There will be winners and losers in AI and cryptocurrencies, which is why Your Survival Guy likes utilities. Utilities have been steady dividend payers for years. Why not invest in areas that AI and crypto will depend upon? Katherine Blunt and Jennifer Hiller report in The Wall Street Journal that the main focus of the annual CERAWeek by S&P Global conference in Houston this year was finding enough energy to power AI. They write:

Every March, thousands of executives take over a downtown hotel here to reach oil and gas deals and haggle over plans to tackle climate change. This year, the dominant theme of the energy industry’s flagship conference was a new one: artificial intelligence.

Tech companies roamed the hotel’s halls in search of utility executives and other power providers. More than 20 executives from Amazon and Microsoft spoke on panels. The inescapable topic—and the cause of equal parts anxiety and excitement—was AI’s insatiable appetite for electricity.

It isn’t clear just how much electricity will be required to power an exponential increase in data centers worldwide. But most everyone agreed the data centers needed to advance AI will require so much power they could strain the power grid and stymie the transition to cleaner energy sources.

Bill Vass, vice president of engineering at Amazon Web Services, said the world adds a new data center every three days. Microsoft co-founder Bill Gates told the conference that electricity is the key input for deciding whether a data center will be profitable and that the amount of power AI will consume is staggering.

“You go, ‘Oh, my God, this is going to be incredible,’” said Gates.

When you consider the massive amounts of energy needed to run server farms around the world for cryptocurrencies and AI, doesn’t it make sense to look at energy?

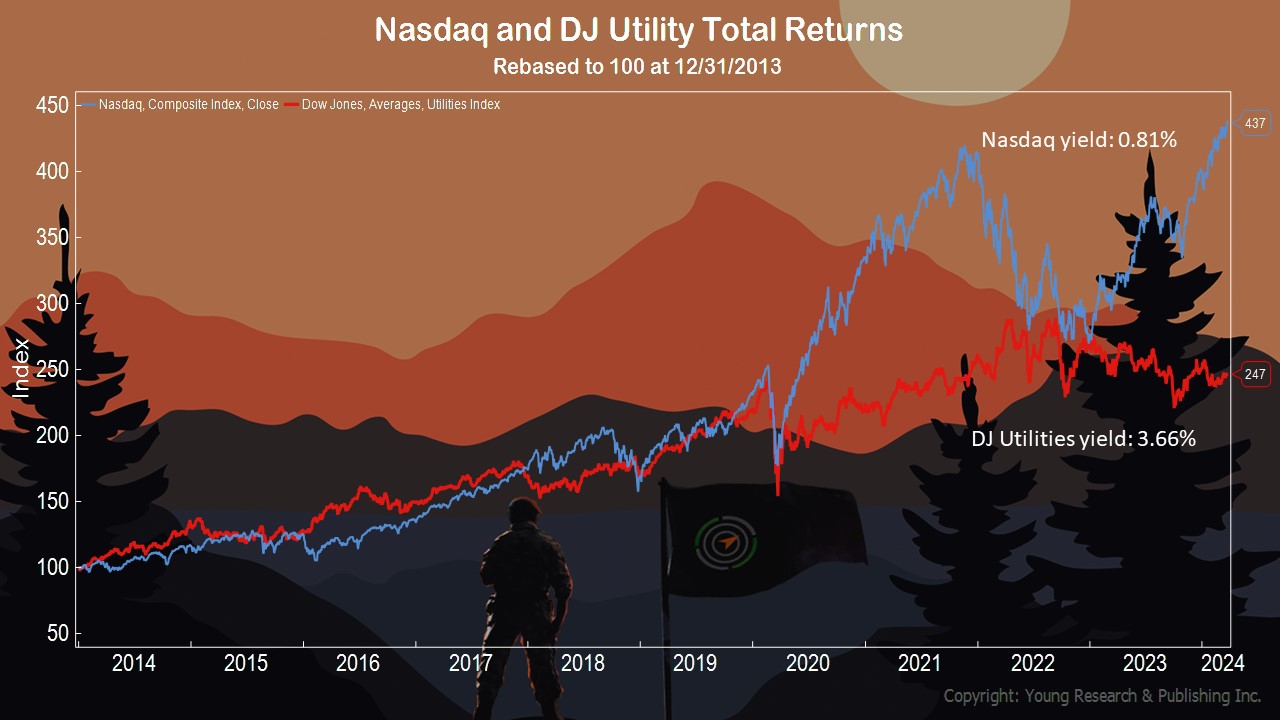

Your Survival Guy looks at the above comparison between the DJ Utility Index vs. Nasdaq and likes what he sees with utilities. The dividend yield is 3.66% for the DJ Utilities Index vs less than half of that for Nasdaq at 0.81%.

Action Line: When you want to talk about getting paid for your investments, I’m here. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.