It is no surprise that the Fed cut rates yesterday (pay attention to The 4 Biggest Surprises of the 2024 Election) in the face of rising stocks, commodities, real estate, and more. Those are all inflationary signals in my book.

Rising bond yields suggest the same as investors demand more bang for their buck to hold Treasurys for longer. It would be nice if the Fed got out of the inflation business altogether and focused on stability with a gold standard. Since the Fed took over running America’s monetary policy, the value of the dollar has fallen from around 1/20th of an ounce of gold in 1913 to around 1/2707th of an ounce of gold today. Is that what counts for the price stability half of the Fed’s dual mandate?

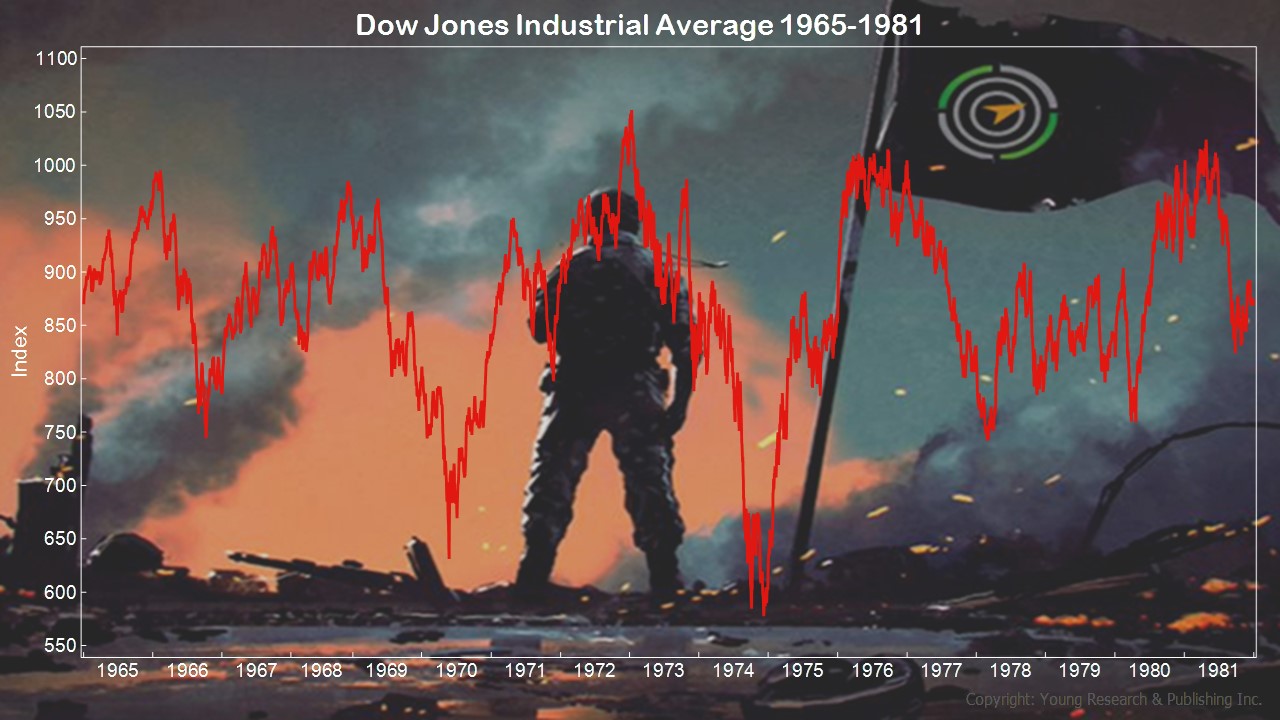

When you consider past inflation and perhaps more to come, you want to be sure you get paid to be in this market. You know from the chart below how that 70s show looked: Prices did not save the day.

Prices are qualitative and may not go higher on your schedule. Income, on the other hand, is quantitative and can be transferred regularly to your checking account for retirement spending. And when it comes to compounding money, time is your most valued ally. Income helps you stay in the game.

One comment I get from clients is that they wished they joined our investment team sooner. Well, one way to help your family is to introduce your kids and grandkids to us. Once you’re in the door they’re free to join at any time, even if they don’t meet the minimum on their own. Just let me know.

Action Line: Many of life’s opportunities come from who you know. You can open the door to your family by emailing me at ejsmith@yoursurvivalguy.com. I’ll be sure to make the proper introductions.