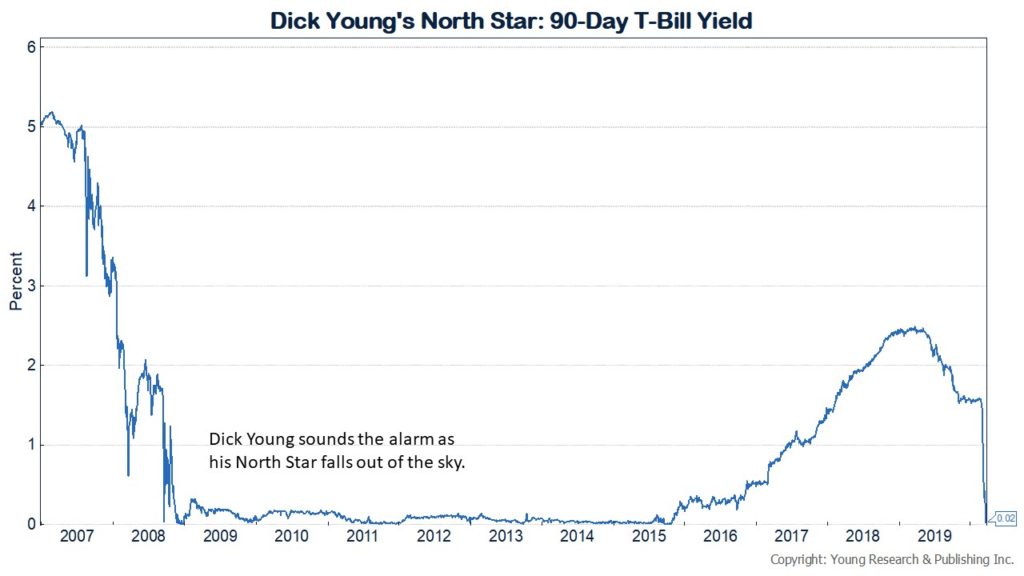

You’ll recall it wasn’t too long ago that investing legends Warren Buffett, Jack Bogle, and my father in law Dick Young were calling for a prolonged period of reduced returns. Not only for the stock market but for bonds, as Dick Young’s North Star was scraping the bottom of the charts as if it had fallen out of the sky.

At the time, Dick Young wasn’t predicting a pandemic like the coronavirus, he was simply studying what was in front of him just like he does today, and concluding that it looked pretty darn ugly.

You see, when the risk-free rate of return costs you money (after inflation and taxes), it’s telling you something about the investment landscape: You had better be paying attention.

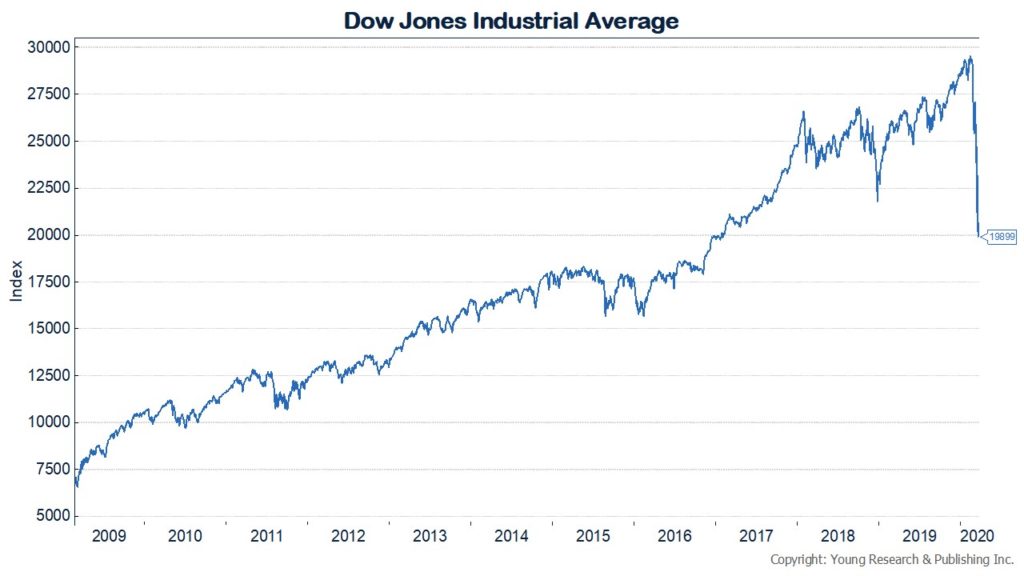

But after a ten-year bull market in stocks, investors lost sight of how hard investing actually is. Now they’re wringing their sanitized hands wondering how this could happen to them.

When Dick Young’s North Star is yielding zero, and investors are looking for the market to do something for them, bad stuff can happen. Whether it’s a virus or some other risk, investors shouldn’t rely on the theory that the market will save them.

When they do, and things turn south, it becomes a free-for-all as investors who should have never been in stocks, panic, and sell them.

And I’m not talking about the blue-chip dividend payers we cultivate for our clients.

No, that was too boring for the hand-wringers (I know because they told me). They were buying the “next big thing.”

And so here we are as they blame a virus for their portfolio shortcomings.

Hey, investing isn’t supposed to be easy.

Did I predict this virus? No, but I know investing is hard.

Are we near the bottom?

We’ll be at the bottom when the selling stops and investors wake up to the values staring back at them.

But understanding values is easy compared to understanding an investor’s psyche. That’s many times more difficult.

Because it’s the irrational investor who’s always a danger to the prudent one.

Before I was born, my dad was one of the most successful Fuller Brush salesmen in the area.

All of his valued customers knew his name, and he certainly knew theirs. They were buying his products by the carload every single week.

After his visits and talking about life and the problems of the day they would say, “Thanks for stopping by Randy, it was great to catch-up with you.” And before leaving, he would ask, “the usual order this week?” And his customer would always say, “Oh, I almost forgot, yes, thanks Randy, same as last week.”

He knew his customers like family.

And to me, that’s what investing is all about.

It’s understanding yourself, like you know your family, investing accordingly, and then getting on with your day.

It’s not about letting markets ruin your day, even if that’s all you can think about while you’re stuck inside.

The sun will come out again. Maybe not tomorrow. And you’ll be able to go about your life. Maybe in a different way than in the past, but isn’t that life? Of course, it is. Things change. Life goes on.

Read my entire series, Coronavirus Infects Stock Market here.