You know from here, here, and here that saving for retirement is easier said than done. When should you secure your finances and move to a more defensive stance? When do you meet with a planner and talk about income needs? Are you on the right path right now in the middle of the chaos? What happens when Nasdaq craters by 20% in the first four months of the year? This is all real-life stuff. We’re all living it in real-time.

When it comes to a return on your savings, I want you to be laser-focused on the return of your savings. Too many investors talk about buying low and selling high (easier said than done). Listen, the buying’s easy. It’s the selling that’s a whole other matter. When do you get back in? You’re talking about serious stuff. The idea of outliving your money is scary. You don’t want that idea to turn into reality for you.

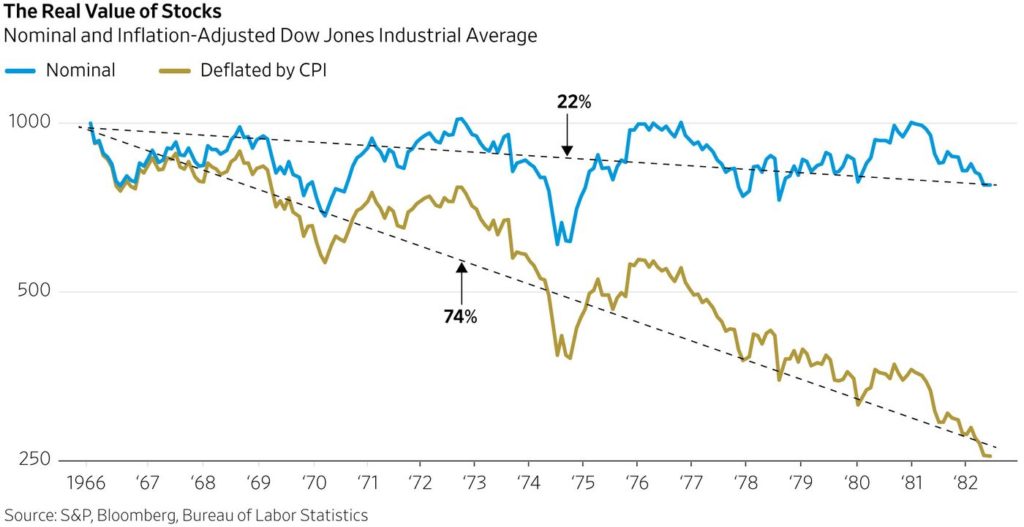

As you know from here, the stock market can stay down for a long, long time. Take 1965 through 1981, when stock prices were basically flat for 16 years. That’s an entire retirement for many, and when you consider the toll of inflation today, it’s a real ugly situation. Take a look at this piece from Arthur Laffer and Stephen Moore in The Wall Street Journal:

What about the stock market and Americans’ wealth? Mr. Laffer’s warning of a bear market turned out to be spot on. As the nearby chart shows, the Dow Jones Industrial Average briefly climbed above 1000 in the mid-’60s and then bottomed out at 777 in the summer of 1982—a 22% reduction in stock values in nominal terms.

But investors, like workers, care about their real return. Adjusted for inflation, the industrial average (and the S&P 500) fell during that period by more than 70%—the worst 15-year stock performance since the crash of 1929. President Ronald Reagan and Fed Chairman Paul Volcker had to sweat the 11% inflation out of the system through a return to a stable-dollar regime along with supply-side tax cuts that encouraged the production of more goods and services. A bull market ensued, with the Dow Jones Industrial Average rising to more than 30000 between 1982 and 2022. Over that 40-year period inflation averaged a benign 3%—until the arrival of President Biden and the Modern Monetary Theory crowd.

Your key is to make sure you’re paid to be invested in the form of dividends and dividend increases. Don’t live and die by stock prices. This stock market’s a casino; just ask Buffett and Munger. Instead, focus on being an investor. Investors get paid. Investors seek out solid businesses with cash flow.

Action Line: If investors realized how devastating inflation can be—it is the silent killer—then I think a lot more would get some dividend religion. Isn’t it time you did? If you’re with me, let’s talk.