to our editorial staff back in Newport, RI.

Thanks to one basic concept – compound interest – I have been able to comfortably and with astounding consistency plot the course for our ultra-conservative, balanced investment firm for over five decades.

You can bet that Debbie and I were pretty proud when our son Matt recently called to tell us that Barron’s had informed him that he had been selected to Barron’s Hall of Fame (2012-2022), while CNBC had just ranked our modest investment management firm #5 in America (2021) out of more than 14,800 registered investment companies. I guess when all is considered, there is a lot of good that be said about compound interest, consistency, and the value of the Prudent Man Rule. Disclosure

As they say, “It works for me.”

Dick Young

Old Town Key West

5 April 2022

90 miles from Cuba