Katherine Loughead discusses state pension data from The Pew Charitable Trusts at The Tax Foundation. I’ve warned many times that states are under-funding their pensions and using unrealistic expected rates of return to hide their malfeasance (read here, here, here, and here). The low funding ratios are starting to bite. She writes:

As of fiscal year 2016 (the most recent data available), states reported a combined $1.4 trillion in state pension plan funding deficits.

Over the last two years, below-expected returns on investment and insufficient state allocations contributed to widening shortfalls in numerous states.

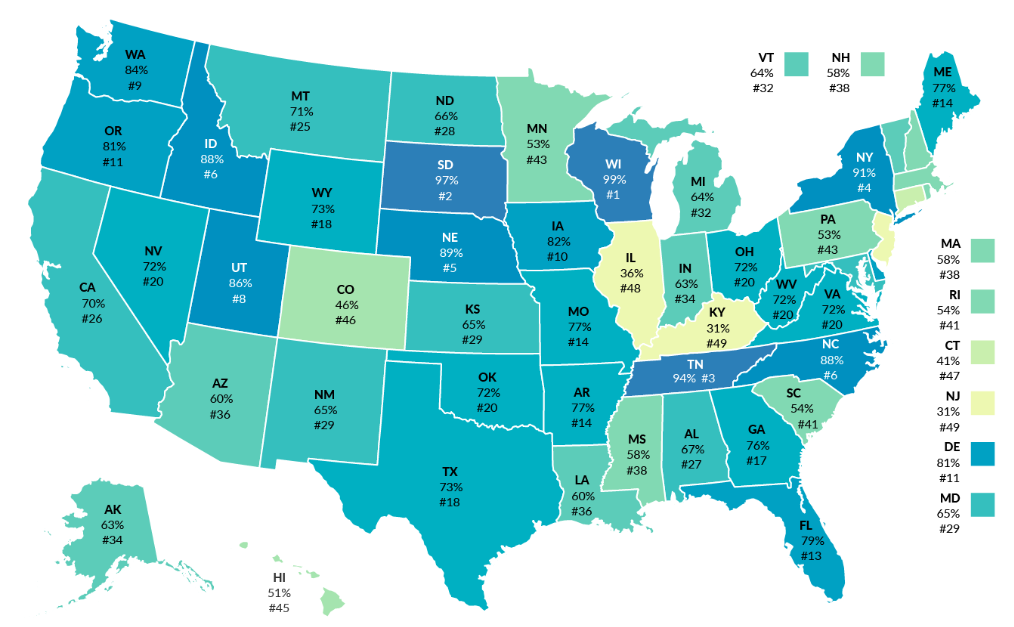

This week’s map shows the funded ratio of public pension plans by state, calculated by measuring the market value of state pension plan assets in proportion to each state’s accrued pension liabilities.

Lower funded ratios indicate when a state’s pension plan is not adequately funded, while higher funded ratios are evident in states whose pension assets are keeping relatively good pace with accrued liabilities.

Read more here.