In my conversations with you this week, we’ve talked about Liberation Day and the weather. It’s cold out there, and it’s a cold reality hitting Washington, D.C. What should investors do? What is the best move right now? I don’t know about you, but sticking to the plan sounds good to me.

What always sounds good to me is “diversification and patience built on a foundation of value and compound interest,” coined years ago by Dick Young. With that one phrase, you immediately take yourself out of the forecasting business and create an all-weather strategy.

It’s not going to be easy. Articles are being written as we speak about the death of the balanced portfolio—to mix fear with doubt. Not helpful. What the authors—most are just that, not actual money managers—fail to discuss is the margin of safety with fixed-income instruments like Treasurys and bonds.

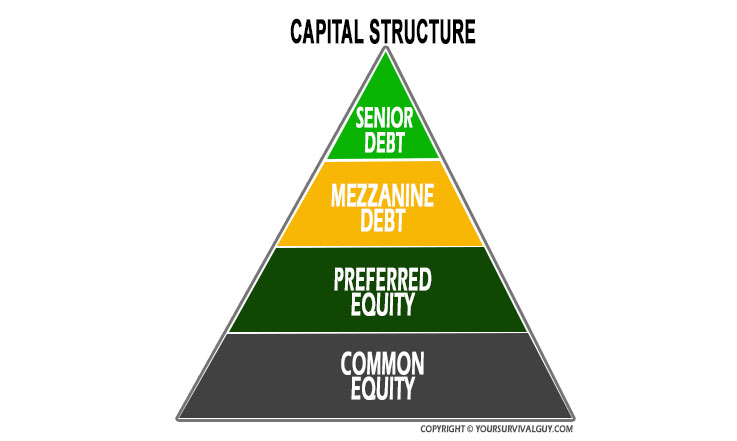

When the you-know-what hits the fan, it’s the capital structure that matters most. In other words, it’s your return of assets, not return on them, that matters most. Do not lose money.

Action Line: Do not hate the weatherman for the weather. This is not a market to fool around with. If you’re retired or soon to be retired, forget “predicting” the next big Trump trade. Instead, understand your risk tolerance. You be you. Because I’ve written to you before, risk tolerance—like a food allergy—oftentimes is discovered after the fact. When you’re ready to talk, email me at ejsmith@yoursurvivalguy.com. But only when you’re serious.