While the Nasdaq has faced headwinds over the last thirty days, treasuries in the 7 to 10-year range have maintained positive performance. This is an illustration of the value of counterbalancing in ones’ portfolio.

Take a look at the longer-term view of counterbalanced returns. In most instances, when the S&P 500 has finished the year in negative territory, intermediate-term government bonds have finished in positive territory.

Take a look at the longer-term view of counterbalanced returns. In most instances, when the S&P 500 has finished the year in negative territory, intermediate-term government bonds have finished in positive territory.

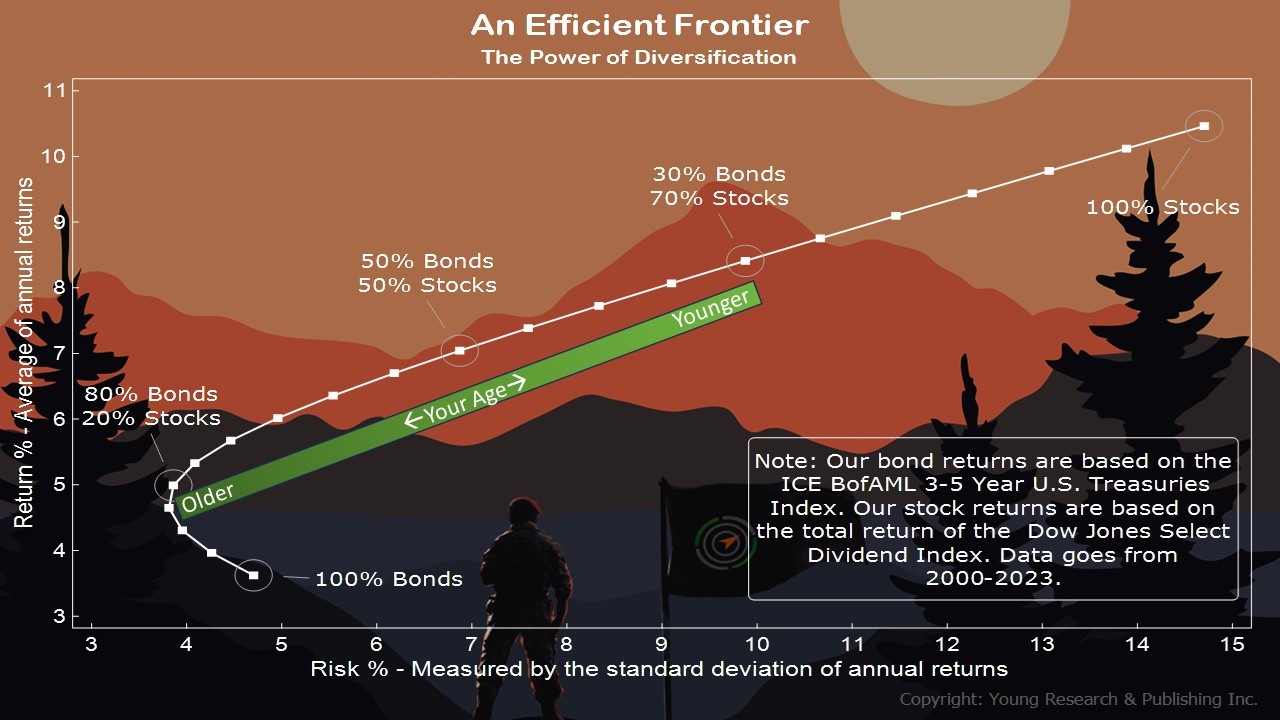

Balancing a portfolio using your age as the percentage to put into bonds is an old rule of thumb that is a good guide to getting started on targeting a risk tolerance that works for you.

Balancing a portfolio using your age as the percentage to put into bonds is an old rule of thumb that is a good guide to getting started on targeting a risk tolerance that works for you.

Action Line: Other factors should be taken into consideration as well. When you want to discuss your portfolio balance and an investment plan, email me at ejsmith@yoursurvivalguy.com. I’ll know you’re serious about planning your retirement because I am, too. In the meantime, click here to subscribe to my free monthly Survive & Thrive letter.

P.S. Some more to read on balanced investing: