You pay attention when the founder of the Vanguard Group, Jack Bogle speaks. As the father of the index fund it would be hard not to include Mr. Bogle’s bust on the Mount Rushmore of financial legends. Therefore, when Bogle speaks, I listen. As do thousands of his groupies known as “Bogleheads.”

“There no longer can be any doubt that the creation of the first index mutual fund was the most successful innovation—especially for investors—in modern financial history,” writes Bogle here, “The question we need to ask ourselves now is: What happens if it becomes too successful for its own good?”

Back in 1976, a year after founding Vanguard, Bogle’s First Investment Trust was launched as a way for investors to track the S&P 500. Many in the industry, explains Bogle, scoffed at his idea. Who wants average returns when the game is to beat the market?

As we all know, it wasn’t about beating the market. It was about offering a sound investment at a fair price.

In the forward to Mr. Bogle’s seminal book, Bogle on Mutual Funds, my father-in-law Dick Young wrote “Congratulations! You have made one of the wisest investment decisions of your life…Jack Bogle’s basic premise is the model of simplicity and integrity: Give investors clearly defined investment products at the right price.”

It turns out investors were listening.

42 years after the birth of his index fund, explains Bogle, $4.6 trillion is invested in stock funds while total assets have exceeded $6 trillion.

U.S. index mutual funds are so huge that they comprise 17% of the total U.S. stock-market, and that doesn’t include what mutual fund companies own in their actively managed funds.

Only three companies account for most of the indexing world’s assets: Vanguard (51%), BlackRock (21%), and State Street Global (9%). How long will it take for the big three, notes Bogle, to own a third of corporate America?

And, my point, as Americans age, consider how much money they’ll have tied up in stock funds.

In his must-read piece, Bogle offers ways to resolve the issues connected with the concentration of corporate ownership by these funds. But as tends to happen in politics, it’s difficult to rally around the problem when most Americans have little to no savings, and have bigger fish to fry—like putting dinner on the table.

But make no mistake, this is a big issue and one we’ve been warning you about for some time now.

Also troubling is that retirees, especially those with pensions, do not realize how concentrated their holdings are in just a handful companies.

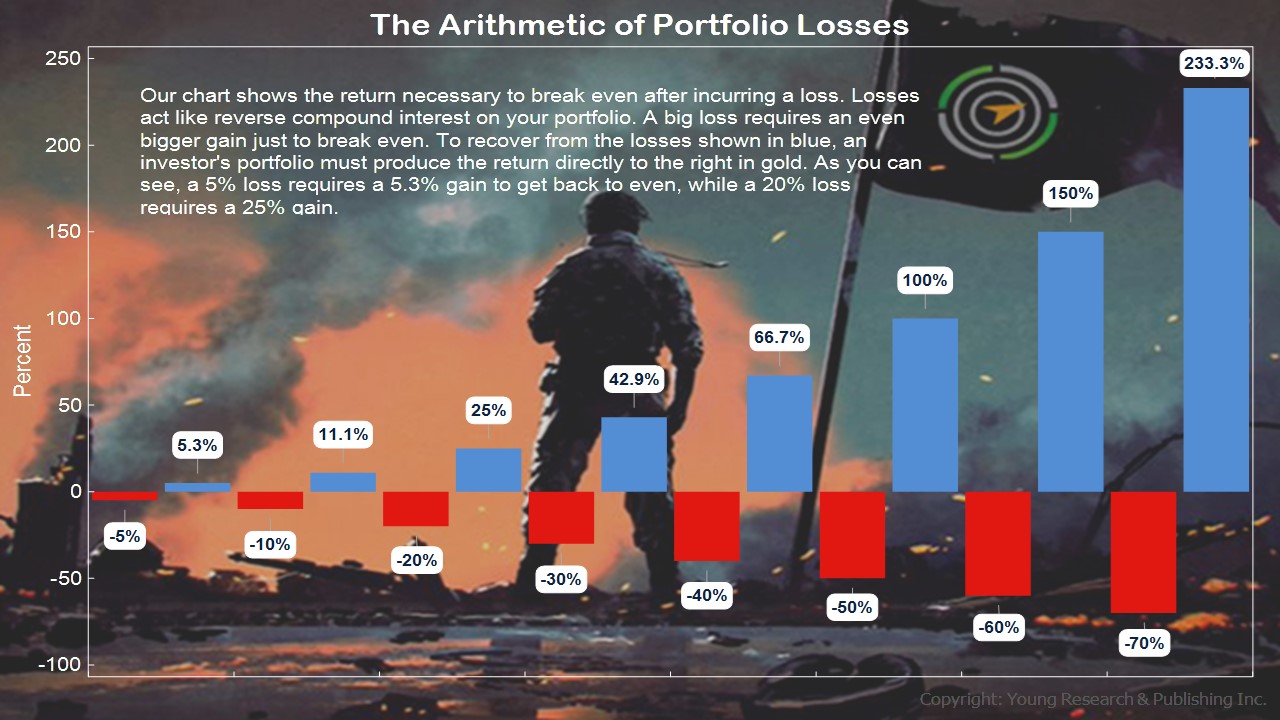

At this pace a ton of money continues to pile aboard a boat that’s taking on water.

I want you to focus on your bonds. They will be there when the calm waters of an upward moving market begin to churn. And I want you to recognize that the S&P 500 may sound like a well-diversified portfolio, but in essence only a handful of companies, mainly FAANGS, are singing “row, row, row your boat.”

You’ve heard this tune before.

Read more about Vanguard here: