“Never forget what I’m telling you here”

-Dick Young

When it comes to living off a portfolio for a lifetime, the word lifetime can mean different stretches of time for different investors. As you read in parts I, II, III and IV, I’ve been studying the FIRE movement—Financial Independence, Retire Early—to help teach the next generation how to think about money, and to help you think about your retirement. Like I have said, if this group is retiring in their 30s, and living off their retirement savings for the rest of their lives, then we should be able to pick up some intelligence.

Which brings me to that daunting subject of a Safe Withdrawal Rate, or as the FIRE movement simply refers to it: SWR. The most common SWR I’ve read from this group is a four percent withdrawal rate. And I think that’s a fair place to start, but personally I lean closer to three and if less is possible, then all the better.

What I have found encouraging is the FIRE lifers aren’t living in a vacuum. They’re adjusting with the times, and working side-hustles if and when necessary to help preserve their savings. But I want you to be able to retire when you’re ready, and it’s why I recommend the lowest draw rate you can handle.

The harsh reality today is that the investing environment looks like scorched earth. It’s barren. It’s like Mars. Not real livable.

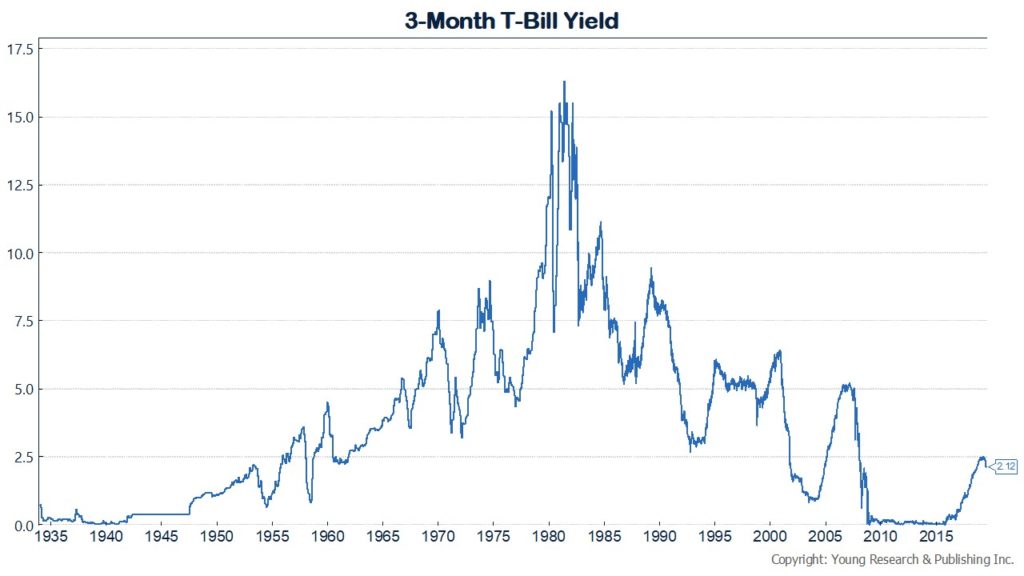

In the “Dick Young’s North Star” section of the February 2003 issue of Intelligence Report, he wrote: “I want to be real clear here. When the risk-free rate of return is a) negative in real terms and b) below 4% in nominal terms, red flags are flying. There is a regular and dangerous tendency to overreach and overstep with inappropriate and risky investments when investors cannot get a decent return on 90-day T-bills [see chart below]. Never forget what I’m telling you here on T-bill yields. The 90-day T-bill rate is the conservative investor’s North Star. It is certainly mine.”

You don’t need to know much about history to remember what happened in 2007 and to appreciate what Dick was telling investors. He wasn’t pontificating. He was describing the dangers at that specific moment in time.

Today, the risk-free rate is a) near zero after inflation and b) well below 4% in nominal terms. Red flags are flying. And like a broken-record, you are seeing investors pile into inappropriate and risky investments because they can’t get a decent return on 90-day T-bills. Index funds and ETFs that mimic perhaps the largest “managed” index in the world, the S&P 500 as I wrote to you here and here, are partying like it’s 1999. Investors have gotten so entangled in trading this formula or that stock option—they can no longer strike through the nub of things.

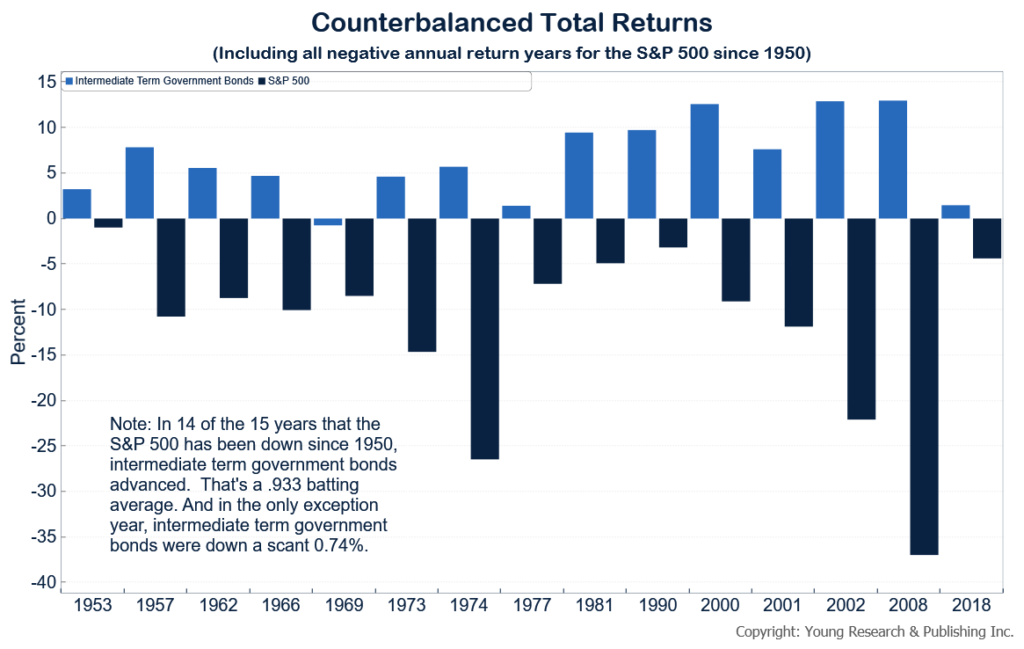

Run your finger left to right along the T-Bill rate and you can see how a low-interest rate policy has gutted the risk-free yield. In turn, it has pushed investors into stocks hoping for the market to do something for them. My take here is that when rates are this low it should push investors to work longer. Working longer is the one real variable investors have 100% control over. There’s no way I would leave a job in my 30s seeing that the bull market in bonds is o-v-e-r. That being said, I believe investors are naïve not to own bonds mainly to counterbalance their stocks.

What I want you to think about is this: The more you can put into bonds, the more comfortable I believe you’ll be. Can you put 70% in bonds and live off 3%? If yes, do it. If not, keep working (or spend less).

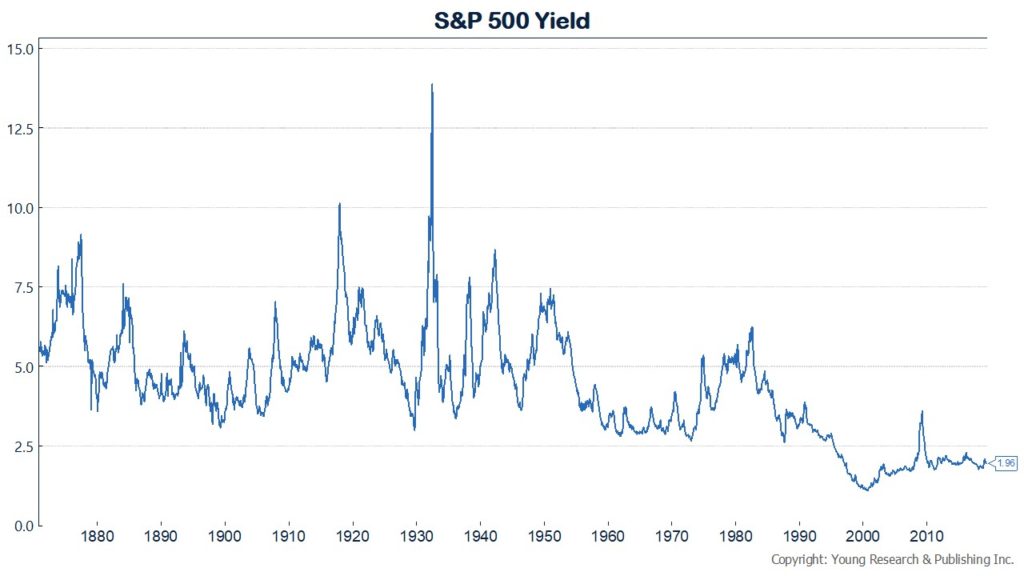

Next, I want you to look at the S&P 500 yield, or lack thereof. Historically stocks returned about 10% with about 4% coming from dividends. For most investors, dividends are an afterthought, or not thought of at all. But if you’re planning on living off your portfolio the hard truth is you need to focus on dividends, dividend increases and not killing your shares by selling them to live.

Take a look at the speculative S&P 500 index where dividend yields have historically been below the Dow for a scarier look. This is a pretty ugly chart. As the lemmings jump into the same passive index funds, the flow of money is like squeezing a water balloon—a self-fulfilling prophecy of expansion—until it bursts.

A retirement plan overloaded in stocks and not focused on yield for income is one that is set up for disaster if stocks crash. For some, going back to work is an option (FIRE self-starters) but those in their golden years will be less willing and able to work. If you can extend your working years, then do it.

That gives you an indication as to where we are today with income, and why reducing your annual draw rate as low as possible is necessary.

Investors who are loading up on stocks and forgetting the North Star are perhaps setting themselves up for portfolio hardship that will either push them out of the market, or set them back so many years in terms of lost value they will have no other choice but to either go back to work or live a much different lifestyle.

Remember, you want to be able to teach your grandchildren and children how to be careful with their money, and at the same time make sure you’re a sound steward of your own.

Follow along with my entire series on FIRE here.