Let’s get right into this. Yesterday you saw the stock market make a complete reversal after being down enough to have the talking heads going crazy. What to do? How about this: “don’t just do something, stand there?” In times like these you need to think like a Rich Man, not a Poor Man. It’s the Rich Man who doesn’t need the market, and if it’s a buying opportunity, he buys. That’s how Your Survival Guy wants you to think about markets, ALWAYS.

Do you go crazy when the value of your home changes month to month? It might be nice to see what you could “get” on Zillow, but if you sell where will you live? The same is true with your portfolio. If you sell, when will you get back in? Because the only guarantee you have with stock money in cash is the question: How much of it will inflation eat away?

Think about your family and how you operate your finances. If you want to go on a bucket list vacation, you plan for it. You save. You do your research. You go on the trip because you made a list of what you HAD to do to make it happen. Look, I wish the stock market went straight up every day, all day long. But it doesn’t, and FORTUNES are lost.

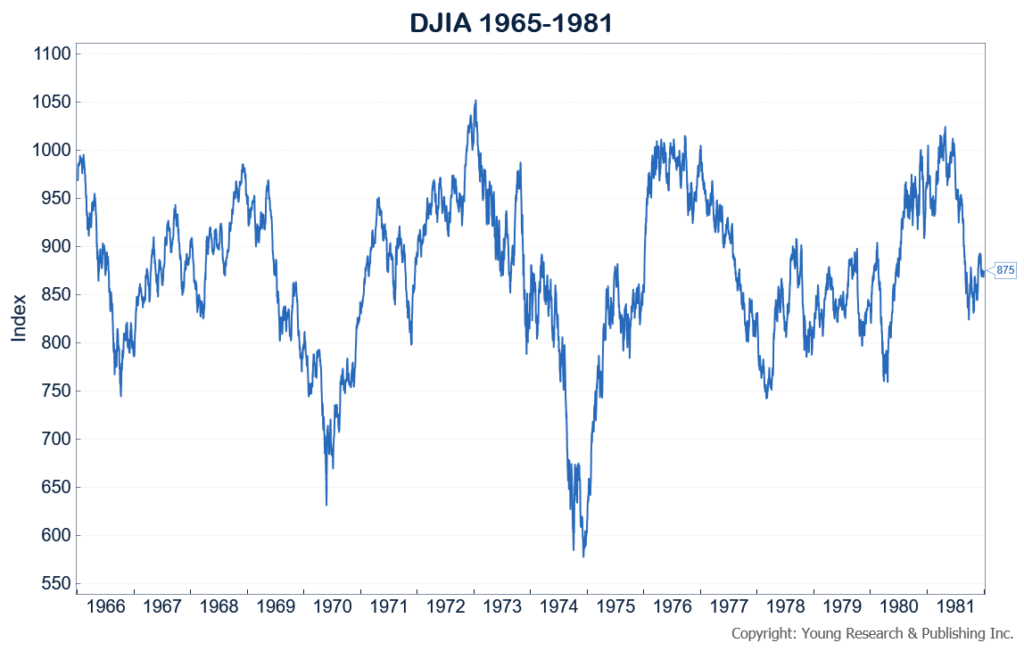

If you want to be a stock investor, then make a plan. Understand, this is money you don’t want to HAVE to touch for five or seven years. Is that enough time to make money? Look, I’m Your Survival Guy, not “Your let’s-throw-some-money-at-this-and-see-what-happens GUY.” I want you to be paid simply for being in this market, in the form of dividends. Look at the ups and downs from 1965-1981—and you see how ugly markets where during a time of stagflation. Dividends were your savior.

Action Line: When employment participation in the workforce is at GREAT DEPRESSION levels (see below), you need to pay attention to what’s going on all around you. You need to figure out your situation. I’ll keep you focused with my monthly S&T letter. Click here to sign up.

In The Wall Street Journal, Mene Ukueberuwa explains the “Underside of the ‘Great Resignation’” and the negative effects of an economy with a flat-lining work rate. He writes:

But the flat-lining work rate also fits a pattern that long predates Covid. “Male labor-force participation has dropped after most recessions in the postwar era,” Mr. Eberstadt says. “When the economy recovers, it ticks up a little but never gets back to where it was.” In other words, staying out of work even during good times has become an America tradition.

Mr. Eberstadt, 66, wrote the book on this decades long flight from the workforce. As its title suggests, “Men Without Work” (2016) focuses particularly on prime working-age males. But the trend also applies to women and seniors, including in the Covid era.

“Overall labor-force participation peaked in 2000 at about 67%,” Mr. Eberstadt says, counting everyone 16 and older. “We’re currently about 5 points lower than that.” Population aging is a major cause of the drop, with a greater share of Americans now at retirement age. “But the work rate for prime-age people—25 to 54—has also been going down since the turn of the century.”

The decline started with men, at the same time women entered the workforce en masse. “In 1961, labor-force participation for prime-age men was at 96.9%,” Mr. Eberstadt says. Since then, “the chart looks more or less like a straight line down.” By November 2021, “the seasonally adjusted rate was 88.2%.” Almost 1 in 8 men is sitting out during his best years. (Your Survival Guy’s emphasis)

That may not sound huge, but the drop is unprecedented. “Would we think it was a crisis if the work rate fell below the Great Depression level?” Mr. Eberstadt asks. “Well you can check that box. We’re already there.”