Happy Easter. Here’s a rundown of my conversations with you and other thoughts as inflation eats away at the chocolate bunnies:

Financial Planning: Yes. I do it. It’s part of my regular conversations. What’s the key ingredient? Y-O-U. Like a four-star Michelin chef, I simply put the dining experience together for you. Are there planners out there who serve you the equivalent of a Happy Meal by just cranking out the food? Yes. Will they make good on the promises falling out of their mouths like crumbs? I’m not so sure. Listen, I’m Your Survival Guy, not your “order’s up, come and get it” guy. Glossy reports are like fast food. Do you really want to bet your life’s savings on them? You’ve followed Richard C. Young’s money strategies for years. Be a Prudent Man.

Ukraine/Russia/China/France: Don’t look now, but French President Macron is under pressure from nationalist/populist Marine Le Pen, and, shocker, the establishment can’t understand why—much like they will never understand Trump. As Richard C. Young writes in the April 2017 issue of Richard C. Young’s Intelligence Report:

France’s Marine Le Pen is on a Roll

My multi-year swing through Europe and, more specifically, France allowed me to gauge momentum in European nationalism and resentment of radical Muslims, and to assess the steam building under Marine Le Pen’s Front National. My conclusion? The trend was powerful. Radical Muslim immigration would indeed become a red-hot topic and Le Pen a force to contend with in the 2017 French presidential election. I saw all of this doing no end of good for the Trump campaign and foresaw what would most certainly be a shocking—for the media, at least—Trump victory.

Why is it that in every conflict, the neocons want us to get into the fight of nation-building? The situation in Ukraine was years in the making, no thanks to our meddling. And yet, the left will never appreciate how Trump kept Putin in check. They’ll never understand the importance of relationships—in keeping your enemies close—like Trump did. But now that we’re in the thick of this mess, you can’t have an intelligent conversation because anything less than support for Zelensky (not exactly a Boy Scout) is shut down by the woke.

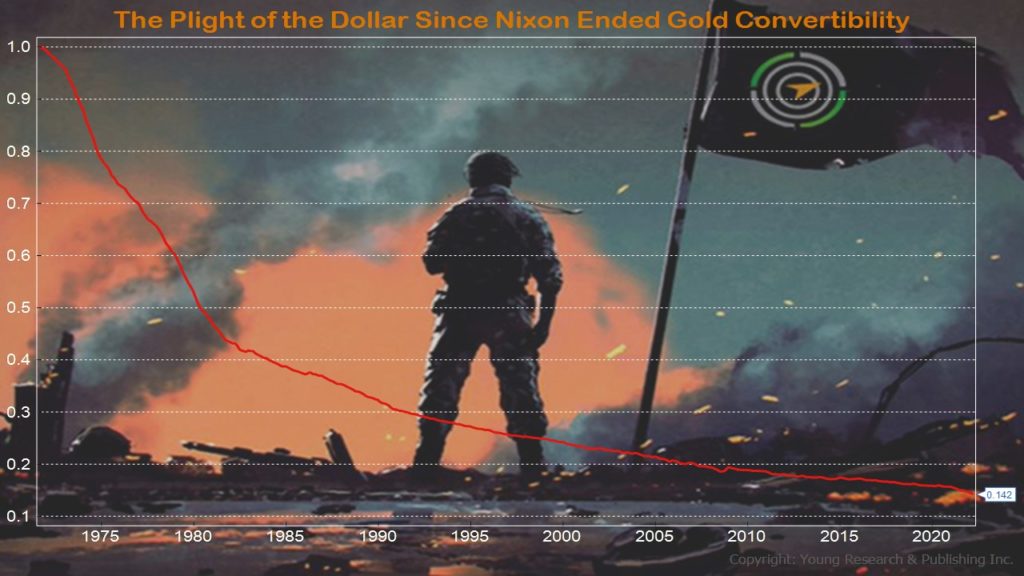

U.S. Dollar: For as long as Your Survival Guy’s been on earth, the Federal Reserve’s been in the business of ruining the dollar. When I was scooping ice cream during the summers at Oxford Creamery, you could get a small cone for $0.25.

Inflation is the business of the Fed. And it always will be. It destroys the dollar at every turn.

But here’s the kicker. If you own a solid business, you simply fight inflation by raising prices which is the beauty of dividend-paying stocks, especially the ones with consistent, predictable (easier said than done) increases.

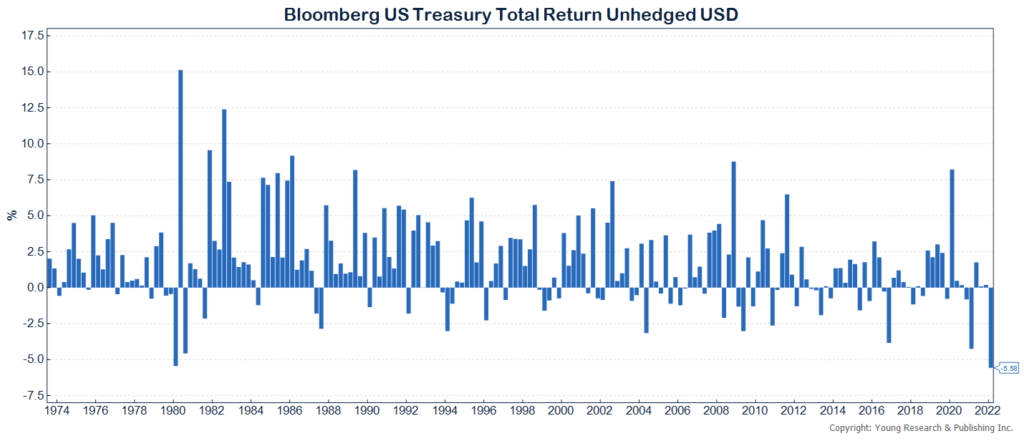

Headline Inflation: With that said, don’t make knee-jerk decisions with your lifetime of savings based on headlines. Take a deep breath. Be thoughtful. We’ve been through a brutal couple of years. And the pent-up demand, the traffic in Florida, and the travel that’s taking place is simply nuts. It’s like trying to sip water out of a fire hydrant. Bond prices are down? So what. Collect the interest, buy more shares at lower prices and be the contrary investor other’s only dream they can be. Understand, this is the worst of times in 50-years.

Recession: There will always be a group that feels like the economy is in a recession—and they’re looking for more from the government. Today they reside in your White House. If you’re a saver, if you protect and keep what you make, you can get through times like these. You know the importance of self-reliance.

iBonds: Love ‘em. Why wouldn’t I? Put the onus on the government and make them pay. What’s not to love? They’re capped at $10k, so call up your bank and do it with your lazy cash. Yes, there’s talk about raising the cap to $100k, but I’m not lovin’ that. Do you really think the government will make good on the promise? Count me out.

Bond Prices, Part I: Back in December, the 10-year Treasury bond yielded 1.37%. Earlier this week, it rose to 2.74% for an increase of 1.37%. Bond price sensitivity, measured by duration, estimates that for every one percent increase in rates, prices should decline, in percentage terms, by the years of maturity. In this example, that’s a decline of -13.7%. For many of you, your maturities are much less than ten years. That’s why this move in interest rates has been more palatable.

Bond Prices, Part II: Keep in mind, bonds trade on the open market just like stocks. In other words, bond prices are a qualitative event—among other things—a sum of the market’s emotions and angst. Do not make life-altering changes based on other people’s opinions. They just might end up being wrong. And often are.

Let’s Talk: Some of you are telling me you’ve hesitated to get in touch with me because you didn’t think you’d meet our minimum. Don’t be like that. You’re valued. Let’s talk. You might end up liking what you hear.

P.S. Happy Easter. I wrote this to you back in 2019:

Happy Easter: Meet the Man behind the Sweet, Parisian, Macaron

Standing on the steps of the Madeleine church in the 8th arrondissement, looking down Rue Royale, you can see the Place de la Concorde. Where Rue Royale meets Rue du Faubourg Saint Honore, across the street from Gucci, you’ll see the mint green awnings of maison Ladurée, home to the macaron (pronounced mah-kuh-ron)—meringue like cookies, the color of Easter eggs, sandwiched with an emulsified filling.

Groupe Holder is the private baking—not banking—conglomerate owned, founded and controlled by 77-year-old Francis Holder. The company is comprised of Ladurée’s 85 shops in 50 countries, the artisanal bakery-café chain Paul with 740 stores in 43 countries, and an industrial arm known as Chateau Blanc. “Long obsessed with America’s industrial food processes, Holder embraces smooth mass production, and that has propelled his rise,” explains Chloe Sorvino in “The Artisanal Industrialist,” her piece in Forbes: The World’s Billionaires. “But he balances affordability and speed with a distinctly French attitude about the best ingredients and product quality—still using fresh yellow butter in mass-produced loaves and pastries.”

Holder is responsible for France’s top three macaron sellers. The first two logically being Ladurée and Paul. The third may surprise you: Mcdonald’s. McCafe macarons are not only popular in France, but also in Spain, Italy, Belgium, and Japan. “Some were surprised about McDonald’s being third,” Holder says. “We said, ‘That’s obvious. We are the one who delivers them.’ Because McDonald’s is really loyal, this baker has factories throughout the world.”

P.P.S. For Rush Fans Only:

I’ve been listening to Grace Under Pressure by Rush from 1984. If you’re a drummer, you know there’s nothing like playing behind a guitar solo. Check out “Between the Wheels” and guitarist Alex Lifeson’s work around minute 3:25. Warning: Check your speaker volume!