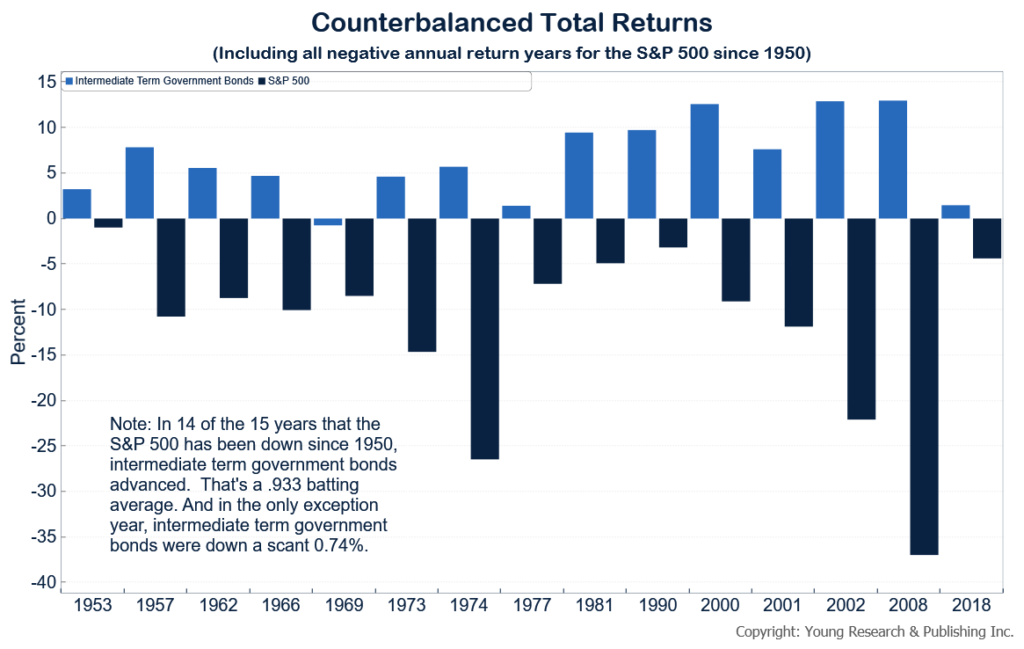

You’ve read about low bond yields. Well, the yields may be low, but bonds, they’ve protected portfolios like bubble wrap. (See the chart of Counterbalanced Total Returns below for the returns of bonds in years when the stock market has fallen).

What investors forget time and time again, is that the key to investing is for you to get your money back. Not some of it—all of it.

The income from interest on bonds, the dividends from stocks—they help you not only do that but also help you maintain your lifestyle. A lifestyle where you continue to do the things that matter to you like visit your grandchildren, take bucket list vacations (coronavirus isn’t forever, you will be able to travel again), and have peace of mind while everyone else is in a panic.

You spent a lifetime saving for retirement.

You worked for your money—don’t expect Mr. Market to work as hard as you did for it.

Remember, money is lazy.

It needs to be told what to do.

It’s like living with teenagers (I live with two in their late teens).

When you retire, it’s make or break time for you as an investor—much like raising a teenager is make or break time for a parent.

You need to continually show them the way so they will know how to be productive adults, how to be responsible, and, how to pick up their stuff that’s all over the house.

There’s a reason you forget these things and then have no problem buying tech stocks or spoiling the grandchildren.

Caring for investments and children isn’t easy. You can’t suffocate them in bubble wrap (although you might want to at times). You manage them in a way, where, if done right, you never lose them.

Read my entire series, Coronavirus Infects Stock Market here.