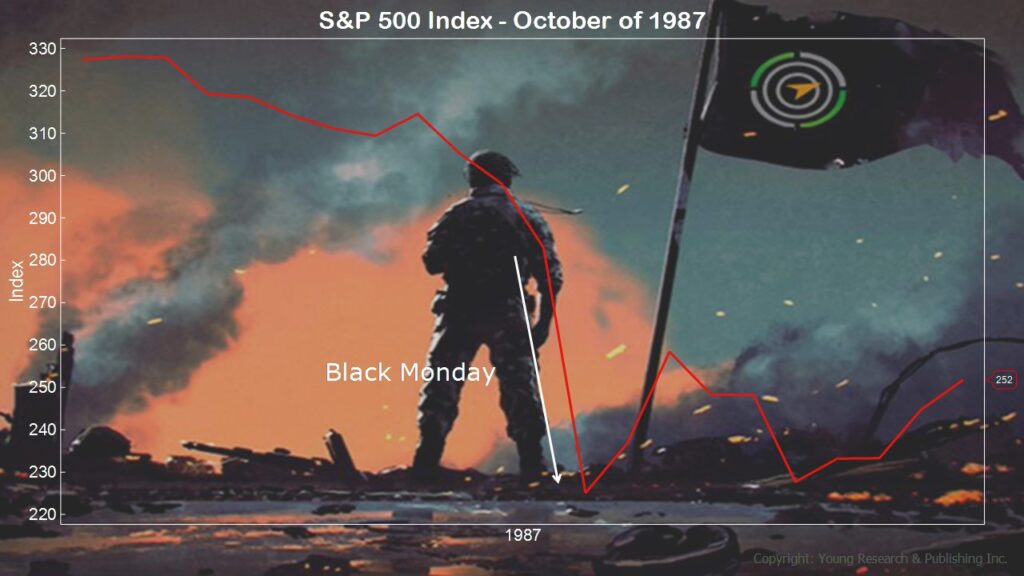

In The Wall Street Journal, John Greenwood and Steve H. Hanke, both economists at Johns Hopkins, discuss the similarities of today’s markets to that of 1987, and October 19 of that year, which is known as “Black Monday.” They write:

This brings us to the stock-market crash of 1987. In that year the key 10-year bond yield rose steeply from January onward (from 7% in January to 10% by Black Monday in October) and the money supply slowed sharply.

In 1987 growth of M2 declined by almost half, from 9.7% year-on-year in January to 4.9% in September, while M3—no longer published by the Fed—slowed from 8.7% to 3.6% over the same period. A bond-market crunch and monetary squeeze together led to a sudden, drastic reassessment of equity-market valuations. The same could happen today, particularly since the current jump in bond yields and monetary squeeze are much more pronounced than in 1987.

Because of the sustained decline in the money supply, the economy is in real danger. So far, only the remaining excess money the Fed created between 2020 and 2021—the cumulative excess savings from the Covid handouts—has been keeping businesses hiring and consumers spending. The effects of the excess money are still giving the economy a lift, but that extra fuel is almost exhausted. When it dries up, the economy will run on fumes.

In all of this, an appreciation for time lags is critical. The Fed ignored the huge acceleration in the quantity of money and thus failed to anticipate the ensuing inflation. When inflation struck in early 2021, Fed officials tried to argue it was “transitory,” caused by supply-chain disruptions.

The Fed continues to ignore the money supply, and we now face the opposite problem. The money supply has been contracting for 18 months, and soon, after the overhanging extra money from 2020-21 has been used up, spending will plunge and inflation will fall, not simply to 2%, but below—and perhaps even into deflation in 2025.

Since Fed officials pay no attention to either monetary aggregates or their credit counterparts, they are overlooking these signals, and the risks are intensifying each day. Instead, we hear Fed leaders talk about being “data-dependent”—keeping their eyes firmly on lagging economic indicators such as the labor market and the composition of the consumer-price index, not the monetary causes for their movement.

Monetary analysis tells a very different story than the measures the Fed follows. The first effect of a monetary contraction is higher market interest rates for a brief period. Then comes an economic slump. The economy goes into recession and inflation falls. This results in a second and more permanent effect of subpar money growth, namely lower interest rates and a weaker currency.

When the stock market crashes, “higher for longer” will become a thing of the past as the Fed makes an abrupt pivot. Then the 10-year yields and U.S. dollar will come tumbling down.

Mr. Greenwood is a fellow at the Johns Hopkins Institute for Applied Economics, Global Health and the Study of Business Enterprise. Mr. Hanke is a professor of applied economics at Johns Hopkins University.

Action Line: If you’re worried your stock portfolio could suffer from a 1987-style crash, maybe it’s time to revisit your bond portfolio. Crashes like Black Monday happen when too many investors (or more appropriately, speculators) make mistakes. Avoid some of the biggest mistakes by downloading my free special report on the Top 10 Investing Mistakes to Avoid.